Executive Summary

It never ceases to amaze me how financial pundits give such credence to financial projections which more often than not are materially wrong. Yet in the short run, the stock market tends to react to such misleading data. Probably the best example is to look at long-term interest rates. Even what are considered “astute” pundits do not seem to understand that the Fed does not set long-term interest rates, only very short-term rates. Long-term interest rates can ebb and flow in the short-term; however, over the long run they tend to track economic growth and inflation. (Shown in the first graph below.) The second graph shows the atrocious track record by pundits who have been predicting higher rates for decades. I also highlight an anomaly in M1 versus M2 money levels and recent changes. I believe this situation warrants monitoring. It is important to understand what drives long-term rates and study the changes closely. Now is the time for vigilance, not blindly following pundits with atrocious track records.

Please proceed to The Details.

“Forecasts usually tell us more about the forecaster than of the future.”

–Warren Buffett

The Details

It never ceases to amaze me how financial pundits give such credence to financial projections. It does not matter if one is referring to the Federal Reserve Bank’s (Fed) projections for economic growth and interest rates, corporations’ projections for their forward earnings, or economists’ forecasts for GDP; they are almost always overly optimistic or flat out wrong. Yet in the short run, the stock market tends to react to such misleading data. Probably the best example is to look at long-term interest rates. Even what are considered “astute” pundits do not seem to understand that the Fed does not set long-term interest rates, only very short-term rates.

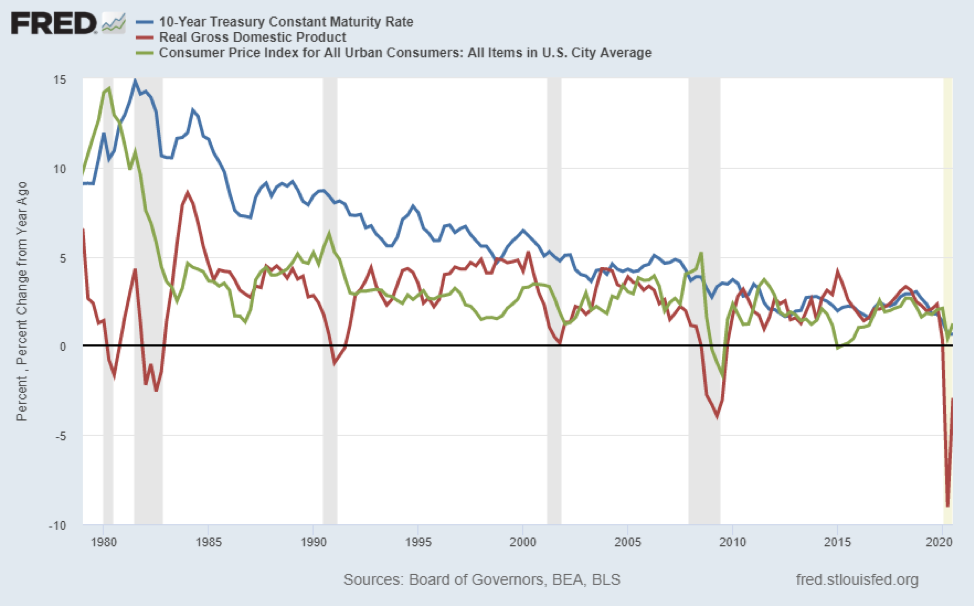

Long-term interest rates can ebb and flow in the short-term; however, over the long run they tend to track economic growth and inflation. See the correlation in the chart below prepared with data from the St. Louis Fed FRED database.

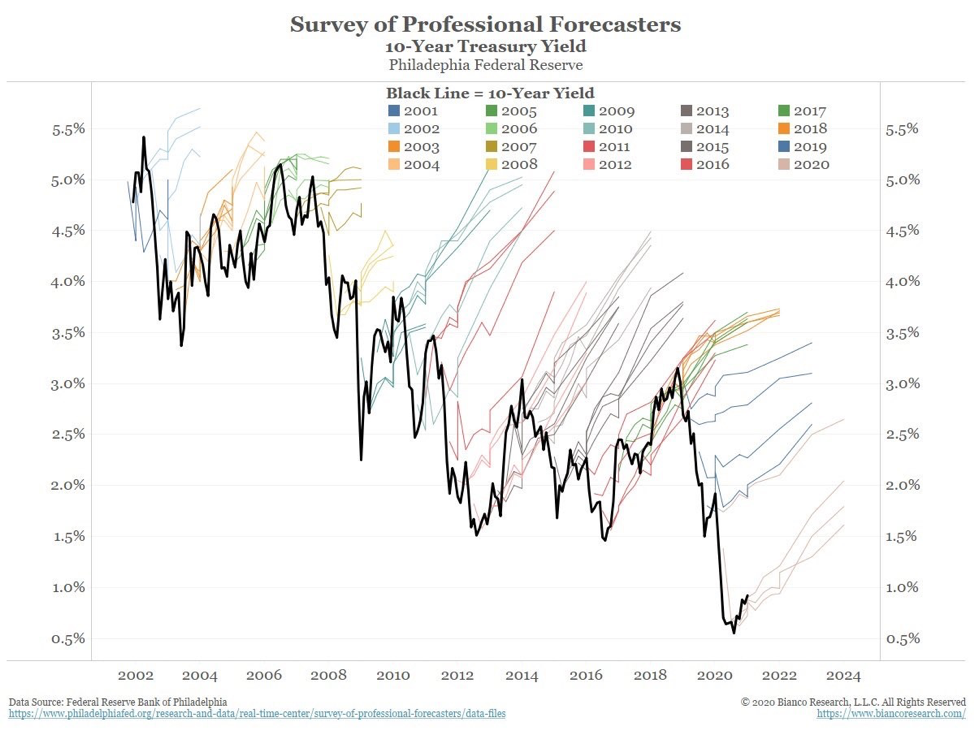

For over two decades market “experts” have been predicting that long-term interest rates would rise. With the birth of massive amounts of created money through various QE (Quantitative Easing) programs during and after the Financial Crisis, the cries for soaring rates became incessant. At the time I stated that long-term rates would continue to fall due to disinflation and falling rates of economic growth. As with all financial data, nothing moves in a straight line; however, the overall trend for interest rates has been downward. See the actual movement of 10-year Treasury yields (black line) and the annual calls for jumping rates in the graph below.

If it were not so serious, it would be funny. The prognosticators never cease their fear mongering for higher rates. I am not saying that Treasury rates will never rise. However, at the current time, in the middle of a pandemic, with close to 20 million people collecting some form of unemployment benefit, and long-term growth slowing, I do not believe now is the time for a jump in long-term interest rates.

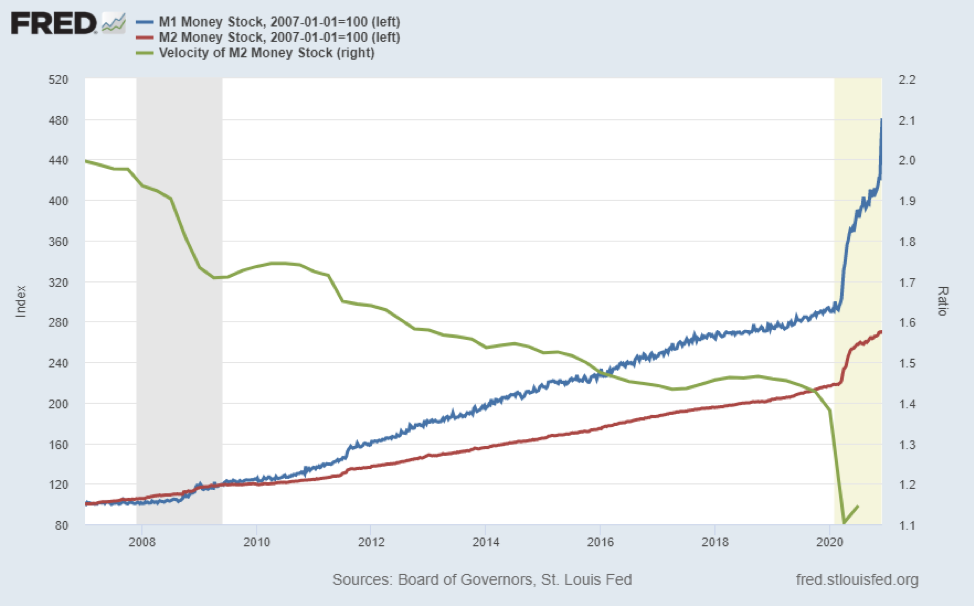

Recently, something quite peculiar has occurred which bears watching. The level of M1, mainly currency and checking accounts jumped like never before. While M2, which includes M1 plus savings accounts, remained relatively flat. There has been no disclosed reason for this enormous jump in M1. The only plausible explanation is a massive sum of money was moved from savings to checking. If this movement in M1 was followed by a surge in the velocity of money (how often funds change hands), then inflation concerns could arise. However, this expectation would be offset by the weak economy and huge unemployment situation. Look closely at the graph also prepared from the FRED database.

Inflation could end up in a tug-of-war between a weakening economy and a likely surge in debt defaults versus incredible amounts of central bank created funds. If velocity were to surge indicating inflation were likely, then it is possible long-term interest rates would rise. However, the rise in rates would in and of itself add havoc to an already precarious economy.

My best guess today is that the economy continues weakening, defaults rise, and the stock market eventually begins to reflect reality. This in turn would create a “flight to safety” with many investors (speculators) selling stocks and purchasing Treasury securities pushing yields down again. In my opinion much hinges on the velocity of M2. At some point Congress will pass another stimulus bill adding to the confusion. Until then, I am not convinced interest rates are going to rise in the short-term. But close observation is warranted. A jump in rates does not guarantee a trend reversal. It could merely be another head-fake of which many have been observed over the past two decades.

Pundits have been wrong for decades, yet still manage to entertain an audience. It is important to understand what drives long-term rates and study the changes closely. Now is the time for vigilance, not blindly following pundits with atrocious track records.

The S&P 500 Index closed at 3,663, down 1.0% for the week. The yield on the 10-year Treasury Note fell to 0.89%. Oil prices rose to $47 per barrel, and the national average price of gasoline according to AAA remained at $2.16 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.