Executive Summary

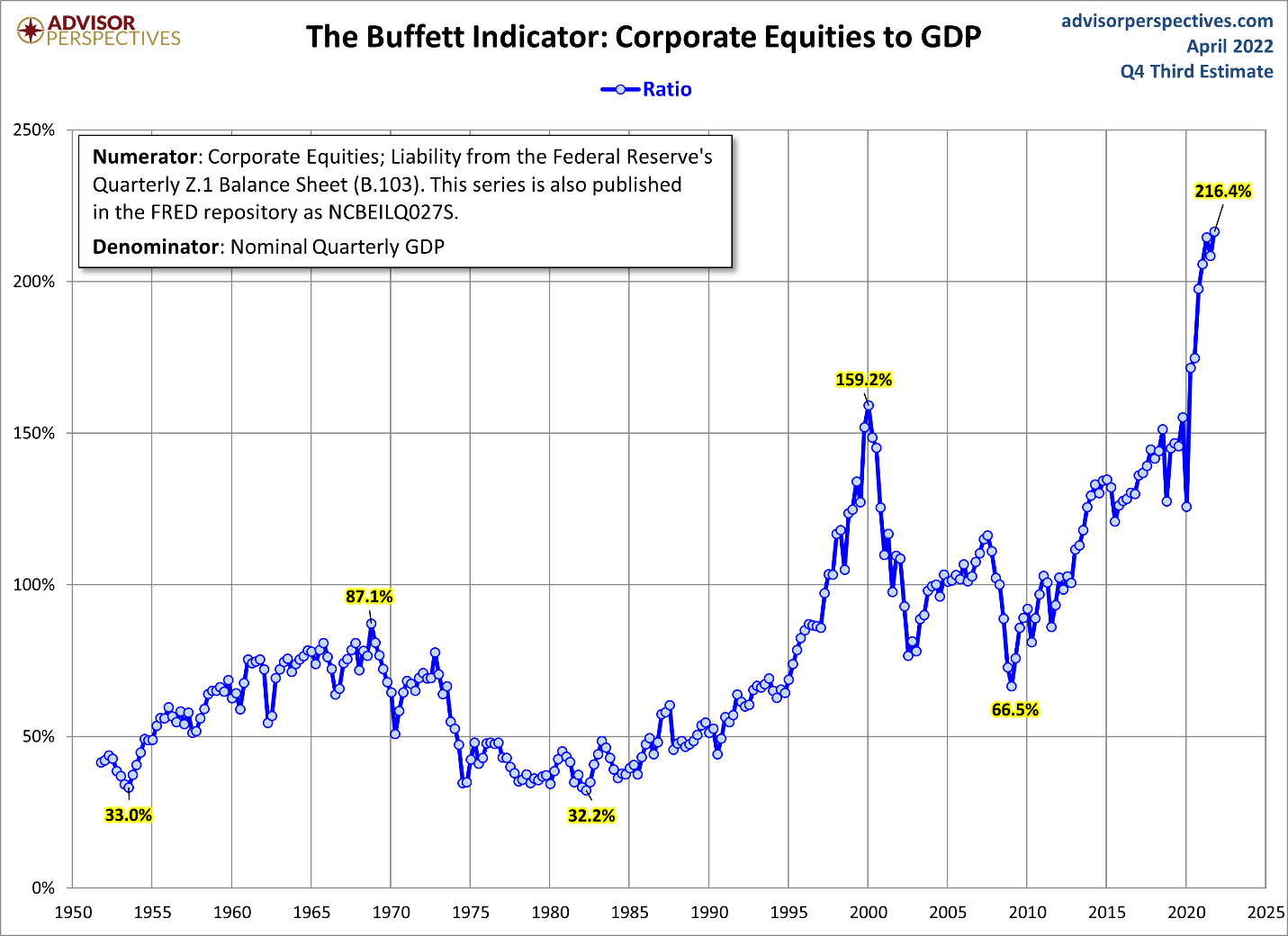

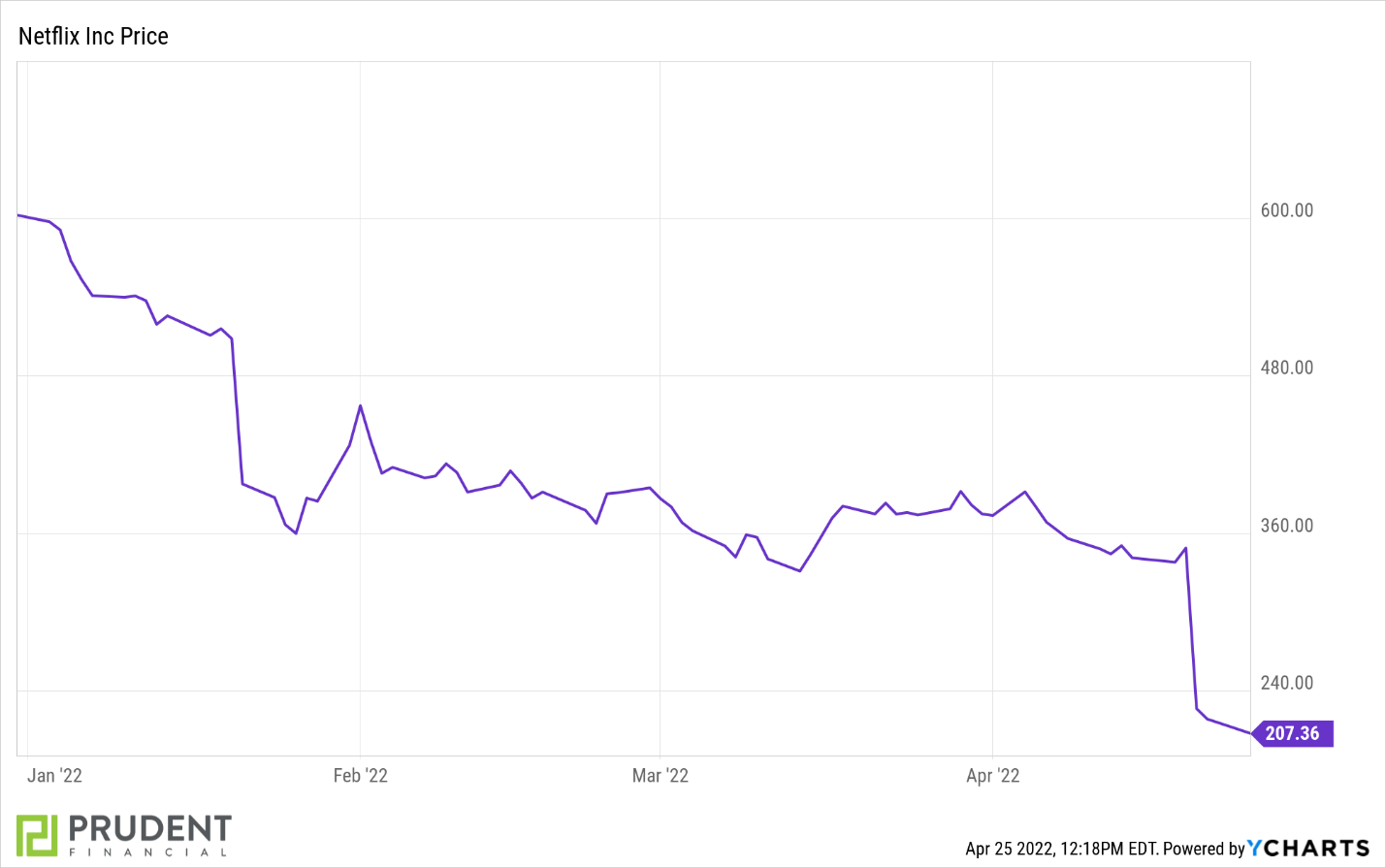

The first graph below is Warren Buffet’s favorite market valuation ratio. Note from current valuations, the S&P 500 would need to fall by 64% to reach the long-term average. While many may think it is not possible, in the last 20 years markets have twice fallen by nearly 50%. The next two graphs show how Netflix and Facebook (Meta) are down 65% and 45% respectively, so far in 2022. And though a drop to the mean may not happen, the possibility is there given the Federal Reserve Bank actions as well as other factors discussed in previous newsletters. I am not making a prediction, but rather illuminating the risks to investors.

Please proceed to The Details.

“It is not worthwhile to try to keep history from repeating itself, for man’s character will always make the preventing of the repetitions impossible.”

–Mark Twain

The Details

In numerous newsletters I have presented a plethora of valuation methodologies illustrating the extremely over-priced stock market. As an example, the graph below prepared by Advisor Perspectives shows Warren Buffett’s favorite valuation ratio, the market cap of corporate equities to GDP. The long-term average valuation level is around 78%. At 216%, the S&P 500 would need to fall 64% just to equal the long-term mean valuation level.

And that is where I may lose some readers. I am sure many are saying to themselves, “There is no way the stock market is going to fall 64%! The Fed simply will not allow it.” However, a brief perusal of recent history outlines a different tale. In the 2000 – 2002 bear market, the S&P 500 fell close to 50%, while the tech-heavy Nasdaq 100 Index fell about 83%. In the Financial Crisis of 2007 – 2009 the S&P 500 again fell close to 50%. If one were to go a little further back in time to the Great Depression, the post-1929 bear market resulted in a peak-to-trough plunge of about 89% in the Dow Jones Industrial Average.

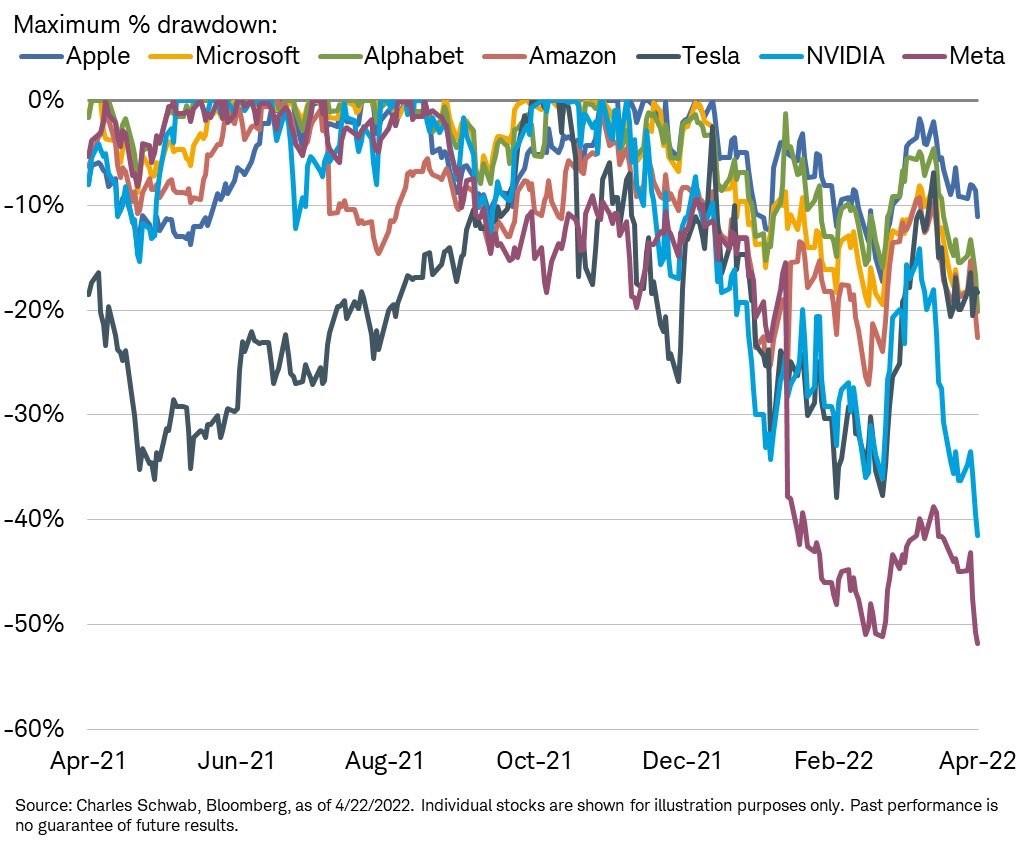

But again, many are probably thinking, “This time is different.” The foundation of the current stock market bubble is comprised of the high-flying FANG stocks. FANG is an acronym for Facebook (Meta), Amazon, Netflix and Google (Alphabet). These stocks were considered invincible. Some pundits expanded the list to include Apple and Microsoft.

Let’s look at what has occurred recently for a couple of these revered stocks. Last week upon revealing first quarter earnings results, Netflix announced a significant reduction in subscribers. Immediately, the stock began to sell-off. Netflix plummeted 35% in one day! Added to the previous year-to-date losses, Netflix is down over 65% so far in 2022.

Another of the storied stocks, Facebook (Meta Platforms Inc), saw its stock price plunge on February 2, 2022, when it fell a whopping 26% in one day. Since the start of the year, Facebook stock is down 45%!

The graph below shows the max drawdown for some of the storied stocks plus a few other high-flyers over the past one-year period.

The volatility in markets is sure to continue as Amazon, Apple and Microsoft are set to release earnings this week. So far, the S&P 500 is down around 10% year-to-date. The Russell 2000 small cap index is down about 13% for the year. And, as outlined before, the Fed has barely begun its monetary tightening campaign as inflation rages on.

In today’s stock markets, with algorithmic and high frequency trading, stock prices move swiftly. With such extreme excesses in valuations, stock prices have a potentially long-way down to reach reasonable levels. To say it cannot happen is to ignore what is already occurring.

The S&P 500 Index closed at 4,272, down 2.8% for the week. The yield on the 10-year Treasury Note rose to 2.91%. Oil prices decreased to $102 per barrel, and the national average price of gasoline according to AAA rose to $4.12 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.