Executive Summary

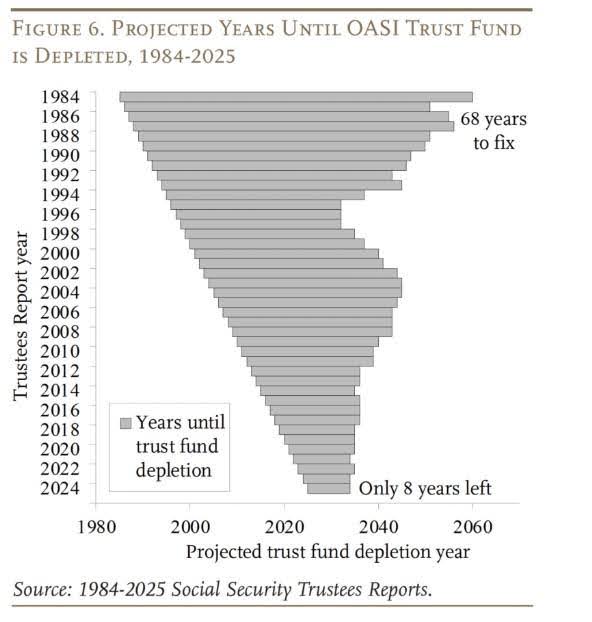

In 1935 Franklin D. Roosevelt signed the Social Security Act into law. One could claim full retirement benefits at age 65. At that time life expectancy for a 65-year-old was 12 more years. In 1945 there were 42 workers contributing for each person drawing benefits. By 1983 this dropped to 3.4 workers for each person drawing benefits. The graph below shows that in 1983, the Social Security Trust Fund was projected to go broke in 68 years. Currently the fund is projected to be depleted by 2033. In 1983 the full retirement age for those born in 1960 or later changed to 67 as a partial fix. Since that time, Congress has done little to fix the rapidly approaching problem. On another note, the 2025 “One Big Beautiful Bill” enacts a new $6,000 deduction per eligible senior to reduce income tax on Social Security. However, the misconception is it eliminates tax on Social Security. No one seems to want to fix the problem, meanwhile the clock is ticking.

For further analysis, continue to read The Details below for more information.

“In retirement, only money and symptoms are consequential.”

–Mason Cooley

The Details

In August 1935, President Franklin D. Roosevelt signed the Social Security Act into law. In 1937, the first payroll taxes were withheld. At the time, full retirement age, or the age at which you could claim full retirement benefits, was 65. The average life expectancy for someone who was 65 years old at that time was about 12 years. In 1945, there were 42 workers contributing to Social Security for each person drawing benefits. By 1983, this had dropped to 3.4 workers contributing for each person drawing benefits. And the life expectancy of someone 65 in 1983 was about 19 years. The combination of fewer contributors per recipient, and longer life expectancy was putting a strain on the sustainability of the program. So, in 1983 Congress enacted legislation to extend full retirement age. This gradual extension pushes out full retirement age to 67 for all those born in 1960 or later. Therefore, those born in 1960 will be eligible for full retirement benefits in 2027. This change does not prevent an eligible person from drawing benefits at age 62. However, benefits drawn at 62 would undergo a substantial reduction of about 30%. Also, any income earned over the prescribed limits would result in a (potentially temporary) further reduction in benefits until full retirement age.

In the early years of the program, excess taxes collected over benefits paid were placed in trust and invested in special Treasury securities. Beginning in 2010, the amount of tax revenue collected for Social Security fell short of expenses paid. The trust fund for retirement benefits, OASI (Old-Age and Survivors Insurance), is expected to be depleted around the year 2033, or eight short years away. However, it could be sooner once it is determined what impact the Social Security Fairness Act, passed in January 2025 but applied retroactively to January 2024, has on benefit payments. This Act eliminates the reduction previously applied to Social Security beneficiaries who are also eligible for pensions from non-covered work.

Once the trust fund is depleted, it is estimated that current tax collections would cover roughly 81% of benefits. So, do I believe that the Federal government will reduce everyone’s benefit payments at that point? No, I do not. I believe the Federal government will merely add to the deficit to cover the shortfall until some revisions are made to the program. I personally feel that any significant changes would be grandfathered so as not to impact current recipients. The easiest and most likely change to enact would be to push full retirement age out again. There is talk of pushing it out to age 70. However, at this point there are no firm proposals to fix the shortage and an increase in deficits is the likely outcome.

Those drawing benefits whose modified adjusted gross income exceeds the prescribed limits currently pay taxes on either 50% or 85% of their benefits depending upon the amount of income earned. Some people might have the misconception that the “One Big Beautiful Bill,” passed this year, eliminated taxation on Social Security income. However, that is not the case. The Bill provides a temporary – 2025 through 2028 – additional $6,000 deduction per eligible senior. This deduction begins to phase out for those with modified adjusted gross income over $150,000 for joint filers and $75,000 for single filers. This deduction is available whether you use the Standard deduction or Itemize deductions.

The Social Security program is in serious financial trouble. Congress has not made any sincere effort to make the program sustainable. If nothing is done, either benefits will have to be reduced, retirement age delayed, or deficit spending increased further. The end of the trust fund is right around the corner. Will Congress wait until the trust runs out before making changes? The uncertainty is unsettling to those approaching or in retirement. The program is not sustainable as is, changes will have to be made. Hopefully, Congress will recognize the importance of the program and make the changes necessary for long-term sustainability. The clock is ticking.

If anyone would like to learn more about Social Security, do not hesitate to give us a call.

The S&P 500 Index closed at 6,603, down 1.9% for the week. The yield on the 10-year Treasury Note fell to 4.06%. Oil prices decreased to $58 per barrel, and the national average price of gasoline according to AAA remained at $3.07 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.