Executive Summary

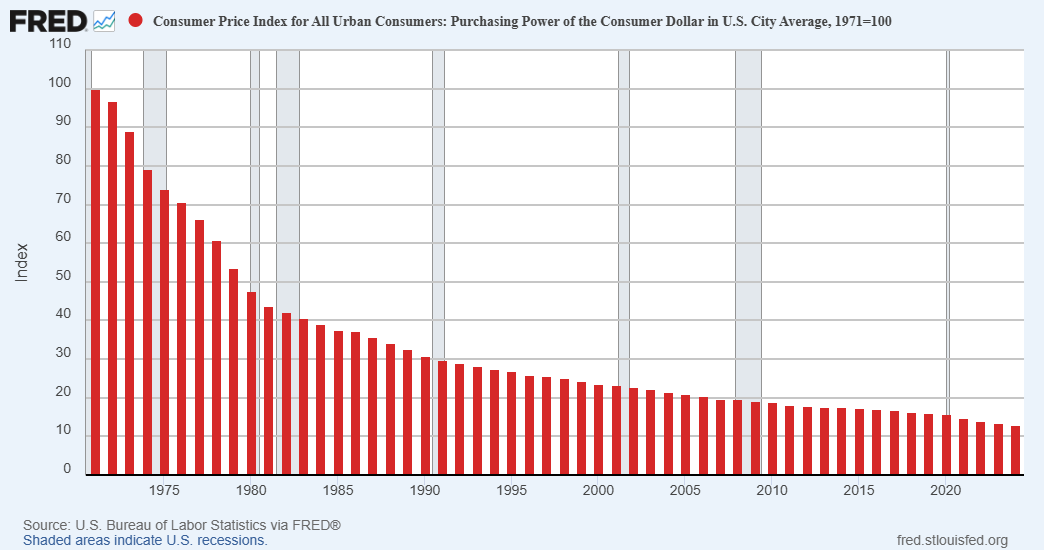

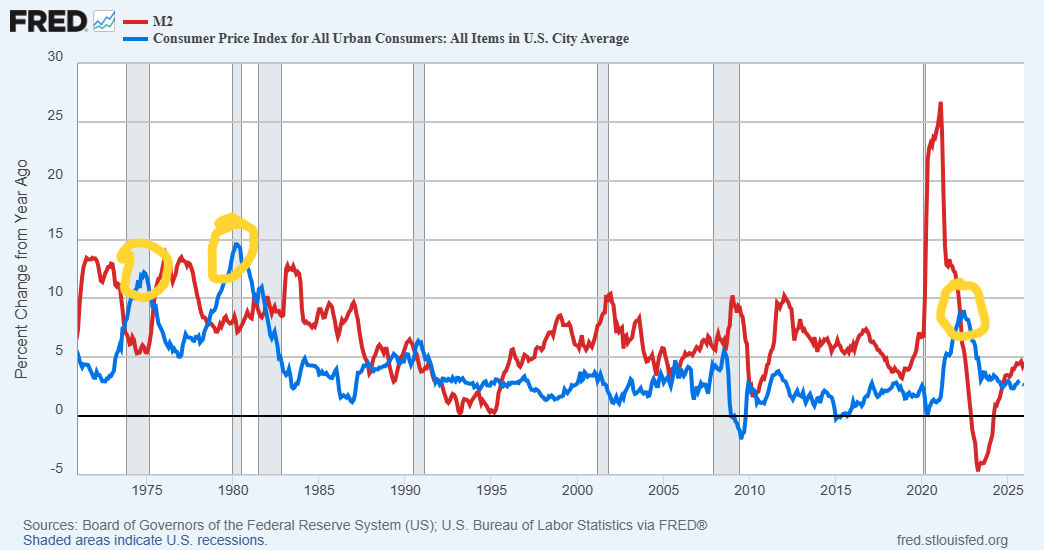

Debasement of the U.S. dollar refers to the loss of its purchasing power, which appears in two basic forms: loss of purchasing power due to inflation or depreciation in the currency relative to other currencies. Inflation, the rise in the prices of goods and services, is typically due to the creation of too much money. The Federal Reserve targets 2% annual inflation, effectively eroding the dollar’s purchasing power and benefiting debtors. From 1971 (the year the U.S. departed the gold standard) to 2024, inflation eroded 87% of the dollar’s value (see first graph). The increase in money supply (M2) has historically preceded notable jumps in inflation (2nd graph). Rising National Debt ($38.7 trillion) and persistent Federal deficits raise concerns of future high inflation. Thus, it is important to analyze real inflation-adjusted data. In coming issues, I will delve into how fiscal and monetary policy have impacted prices of goods and services as well as asset prices.

For further analysis, continue to read The Details below for more information.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency.”

–John Maynard Keynes

The Details

This newsletter is the first in a series I will write discussing the debasement of the U.S. dollar. I am not sure how many will be required to cover the subject, so keep reading to make sure you see them all. Due to the complexity of the subject, I will try and keep the discussion on a higher level. It is easy to go down a number of rabbit holes detracting from the bigger picture. In the simplest terms, debasement of the dollar refers to the loss of its purchasing power. Debasement can appear in two basic forms: loss of purchasing power domestically, due to inflation; and depreciation in the currency relative to other currencies, devaluation due to exchange rates.

I will begin by focusing on inflation before delving into exchange rates. Inflation, the rise in the prices of goods and services, is typically due to the creation of too much money. Or stated differently, too much money chasing too few goods and services. Inflation is normally a slow and steady degradation in the value of a currency. However, there are periods where inflation soared, slowing economic growth and creating havoc. The Federal Reserve Bank (Fed) has targeted 2% annual inflation as their goal. Many people, including myself, do not agree with this secret tax and would prefer to see them target no inflation. So, why does the Fed target 2%? First let’s examine who benefits from inflation. Inflation inures to the benefit of debtors as the balance of their debt decreases in real terms. And who is the largest debtor? The Federal Government! Low inflation allows politicians to grow the debt without increasing taxes. The Fed prefers to use other excuses for their target, including their fear of deflation, providing the ability to decrease short-term interest rates when needed, and affording a cushion against sticky inflation measures.

In any event, many people are astounded when they discover the amount of their savings that is “taxed” through inflation. The graph below shows that one dollar in 1971, the year the U.S. was taken off of the gold standard, lost 87% of its value by the end of 2024. Said differently, $100,000 in 1971 would be worth $13,000 at the end of 2024. If the goal was to keep this money in a safe, interest bearing account, it would have had to earn just under 4% annually merely to maintain its purchasing power.

The graph below shows the annual rate of growth in the money supply (using M2) in red compared to the annual inflation rate in blue. Notice that prior to each of the major spikes in inflation (highlighted in yellow), there was a noteworthy jump in the money supply.

The rapid increase in the National Debt, currently at $38.7 trillion according to USDebtClock.org, continued high non-recessionary annual deficits, and rising interest rates have many people concerned about high or even hyper- inflation in the future.

Hyper-inflation is a rarity using the common definition of 50% per month or higher inflation rate. To achieve such a high rate would involve a complete collapse in the currency. Although it has occurred around the world in the past. Some countries that come to mind are Weimar Germany, Hungary, Zimbabwe, and Venezuela among others. I think most readers would agree that there are many levels of high inflation, not meeting the definition of hyper-inflation, which would still be devastating to a country.

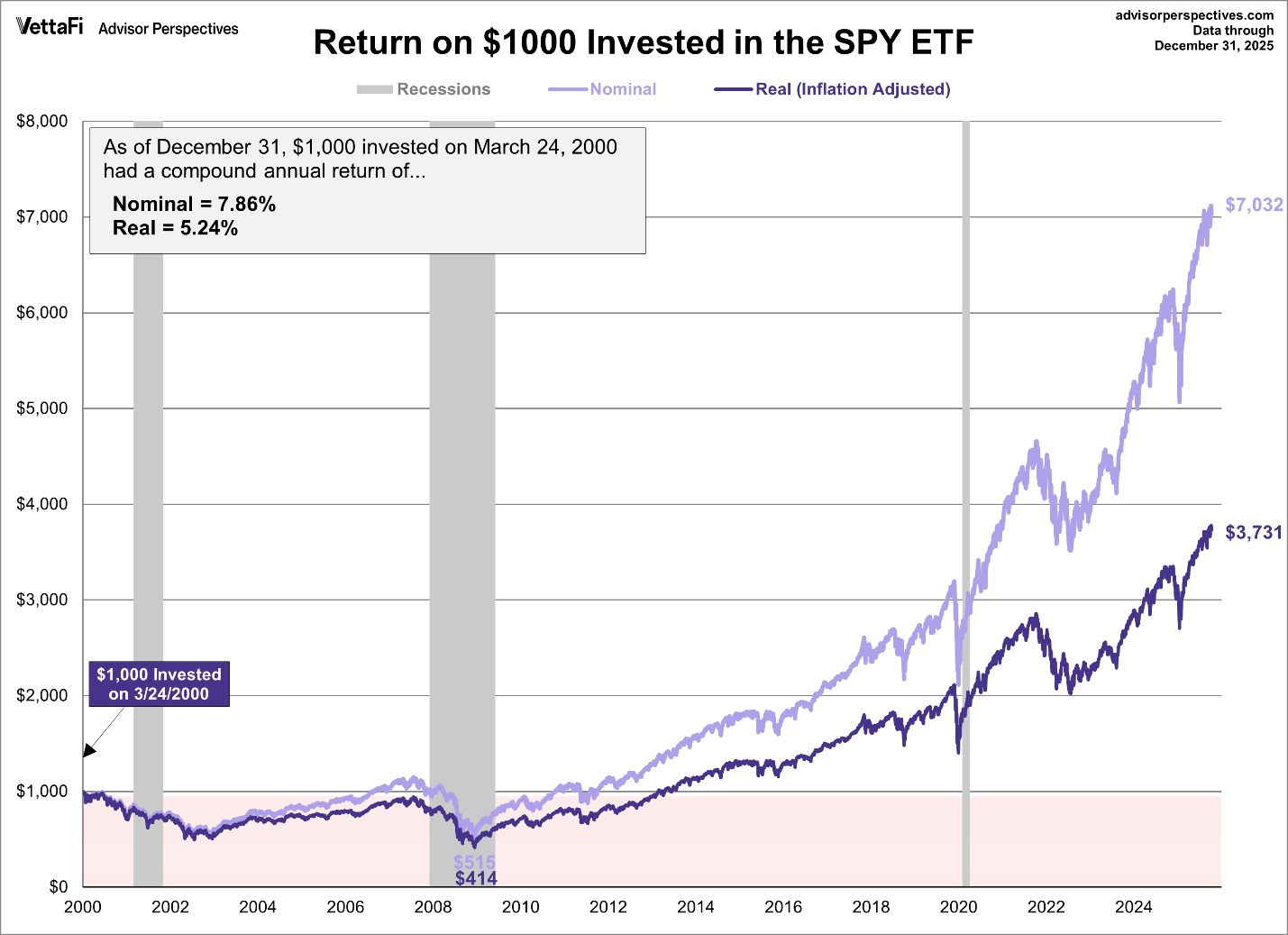

When examining economic and market data, it is common to look at nominal (before inflation) numbers. Over a period of time, especially during periods of high inflation, it is critical to review real or inflation-adjusted data. For example, the chart below shows the growth of $1,000 in the S&P 500 from 2000 to present on a nominal and real basis. Someone not familiar with the impact of inflation might think their $1,000 was actually worth $7,032 today. In reality, that $1,000 invested in 2000 has the relative purchasing power of $3,731. Forty-seven percent of their nominal growth disappeared to inflation.

Next week, I will delve into how monetary and fiscal policy have impacted the prices of goods and services, as well as asset prices. I will also review some of the misunderstood consequences to these policies.

Debasement is devaluing the currency. It is a complex topic with many ramifications. The experimental Fed policy and extreme fiscal programs have had a significant impact, which will be explored in upcoming newsletters. Stay tuned.

The S&P 500 Index closed at 6,939, up 0.3% for the week. The yield on the 10-year Treasury Note remained at 4.24%. Oil prices rose to $65 per barrel, and the national average price of gasoline according to AAA increased to $2.87 per gallon.

© 2026. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.