Executive Summary

Currently speculators continue pushing stock prices higher, justifying the move on technological advances. Similar times in history include the “New Era” of the 1920’s, the “New Economy” of the 1990’s and current AI advances. Economist John Hussman has a valuation methodology highly correlated with actual subsequent market returns over the subsequent twelve years displayed in the first graph. This methodology suggests future 12-year average annual returns would come in around -6%. The Shiller P/E (Cape ratio) and Wall Street’s forward operating P/E valuation metrics (second graph) reflect markets pushing the highest valuations on record. Unless this time is truly different, history shows such markets are usually followed by substantial downturns and possible long periods of low returns. This is not a prediction, but rather a reflection of history and the associated stock market risks.

For further analysis, continue to read The Details below for more information.

“If history repeats itself, and the unexpected always happens, how incapable must Man be of learning from experience.”

–George Bernard Shaw

The Details

Speculators continue to push equity prices higher with little regard for what history suggests lies ahead. Many justifications are given, most of which can be seen in the annals of history. However, many speculators today are too young to remember, or have not had the pleasure of studying, the past. Technological advancements spawned the “New Era” of the 1920’s with radios, automobiles, etc. Then came the “New Economy” of the 1990’s with the advent of the internet and dot.com companies. Today it is the AI revolution. Just as the internet has changed how the world uses technology, so will AI, at some point in the future. However, the herd-like mentality in the equity markets got ahead of itself, both then and now.

The following is from economist John Hussman’s January 2026, Market Comment:

“The defining feature of every bubble is the same: a growing inconsistency between the long-term returns that investors expect in their heads – based on extrapolation of the past, and the long-term returns that properly relate prices to likely future cash flows – based on valuations. Every bubble smuggles the same tragic past into the same tragic future by packaging it with new wrinkles that convince investors that ‘this time is different.’ Ultimately, they still end the same way.

Each speculative episode encourages a certain stubbornness – because humans are adaptive creatures, we base our expectations for the future on the experience of the recent past. We respond far less to those things that are painful but distant in our memory than to those things that are rewarding in real-time.”

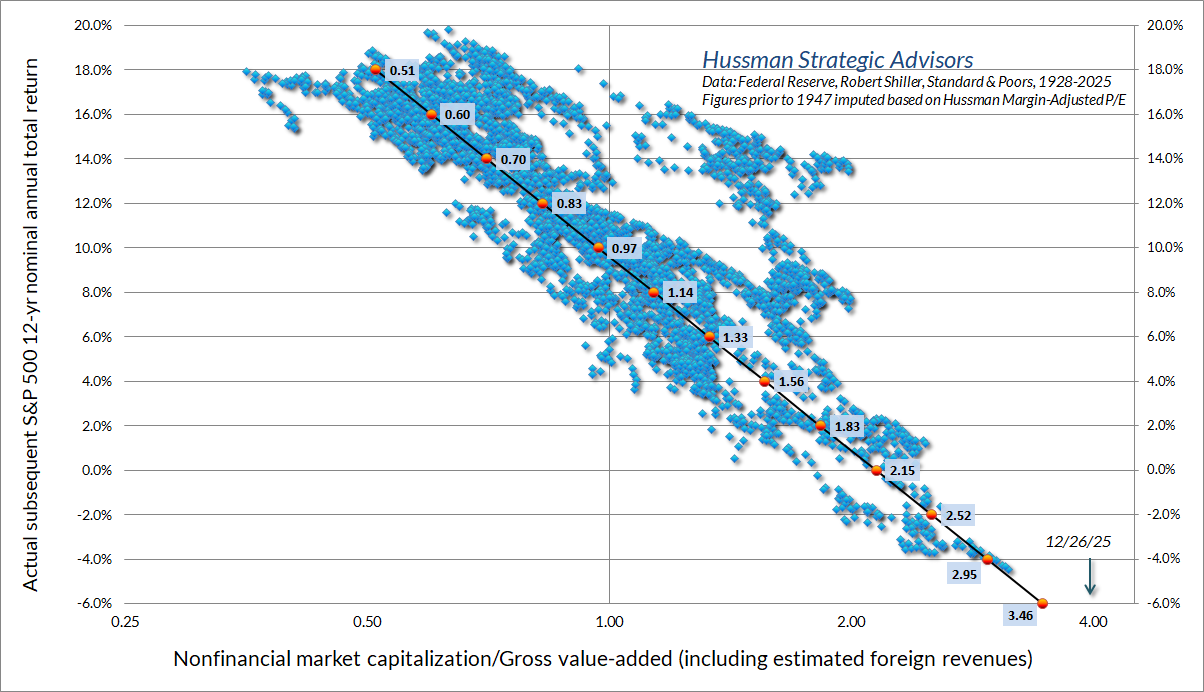

Hussman has performed extensive research into market valuations, and subsequent returns based upon those valuations. The following scatter plot shows the valuation methodology most correlated with actual subsequent returns. That means, at least based upon historical results, it should be one of the most accurate measures of equity valuations. The dots in the graph below represent actual subsequent 12-year nominal returns of the S&P 500 Index plotted against the valuation measure at the start of that period. In simple terms the valuation measure is similar to an economy-wide Price-to-Revenue methodology. At the current measure, shown by the green arrow in the graph, the subsequent actual 12-year nominal return should average around -6% per year.

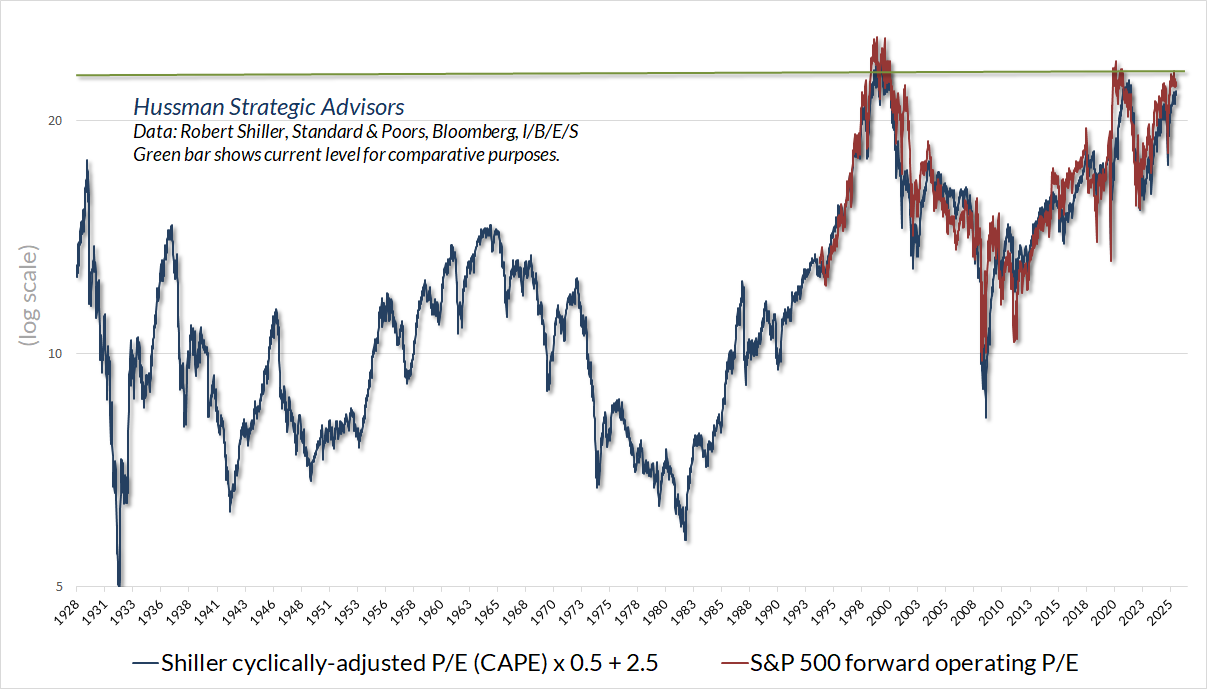

Now, some analysts argue that corporate profits are at record highs and that justifies higher valuations. Yet, the method above incorporates the revenues used to arrive at those record profits. Wall Street likes to use Price-to-Forward Operating Profits. While this methodology was only introduced widely in the mid-1990’s, the results are comparable to the Shiller P/E or CAPE ratio which uses the price of the S&P 500 and divides by the prior 10-year inflation-adjusted average earnings. In Hussman’s graph below, the blue line has a longer history, represented by the Shiller P/E ratio, and the Price-to-Forward Operating Profits in red. Notice the correlation. Even using this methodology, the market is pushing the highest valuation on record.

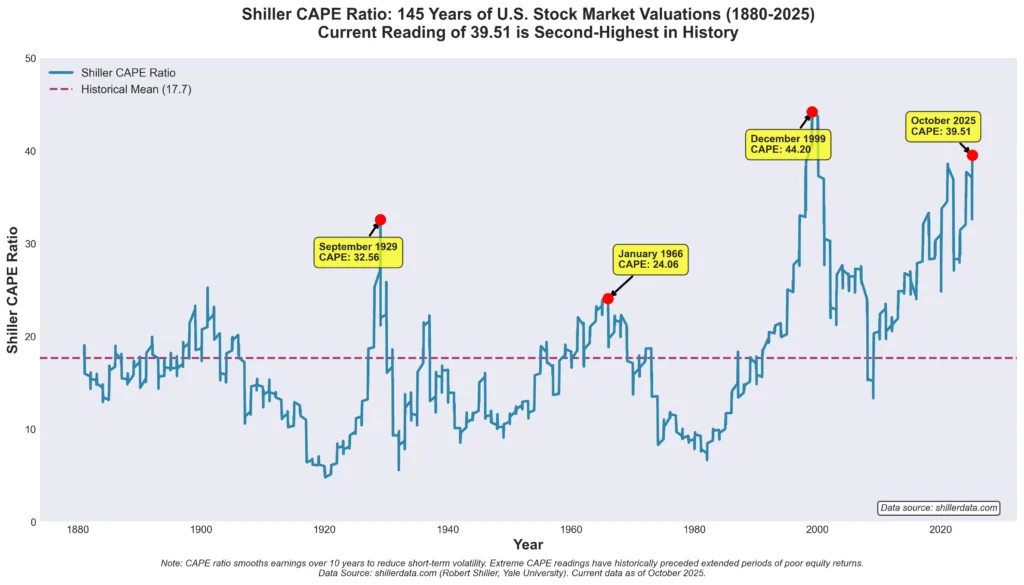

Previously, the Shiller P/E or CAPE ratio has only crossed above 40 once, in the late 1990’s at the peak of the Technology Bubble. Today, it stands at 41. The following is from a blog on BullionTrading.com. This provides some historical perspective on what investors can expect in the near future…unless this time really is different.

“Historical Context: When CAPE Reached These Extremes

September 1929: CAPE peaked at 32.56 before the Great Depression crash. The Dow fell 89% by 1932 and didn’t recover to 1929 levels until 1954, 25 years later.

January 1966: CAPE reached 24.06 during the ‘Go-Go Years’ market peak. The subsequent 16-year period delivered zero real returns for stock investors…

December 1999: CAPE reached an unprecedented 44.20 at the dot-com peak, the highest reading in history. The S&P 500 fell 49% from 2000 to 2002, and declined 15% nominally from January 2000 to December 2010 (approximately 20-25% after inflation)…”

Investors can pretend the past never happened or they can convince themselves that this time is different, but for those who cannot sustain a drawdown of 50-80% where it takes 15 or more years to recover, they might want to examine their strategy. The current bubble is compounded by high margin debt (as was the case in the 1920’s) together with high debt at all levels, consumer, corporate, and government.

Although this bubble is being led by a handful of mega-cap stocks, the fact that the majority of investors are in passive index funds poses a high amount of risk for when the tide turns. The main indices are now highly concentrated in these stocks. When they correct, the indices will plunge and their investors will initiate selling which then feeds on itself.

The purpose of this article is to draw attention to the facts behind today’s equity market and show how historically the story has ended. With this knowledge, one can choose how they want to proceed and how much risk makes sense in this environment.

The S&P 500 Index closed at 6,966, up 1.6% for the week. The yield on the 10-year Treasury Note fell to 4.17%. Oil prices rose to $59 per barrel, and the national average price of gasoline according to AAA fell to $2.80 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.