Executive Summary

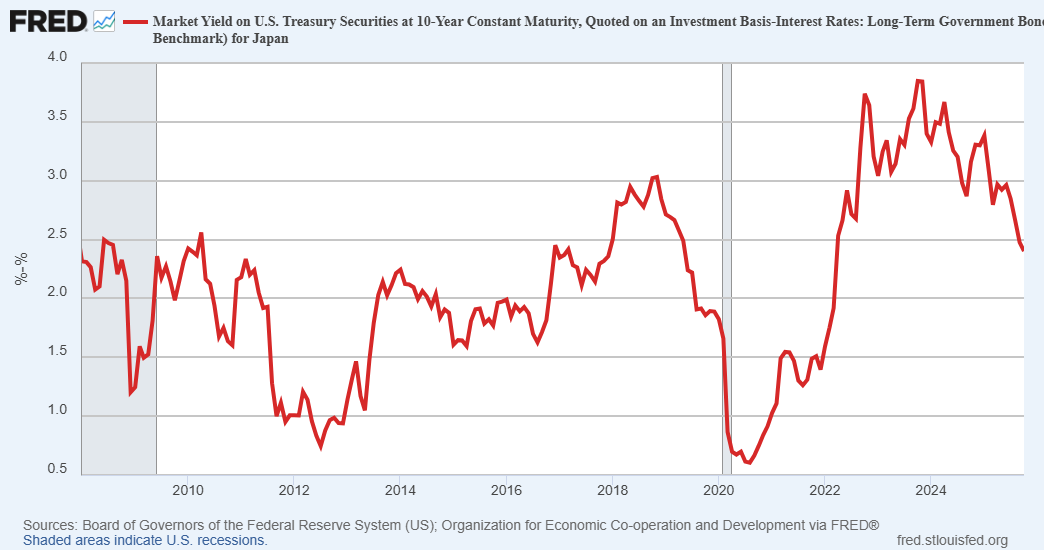

Japan’s Nikkei 225 stock index peaked in 1989 and took 34 years to recover after the dramatic decline (see first graph). In an unprecedented move to combat deflation and spur growth, the Bank of Japan pursued ultra-loose monetary policies – zero and negative interest rates, and massive bond purchases. These actions encouraged the “carry trade.” Investors borrow in yen at very low interest rates to invest abroad, fueling global asset bubbles in real estate, stocks, and bitcoin. By 2023, the BOJ owned nearly half of all Japanese Government Bonds but began tightening in 2024. Japan’s government debt is about 240% of GDP, nearly double the U.S. level. With the economy contracting, despite inflation above 2%, they recently approved a stimulus package. Rising Japanese bond yields and narrowing gaps with U.S. yields (see 2nd graph) raises concerns about the carry trade unwinding. This, some fear, could trigger asset corrections globally.

For further analysis, continue to read The Details below for more information.

“As ‘bandwagon’ investors join any party, they create their own truth — for a while.”

–Warren Buffett

The Details

In December 1989, Japan’s Nikkei 225 stock index peaked and began a dramatic descent falling around 80% over the next two decades. It took over 34 years to regain levels achieved at the 1989 top (See graph below). The monetary tightening by the Bank of Japan (BOJ) in 1989 and 1990, which initiated the crash, was quickly reversed in 1991 as rates were lowered. By 1999 interest rates reached zero percent with the start of ZIRP (Zero Interest Rate Policy). In 2001 the BOJ began purchasing bonds (Quantitative Easing). And in an unprecedented move to combat deflation and spur growth, negative interest rates arrived in 2016. The popping of the bubble by the BOJ created a cultural shift towards saving versus spending. The aging population, shift towards saving, and capital flight, kept a lid on inflation.

Low and negative interest rates incentivized the “carry trade.” This involved borrowing in yen at very low interest rates and investing abroad. These investments varied from U.S. Treasury securities to more risky assets, further increasing the size of asset bubbles seen today in everything from real estate, stock prices, and bitcoin.

By 2023 the BOJ owned close to half of all outstanding Japanese Government Bonds. In August of 2024 the BOJ reversed course and began a process of reducing its balance sheet (Quantitative Tightening). The decades of incredibly loose monetary policy and fiscal borrowing pushed Japanese Government Debt to around 240% of GDP. This is almost double the troubling Government debt levels of the U.S. This could worsen as the Japanese economy contracted by -1.8% (annualized) in the third quarter of 2025. With the economy weakening, a large economic stimulus plan was approved last month. However, core inflation has remained over their 2% threshold for over 40 months. Tightening monetary policy and concerns over inflation, especially with the recently approved stimulus package, are pushing yields up on the Japanese 10-year Government Bond (JGB). The yield on the 10-year JGB has risen from -0.28% in August 2019 to about 1.878% today. While this might appear low when comparing to the U.S. 10-year yield of 4.09%, the gap is narrowing. The graph below shows the difference between the U.S. 10-year Treasury yield versus the 10-year JGB.

Two concerns bandied about today include: the interest cost on outstanding JGB’s as interest rates rise, and the unwinding of the carry trade. When investors determine that it no longer makes sense to borrow in yen and invest in risky assets abroad, factoring in the volatility of markets and any hedging costs, then they will sell the assets and pay-off the borrowed funds. Some financial experts believe the unwinding of the carry trade could be the pin that pricks the asset bubbles. For various reasons, it is hard to estimate the size of the carry trade. Some believe it could fall anywhere from $1 trillion to $20 trillion.

While the U.S. is in a predicament attempting to balance monetary policy with inflation risks and growing unemployment, Japan is in even dire straits. Their debt to GDP is almost double of that in the U.S. Inflation is rising, and their economy is weak. There is a significant demographic problem as their population ages. The risk of higher interest rates imploding the carry trade is real. Whether the global impact will be enough to trigger a major asset correction is unknown. This is playing out in real time in Japan, while the U.S. walks a tightrope between inflation and growth. Will the Japanese carry trade pop global asset bubbles? We will know the answer soon.

The S&P 500 Index closed at 6,849, up 3.7% for the week. The yield on the 10-year Treasury

Note fell to 4.02%. Oil prices increased to $59 per barrel, and the national average price of gasoline according to AAA fell to $3.01 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.