Executive Summary

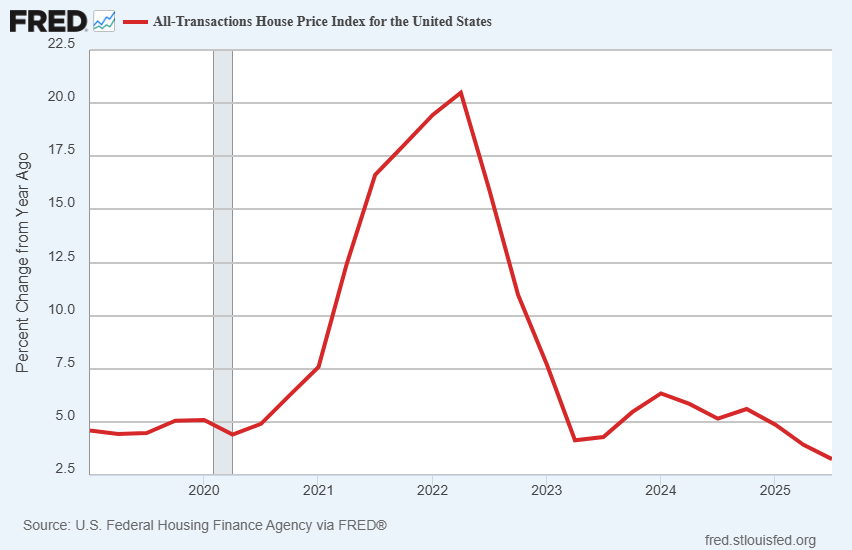

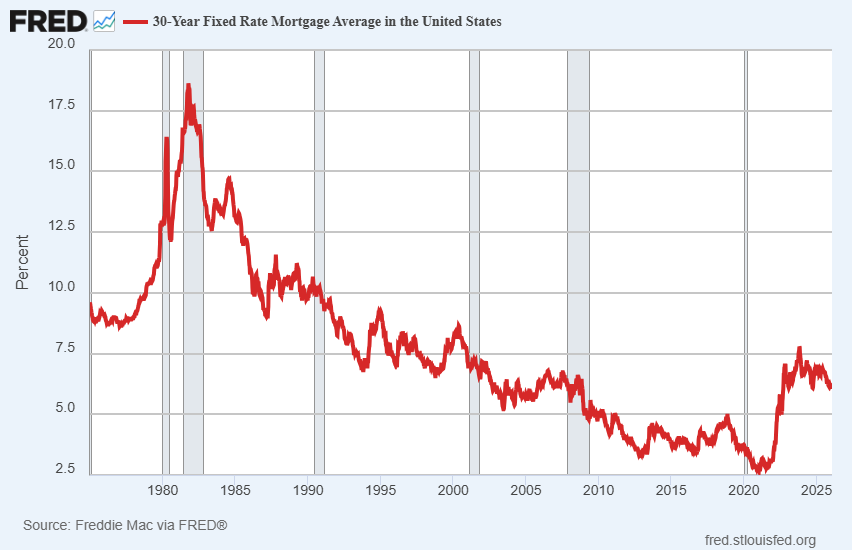

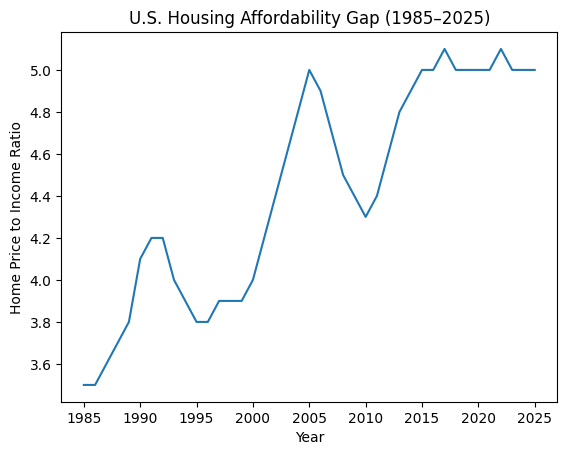

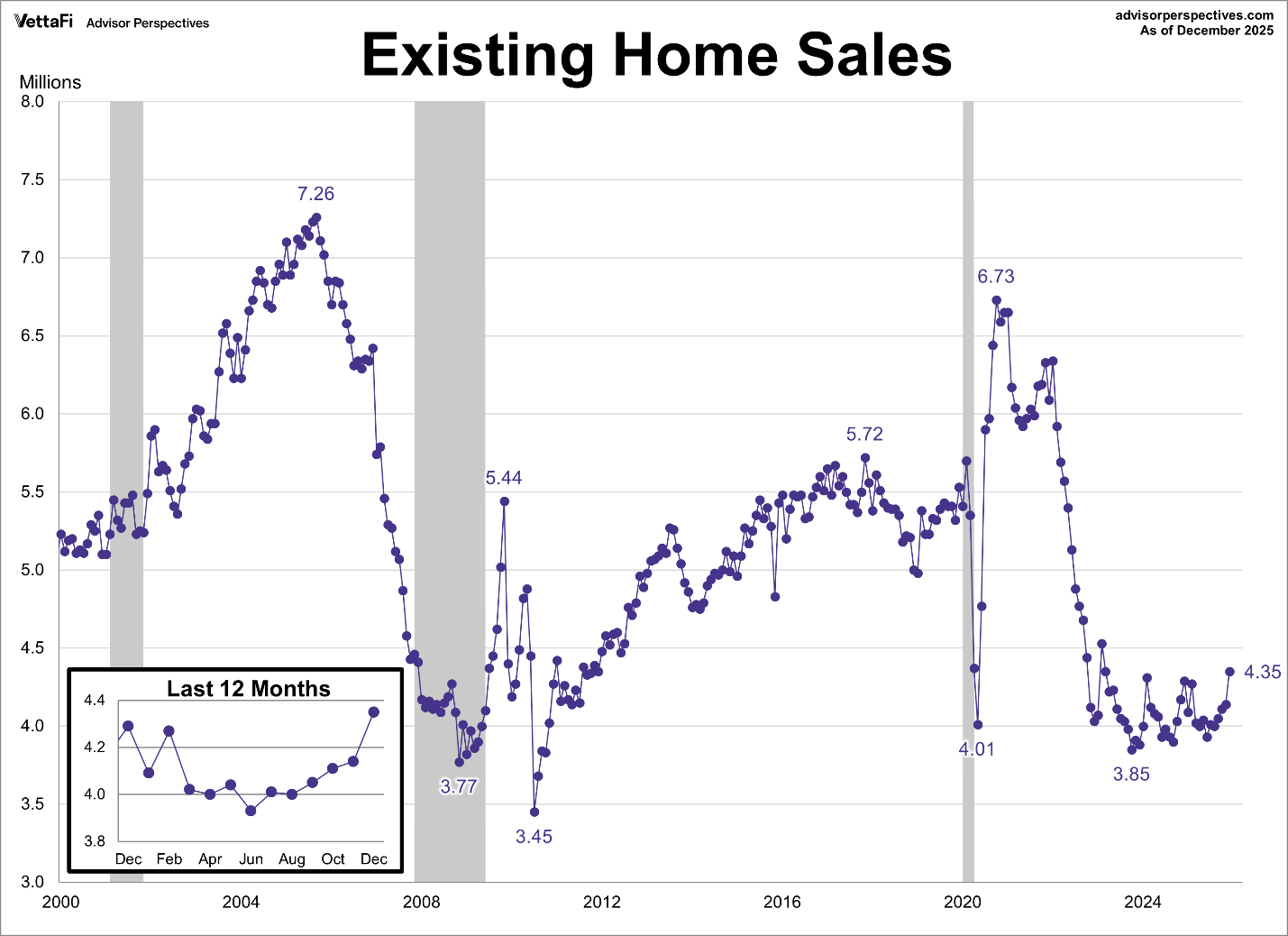

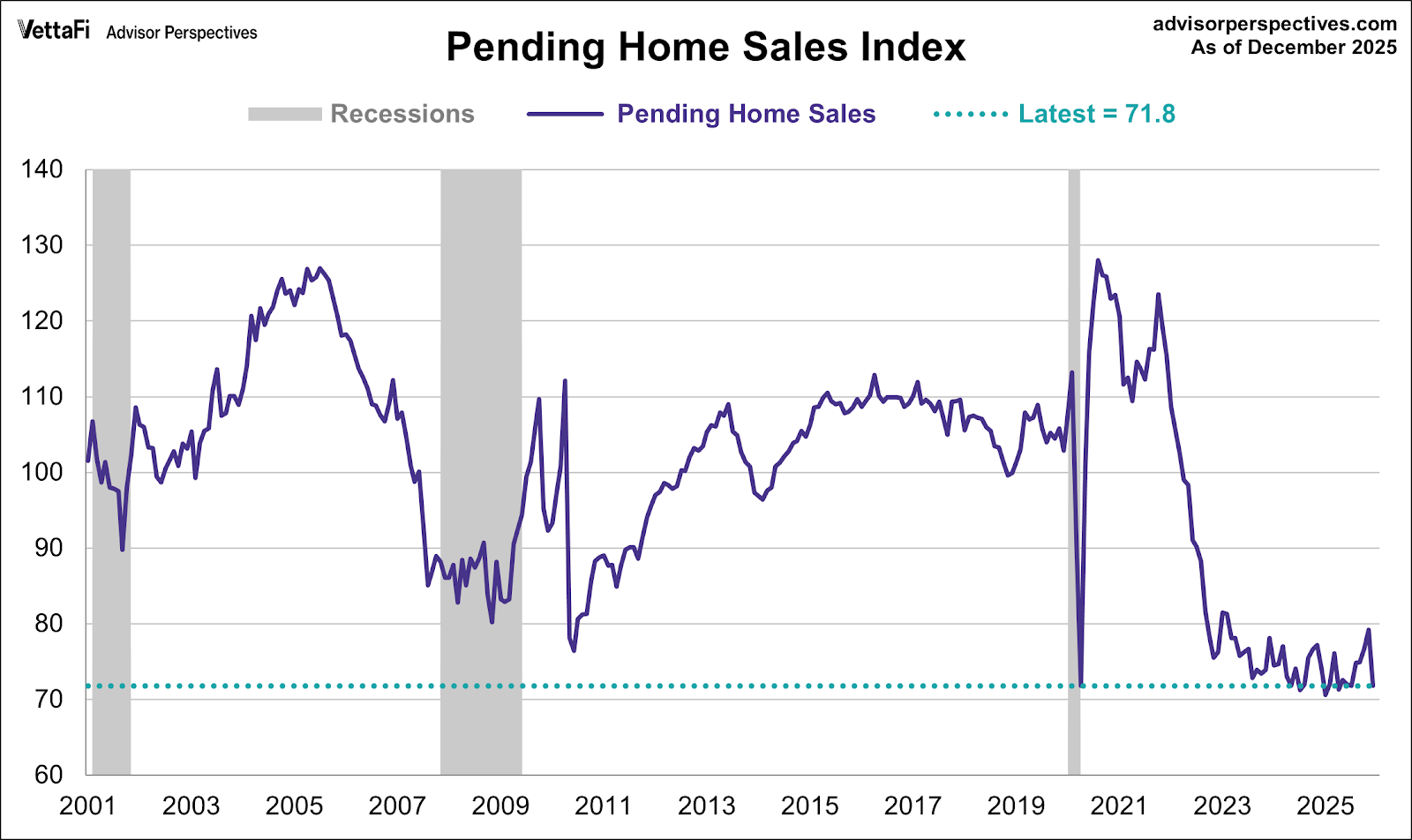

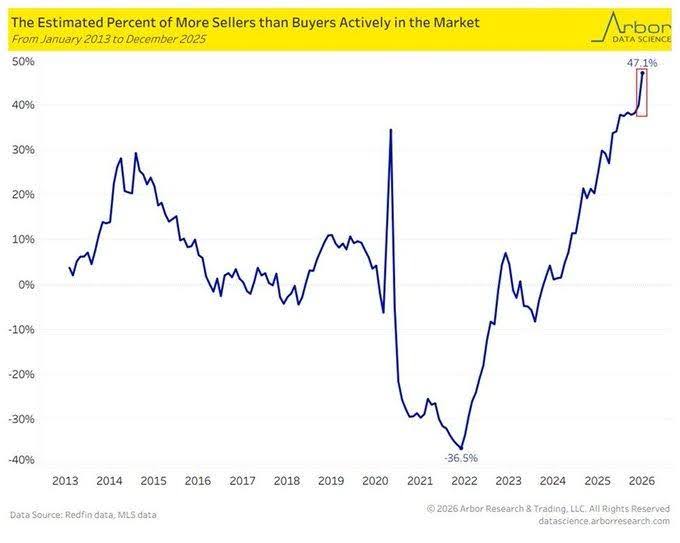

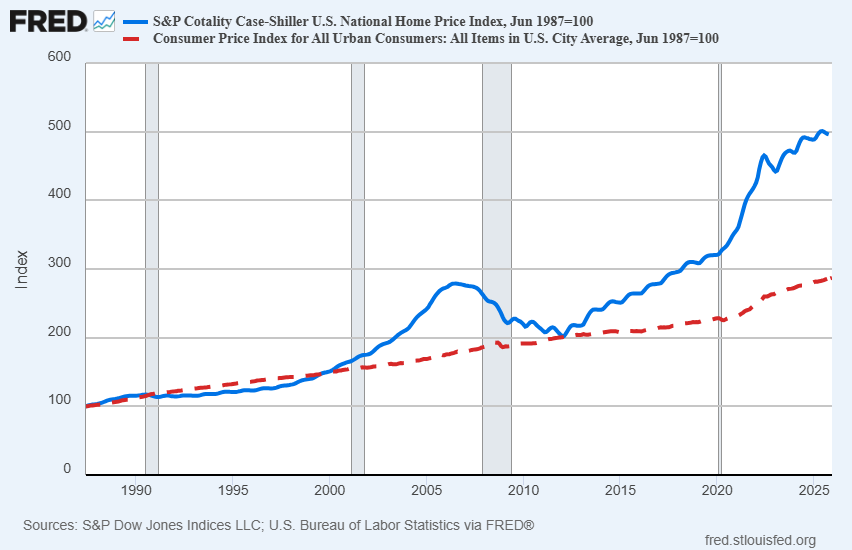

The U.S. housing market experienced a surge in home prices during 2021, driven by low mortgage rates and Federal stimulus. However, the Federal Reserve’s rate hikes in 2022 slowed this growth, due to higher mortgage rates (second graph) and reduced affordability (third graph). Home prices have outpaced household incomes (last graph), keeping the affordability gap near record highs. Existing home sales remain well below pre-pandemic levels, and pending sales are at their lowest since 2001, with many contracts falling through. Sellers hope for a return to previous price levels, but buyers are constrained by income levels and interest rates. Ultimately, the market may require a significant drop in price to restore affordability, as long-term trends suggest prices will eventually revert to the mean.

For further analysis, continue to read The Details below for more information.

“You understand, you can’t create prosperity by just handing out paper money.”

–Marc Faber

The Details

Incentivized by sub-3% mortgage rates, home prices skyrocketed in 2021. The Fed put an end to the rapid ascent in prices by raising the Fed Funds Rate in 2022. The graph below shows the rate of change in home prices.

Federal Covid stimulus and the Fed’s Quantitative Easing ushered in inflation not seen since the 1970’s. The jump in inflation pushed long-term interest rates higher. The 30-year mortgage rate rose from under 3% to a peak of 7.76% in short order, see the graph below.

With house prices rising faster than household incomes, homes simply became unaffordable for most families. The U.S. Affordability Gap or home prices divided by median household income, remains near all-time highs, even with the recent drop in home prices.

The sale of existing homes hovers around 4.35 million units annually. This remains near the lows and is a far cry from the 5.5 million pre-Covid levels, and nowhere near the 7.26 million units sold in 2005 as shown in the graph below. On a population-adjusted basis, homes sold are down 32% from the number sold in 2000 according to Advisor Perspectives.

A look at pending home sales confirms the lack of housing affordability as mortgage rates and prices remain high. The graph below shows pending home sales at their lowest level since 2001 when this data began being analyzed. Additionally, a record 16.31% of pending home sales fell out of contract.

Something has to give in the housing market. Currently, sellers are holding on to hope that the irrationality of home prices driven by sub-3% mortgages will return. Buyers, on the other hand, are clearly saying that they cannot afford homes at current prices and mortgage rates. It seems unlikely with the risk of inflation that mortgage rates will drop to 2021 levels. Even if the Fed continues to lower the Fed Funds Rate, there is no assurance that long-term rates, such as mortgages, will follow suit. So far, mortgage rates are not tracking the drop in the Fed Funds Rate.

The graph below from The Kobeissi Letter, via X, illustrates that there are currently 47.1% more sellers than buyers.

Eventually, sellers will realize that the prices of yesterday are gone, and in order to sell they will have to lower their prices. It is going to take a significant drop to close the affordability gap. Over the long run, home prices tended to track inflation. The graph below shows how irrational home prices have gotten. In order to return to the long-term mean, prices would need to drop around 42.5% on average. The administration’s stated desire to keep house prices propped up means that this type of drop might not occur in the near term. But, over time all things tend to revert to the mean.

Someone has to give. Since buyers are limited by their financial situation, it seems logical that sellers will eventually have to capitulate and lower prices. Monitoring Fed and Federal Government actions could provide answers for near-term moves; however, over the long term, the cycle will rule.

The S&P 500 Index closed at 6,916, down 0.3% for the week. The yield on the 10-year Treasury

Note rose to 4.24%. Oil prices rose to $61 per barrel, and the national average price of gasoline according to AAA increased to $2.86 per gallon.

© 2026. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.