Executive Summary

Prompted by the tragic Surfside condo collapse in Florida, new legislation—the Florida Condo Safety Act—now requires all condo associations with buildings three stories or higher to conduct a Structural Integrity Reserve Study (SIRS) and maintain dedicated reserve funds for structural repairs. Associations can no longer waive or reduce these reserves, nor use them for non-structural expenses. This has led to significant increases in HOA fees and special assessments, especially for older buildings with deferred maintenance. Many owners, particularly retirees, may struggle with the higher costs and face foreclosure if unable to pay. The law’s impact is driving more condos onto the market and could lead to further price reductions. Buyers are urged to conduct thorough due diligence before purchasing, focusing on reserve funds and inspection results.

For further analysis, continue to read The Details below for more information.

“Beware of little expenses; a small leak will sink a great ship.”

–Benjamin Franklin

The Details

Prompted by the horrific event which took place in Surfside, Florida, on June 24, 2021, when the 12-story condominium building called Champlain Towers South partially collapsed killing 98 people, legislation was passed in Florida, the ramifications of which are about to wreak havoc in Florida’s condominium market. With the cause of the Surfside tragedy attributed to structural issues, Florida passed the Florida Condo Safety Act in May 2022. Incorporated into the Act via amendment, is the requirement for a Structural Integrity Reserve Study (SIRS), or a financial and engineering assessment designed to identify major current and future repairs, for all condominium and cooperative associations with buildings three stories or higher. The initial deadline for the study was December 31, 2024; however, it was extended to December 31, 2025. In other words, the deadline has passed and Band Aids are no longer hiding the wounds.

Once the facility study is completed, the SIRS must include a recommended annual reserve funding schedule that estimates how much money the association needs to set aside each year to meet potential future costs. For budgets adopted after the completion of the study, associations cannot waive or reduce reserve funding for structural integrity items identified by the study and cannot use those reserve funds for other purposes.

So, what does all of this mean for condo owners? Condominium owners pay HOA (Homeowners’ Association) fees to cover operating costs of the association. Additionally, funds should be set aside into a reserve account to provide the liquidity to tackle major repair or replacement costs. In the past, many associations elected not to perform reserve studies. Also, the association boards could choose to kick the can down the road by waiving or reducing reserve funding. If a major repair crept up and the funds were not available, a special assessment was initiated to cover the costs. Unexpected special assessments can be devastating to retired condo owners.

Older associations with deferred maintenance can no longer kick the can down the road. New reserve requirements have increased anywhere from 30%-100% or more. And new elevated HOA fees do not eliminate the possibility of a future special assessment. Under the new law, structural reserve funds cannot be tapped for landscaping, pools, cosmetic upgrades, or even emergencies.

Imagine being retired and owning a condo for over a decade, not realizing the association was not keeping up with structural maintenance, and they had accumulated little in reserve funds. Assume your HOA fee was around $400-500 per month. Now, to satisfy the new statute, the HOA fee is raised to $1,100 per month, in addition to a one-time assessment of $30,000 for deferred maintenance. This is happening in coastal areas all around Florida. The result could be devastating as many condo owners will decide they can no longer afford the higher costs and will elect to list their units for sale. Unfortunately, this will not relieve them of their financial obligations. If they cannot satisfy the amount owed to the association, they could end up in foreclosure.

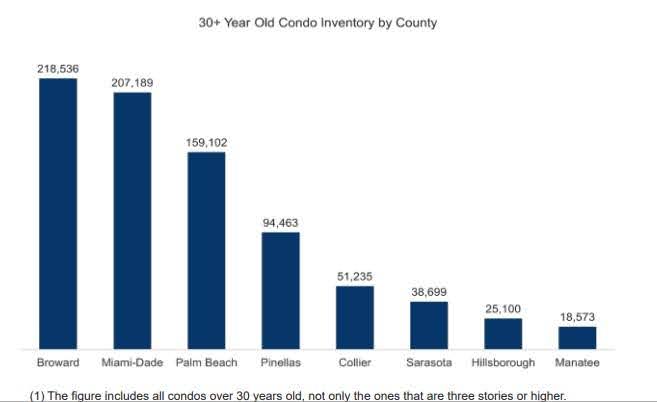

The older the units, the higher the probability that deferred maintenance problems could exist. According to The Future of Florida Condos: Facts & Statistics, by John Burns Research & Consulting, there are approximately 1.1 million condo units in Florida that are over 30 years old. Most are located in the following eight counties.

According to Zillow, there are around 52,300 Florida condos currently listed for sale. This number could soar as the ramifications of the recent law take effect. I expect listings and foreclosures to rise significantly. Some associations will be forced to evacuate and close their buildings.

The impact on some condo owners could be serious. Here is one example. If a condo owner facing a large assessment and the doubling of HOA fees cannot afford to pay, he will likely list his unit for sale. But, if there are structural issues with the building and reserves are underfunded, a lender could refuse a mortgage loan to the potential buyer. So even acquiring an interested buyer might not be enough if the purchaser cannot obtain funding, not because of their finances, but because of the financial status of the condo association.

Note that this issue is not confined to Florida. Other states could have condo associations with seriously underfunded reserves. However, because of the law passed in Florida, prompted by the Surfside collapse, the situation is currently more intense in Florida. The ramifications on the nationwide condo market are hard to predict. But, as corrections in the pricing of housing ensues, expect even greater adjustments in the condo market.

If you are considering purchasing a condo in Florida, I encourage you to review the actual SIRS document, do not take the word of the seller or a real estate agent. Also, review the financial statements of the condo association, with extra emphasis on the status of required and actual reserves. Examine board meeting notes. Do as much due diligence as possible. Doing these things ahead of time could prevent significant financial exposure in the future.

The positive side is that there could be an abundance of supply hitting the market, which should push prices down. If a particular association passes the required inspections and maintains sufficient reserves, they might be able to implement more reasonable HOA fees. Buying under these circumstances will give more comfort that unexpected financial hits will be less likely.

Whether you are interested in a summer retreat in Destin or a change in lifestyle in Siesta Key, if you are considering purchasing a condo, especially an older unit, it is critical that you do your homework. And patience could be your best friend.

The S&P 500 Index closed at 6,858, down 1.0% for the week. The yield on the 10-year Treasury

Note rose to 4.19%. Oil prices remained at $57 per barrel, and the national average price of gasoline according to AAA fell to $2.81 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.