Executive Summary

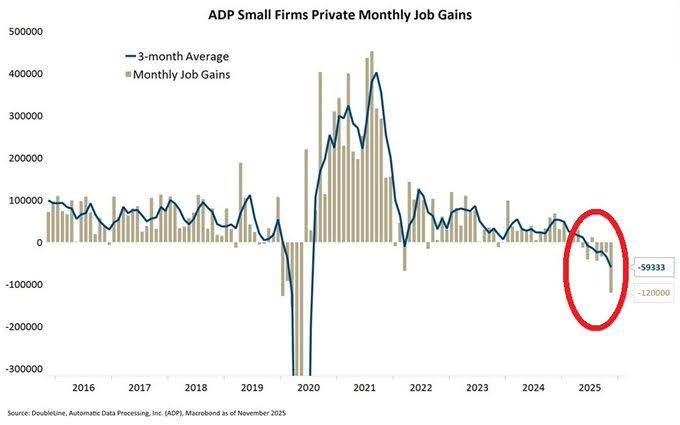

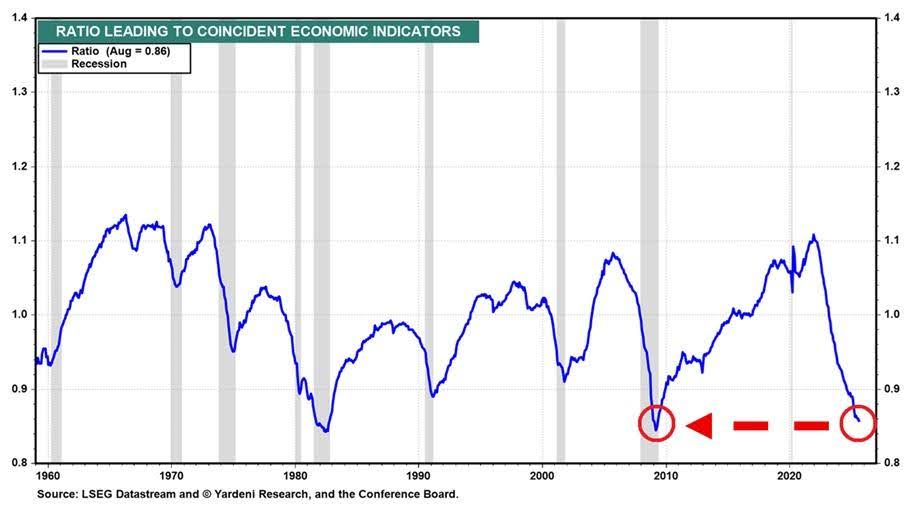

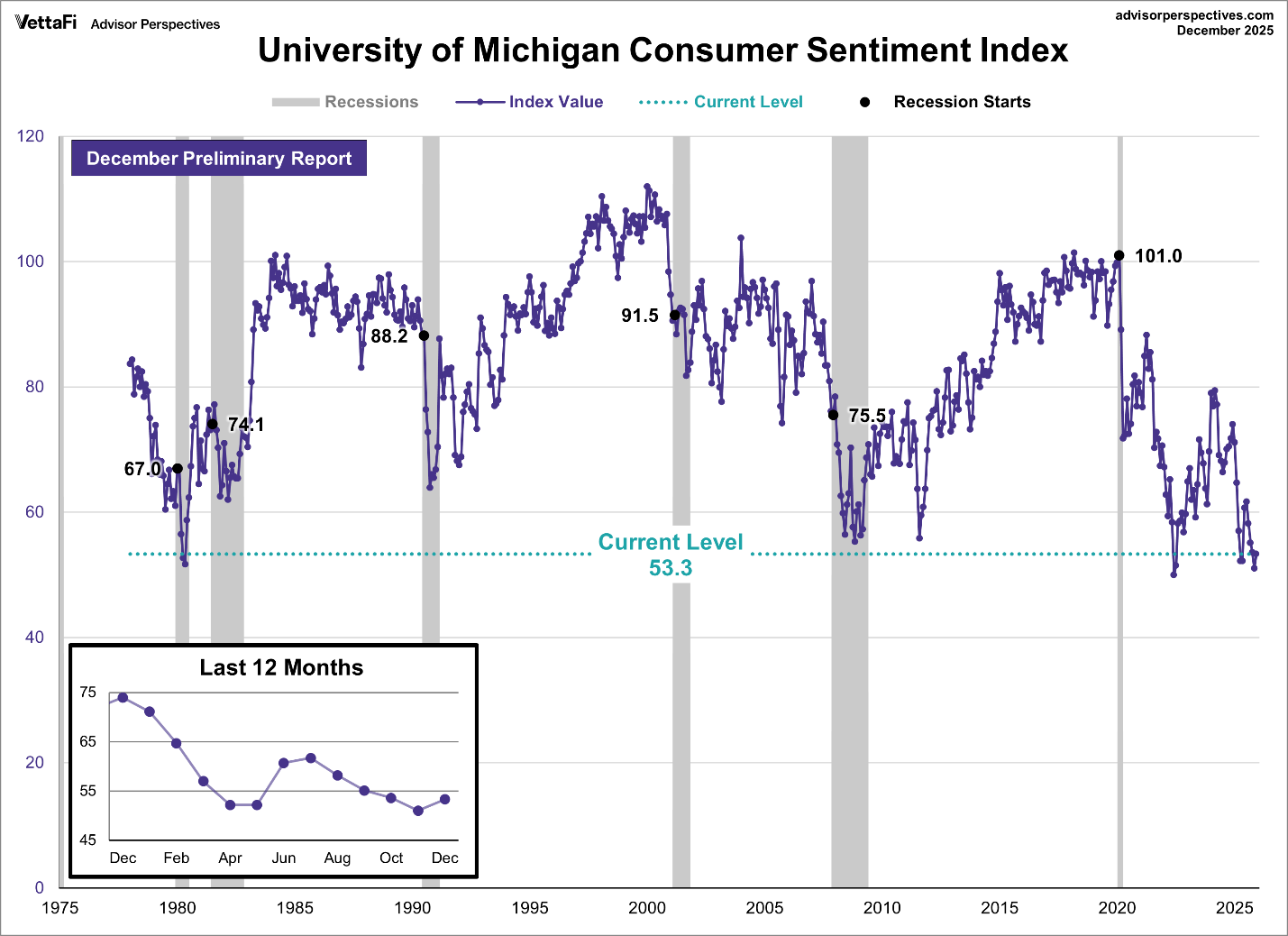

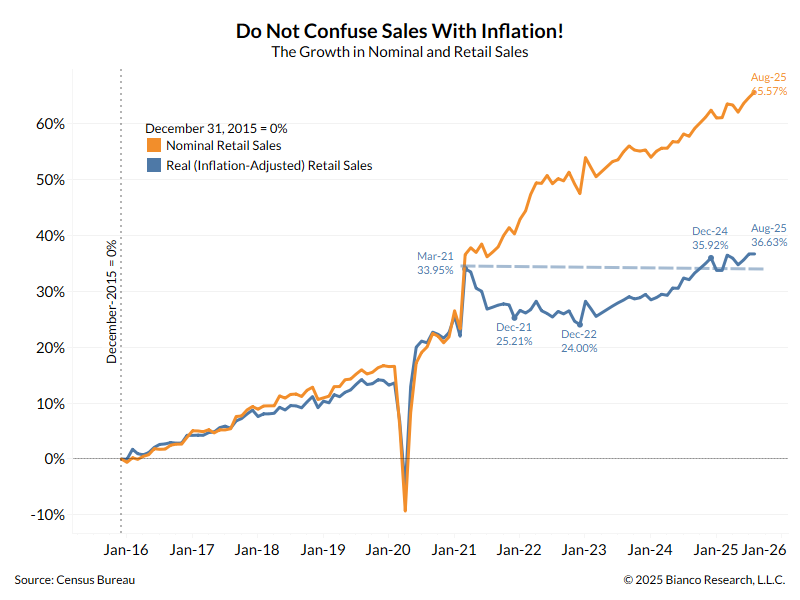

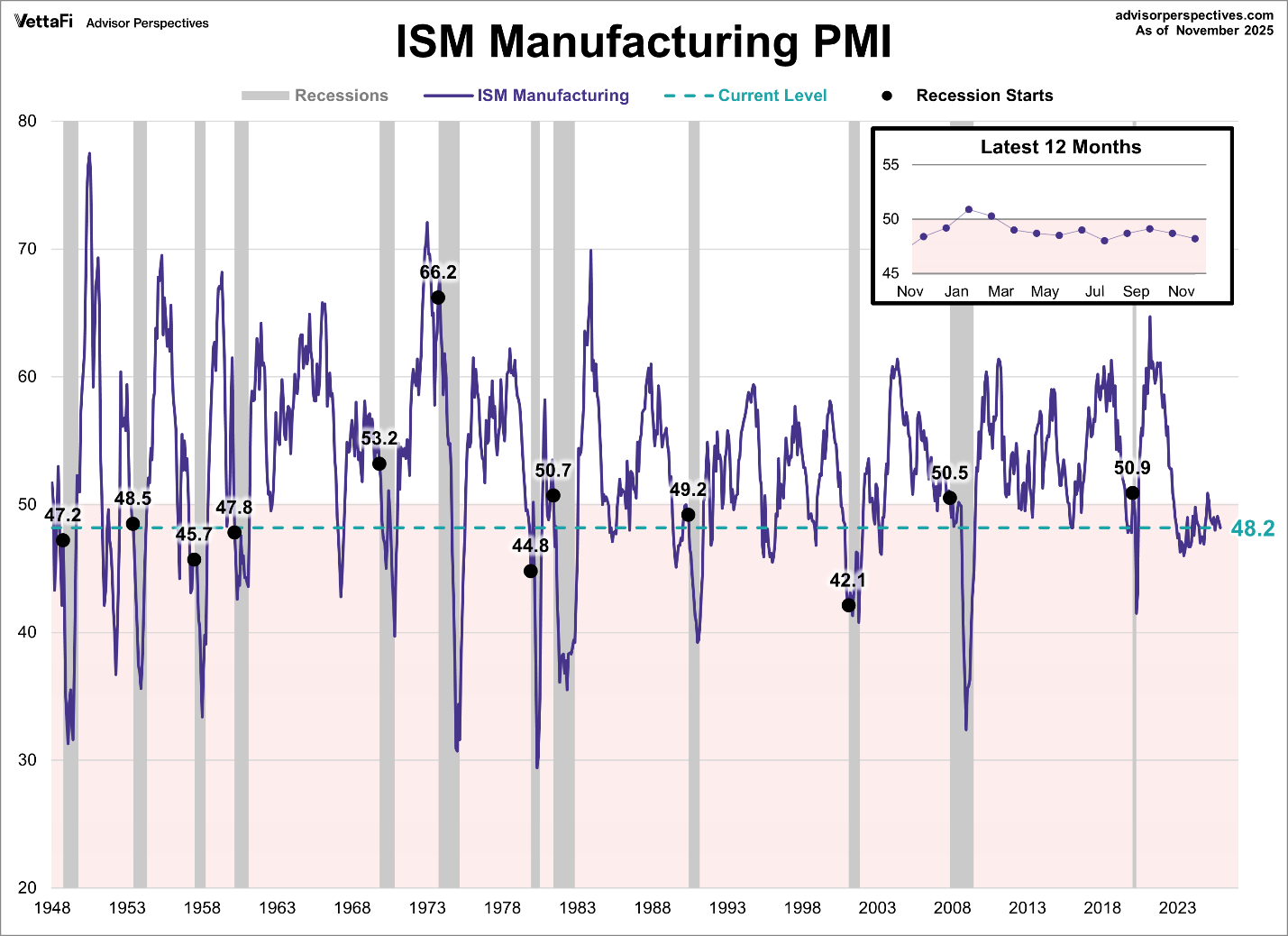

In this missive I will share how investors must feel confused when hearing contradictory information about the economy. The wealthy may feel the economy is strong as long as the stock market bubble is growing, but others may feel as they did in previous recessions. For instance, the November ADP employment report showed private employers shed 120,000 jobs – the most since 2008 (first graph). Small businesses are hurting as seen in the second graph where bankruptcies are up 83% since 2020. Both Leading Economic Indicators and Consumer Sentiment are in recessionary territory (third & fourth graphs). And post Thanksgiving, we were told consumers spent more. However, the fifth graph shows it is mainly due to inflation rather than growth of sales in units. Turning to manufacturing, the Purchasing Managers Index is now below 50, which is contractionary (see last graph). One can see, the data and the news may need to be separated.

For further analysis, continue to read The Details below for more information.

“There are severe limits to the good that the government can do for the economy, but there are almost no limits to the harm it can do.”

–Milton Friedman

The Details

It is quite normal, especially when elections approach, for politics to enter the realm of economic projections. One side wants the economy to shine, and the other is hoping for doom so they can capture more votes. I attempt to keep my analysis focused on the facts, not politics. However, it is very confusing for individuals to decipher the truth, when bombarded by contradicting messages about the economy. In this missive, I will review recent economic data along with current prognostications. However, one way to get a good feel for how things are progressing is by looking at your own situation and others who are close to you.

Even the data itself can appear conflicting on the surface. Treasury Secretary, Scott Bessent, recently stated he expects 3% GDP growth in 2025. Some people, including myself, might ask, “How can that be when so much of the data is recessionary?” A few points to consider: first, GDP is a lagging indicator; second, the data used to calculate GDP is often materially revised as further data is released; and third, current growth numbers are skewed to the upside by the tremendous investment in AI (Artificial Intelligence) data centers and supporting networks. However, it has yet to be determined whether or when these investments will result in profits. Those with a little gray in their hair might remember the massive investments in fiber optic cables and networking capabilities during the Technology Bubble. Despite the internet eventually becoming an integral part of our everyday lives, massive overinvestment in the late 1990’s led to the tremendous downturn of 2000-2002.

The current bifurcated economy seems to be humming along fine for the wealthy. As long as the stock market bubble continues to grow, their wealth increases. However, I will review a number of datapoints below which show that the economy for many individuals is similar to the depths of numerous prior recessions.

The jobs market has become especially weak. Because of the government shutdown, the October jobs report, and September revisions, were not released by the BLS. Note the reports from the BLS have been subject to such large revisions as to almost render them meaningless. However, we do have data released from the payroll service ADP. The following graph, via Global Markets Investor on X, shows recessionary private jobs levels. The November report showed how private employers shed 120,000 jobs, the most since 2020.

Small businesses filing for bankruptcy are soaring. The number of small businesses that have filed for Chapter V bankruptcy has increased 83% over the past five years as shown in the chart below from The Kobeissi Letter via X.

Also from The Kobeissi Letter, “US leading economic indicators are still deteriorating: The ratio of US leading to coincident economic indicators is down to 0.85, the lowest level since 2008. This ratio has now declined for 4 consecutive years.

The Conference Board Leading Economic Index (LEI) tracks forward-looking data, including consumer expectations, manufacturing orders, weekly hours, and initial jobless claims. Meanwhile, the Coincident Economic Index (CEI) measures current economic conditions in real time, such as nonfarm payrolls. Historically, in every case where this ratio has declined as sharply as it has now, the US economy was in a recession.

Consumer Sentiment as shown in the University of Michigan Consumer Sentiment Index is below levels witnessed at the start of the last six recessions.

Many people might wonder how sentiment can be so low when they were just told by the media that people spent more than ever over the Thanksgiving holidays. However, it is important to remember that an increase in sales does not necessarily mean an increase in units. The following graph from Bianco Research illustrates that the recent surge in sales is largely due to inflation or higher prices.

Turning to manufacturing, the ISM (Institute for Supply Management) Manufacturing PMI (Purchasing Managers’ Index) is below 50 at 48.2. This indicates manufacturing is contracting and is consistent with recessionary readings.

The one area that is screaming growth is investment in AI. And, as stated, the outcome of this investment is unknown, and could rhyme with the investment in technology prior to the bursting of the Tech Bubble.

It is okay to hope for a strong economy. And for political reasons, I fully understand the desire for one party to celebrate any economic victory possible, because votes depend upon it. But, to really understand the status of the economy, it is important to separate the wheat from the chaff!

The S&P 500 Index closed at 6,870, up 0.3% for the week. The yield on the 10-year Treasury

Note rose to 4.14%. Oil prices increased to $60 per barrel, and the national average price of gasoline according to AAA fell to $2.96 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.