Executive Summary

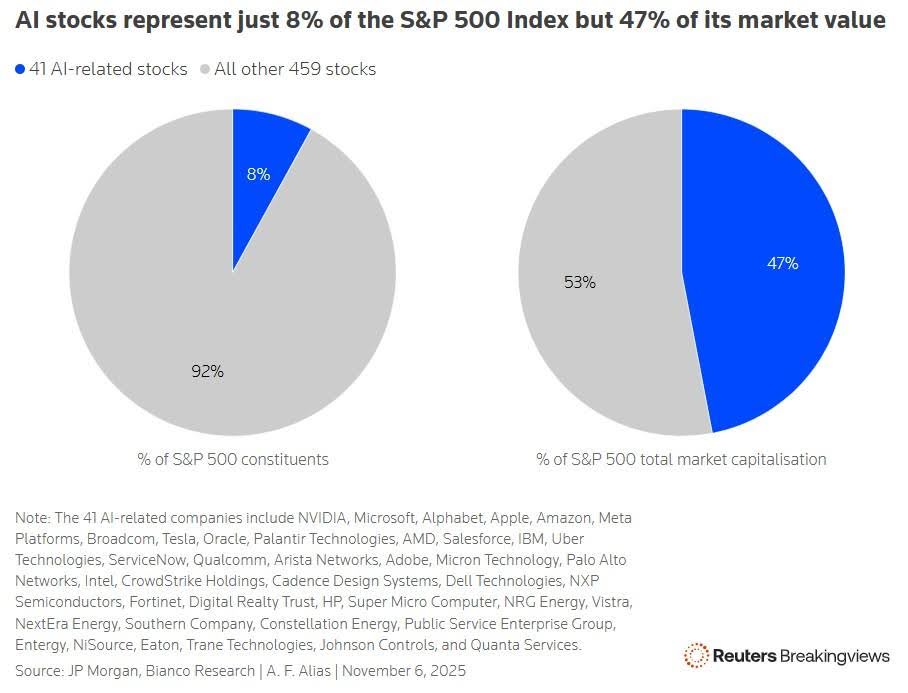

Much of this issue is from a recent Reuters article by Edward Chancellor entitled “Stock market frenzy is a loud echo of the 1990s.” “Fred Hickey, editor of The High-Tech Strategist publication since 1987, used his knowledge of the high-tech industry to highlight wild market excesses during the 1990’s.” Hickey still publishes his newsletter and finds the current market very similar to the dot.com mania. Most important is his skepticism of AI’s impact. He refers to an MIT test of performance of chatbots against humans, and humans beat every model. Thus, he believes when the limitations of GenAI are realized, the overbuilding and investing of these tech companies will result in collapse of both profits and valuations. Currently 41 AI stocks represent 8% of the S&P 500, while their valuations represent 47%, creating an enormous amount of concentration risk on hopes of GenAI. Hickey now believes this time is even crazier than the dot.com era.

For further analysis, continue to read The Details below for more information.

“Man prefers to believe what he prefers to be true.”

–Francis Bacon

The Details

The following information is from a recent Reuters article by Edward Chancellor entitled “Stock market frenzy is a loud echo of the 1990s.” As editor of The High-Tech Strategist publication since 1987, Fred Hickey used his knowledge of the high tech industry to highlight wild market excesses during the 1990’s. Often ridiculed, eventually he was vindicated. However, he did get one thing wrong. He wrote in December 1999, “The lunacy of tech stock valuations is beyond description…I’m certain I’ll never see it again in my lifetime.” This might sound familiar if you read my newsletter last week entitled, “How Are Stock Valuations Justified?” “Hickey still publishes his monthly investment newsletter. He finds much to remind him about earlier dotcom mania. Except this time, he believes [like me] the market is even crazier.”

This too won’t sound unfamiliar to frequent readers, “Today, Hickey observes speculative excesses across the investment world: an options market dominated by zero-day-to-expiry options that provide leverage for day traders; investors conditioned by years of support from the Federal Reserve to buy into every dip, giving the market an aura of invincibility; spoof cryptocurrencies serving as gambling chips for nihilistic speculators; margin debt far above its 2021 peak; and mutual funds’ cash levels at record lows. ‘I’ve seen it all before during the height of the 1999/00 dotcom mania,’ writes a weary Hickey.”

Hickey goes on to highlight the extreme market concentration in AI related stocks. I found his comments on the AI exuberance interesting. “…today he’s extremely sceptical about the future impact of AI. He distinguishes between artificial intelligence, a technology that has been around for decades, and generative AI, which is at the epicenter of the current frenzy. ‘GenAI is probably the most over-hyped technology I’ve ever witnessed in my 45 years of following tech stocks,’ he writes. We are told that GenAI will shortly be in a position to cure cancer, write Shakespeare, win Nobel prizes, and drive soaring productivity growth. In short, as Meta’s Mark Zuckerburg says, it may be ‘the beginning of a new era for humanity.’

Hickey does not buy into this narrative. He points to the profound limitations of large language models (LLMs): chatbots are unable to reason, have no ties to the real world and are incapable of adapting to change. MIT recently tested the performance of a variety of chatbots against humans, and humans crushed every model. […]

Proponents of AI believe that bigger models and more computational power will overcome these problems and lead to the holy grail of superintelligence. Hickey dismisses such predictions.”

Some of those critiquing AI point out that “humans think in terms of mental models whereas GenAI is only capable of ‘regurgitating’ information.” AI is currently incapable of learning from experience. “They lack a goal which, [Richard] Sutton believes, is the essence of intelligence.”

“Hickey believes that the inherent shortcomings of GenAI will eventually be recognized. When that day arrives an enormous overbuild of computer servers and storage will become evident and tech profits and valuations will collapse – just as they did 25 years ago.”

The bottom line is that stock prices are massively overvalued and are being led by “hopes” that AI can produce “miracle” results that many skeptics believe unfeasible. Though drawn out longer than dreamed possible, the end will likely rhyme with the unraveling of the previous Tech Bubble. As Hickey stated, and I agree, “this time is even crazier.”

The S&P 500 Index closed at 6,729, down 1.6% for the week. The yield on the 10-year Treasury

Note fell to 4.09%. Oil prices decreased to $60 per barrel, and the national average price of gasoline according to AAA increased to $3.07 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.