Executive Summary

While the stock market is rising, so also is the U.S. Federal Debt. Currently the balance is rapidly approaching $38 trillion. In the first graph, one can see the Federal deficit spending. With the employment picture weakening, the suspected response from the Government to a recession would be more stimulus or spending. If this ignites inflation, then interest rates could go higher, and the cost of debt increases (second graph). Interest expense and defense spending account for two-thirds of Government spending (excluding Social Security and Health Care), which leaves only one-third of tax revenue for all the other Government expenditures. With ailing Social Security and Medicare programs also exacerbating the problem, the crisis continues to build with no solution from Congress. It seems the road to the turning point to solve the problem is getting shorter.

For further analysis, continue to read The Details below for more information.

“Politicians and diapers must be changed often, and for the same reason.”

–Mark Twain

The Details

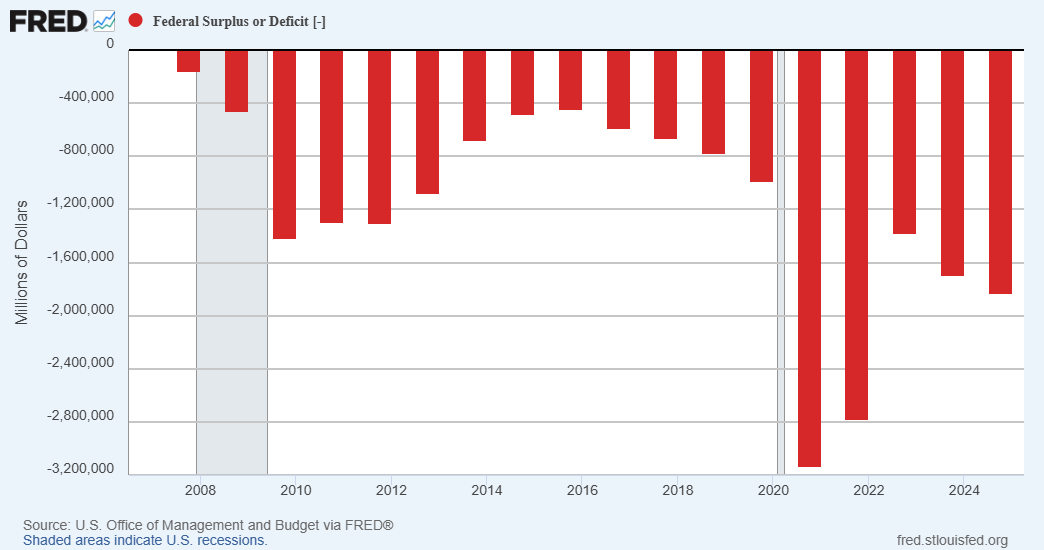

With investors currently enamored by the unstoppable expansion of the stock market bubble, many have lost sight of the crisis brewing in the Federal Government. According to USDebtClock.org, Federal debt is rapidly approaching $38 trillion, presently at about $37.8 trillion. Congress continues to fight over a Continuing Resolution to re-open the Federal Government, with some members attempting to insert even more spending to further increase deficits. The graph below shows annual fiscal deficits. Notice that in 2019, prior to the pandemic, the deficit was slightly under $1 trillion. In 2020, Covid spending pushed the deficit to over three times the 2019 level. The next couple of years saw the deficit shrink back to a still large $1.4 trillion, only to begin rising again in 2023. The estimated deficit for 2025 is around $1.9 trillion.

As written in several recent newsletters, the employment picture is rapidly weakening, and many areas of the economy are exhibiting recessionary activity levels. A recession at this time would likely elicit the typical reaction from the Government, implementing stimulus to attempt to boost consumer spending. This action would send deficit spending back towards 2021 levels. The problem with this solution is that it could re-ignite inflation, forcing interest rates higher.

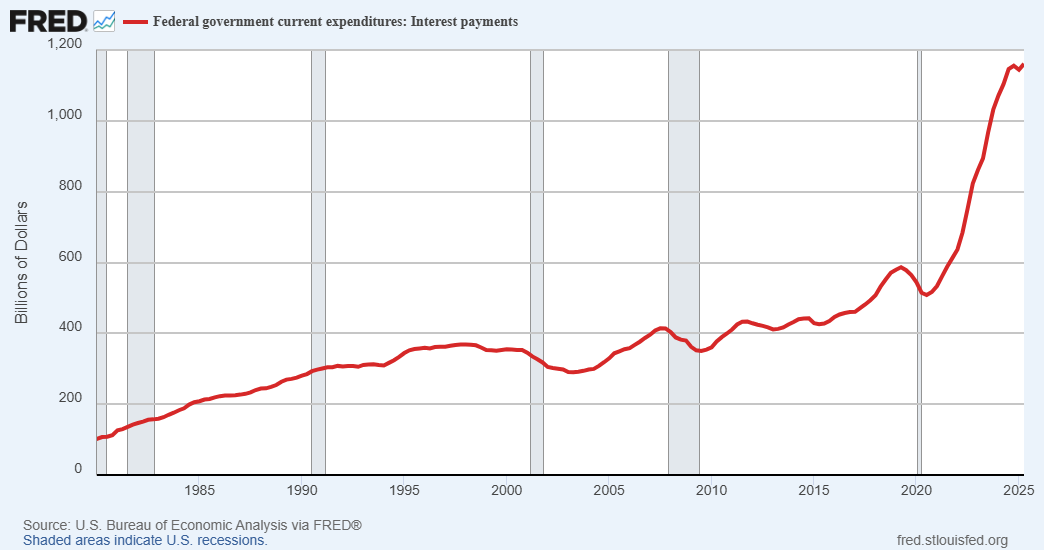

If this happens, Federal revenues will likely suffer. Currently, excluding tax collections associated with Social Security and Health Care (Medicare, etc.), one-third of Federal receipts are spent on interest on the Federal debt. Interest expense is pushing $1.2 trillion annually, as shown in the graph below. Any move higher in interest rates will send that number upwards.

When defense spending is added in, just shy of two-thirds of non-Social Security and Health Care spending is consumed. Imagine that two-thirds of Federal revenue covers only interest expense and defense spending. So, one-third of revenue has to cover all other spending.

To say this is a crisis is an understatement, yet no serious action is being taken by Congress to reduce spending. And to make matters worse, the revenue collected for Social Security and Health Care is insufficient to cover the related expenditures. While some of this shortfall is covered by the rapidly diminishing Trust fund, any further shortage requires additional borrowing to meet the spending.

The current expectation is that if a recession arrives, Federal spending increases, inflation rises faster, pushing interest rates higher. If interest rates rise even a couple percent, interest costs could increase by $750 billion. At this time there is no easy solution. Even if Congress slashed the Federal budget, the result would be a deeper recession. Although, at some point, one has to pay the piper. The can cannot be kicked down the road indefinitely. The road is getting shorter and shorter.

The S&P 500 Index closed at 6,716, up 1.1% for the week. The yield on the 10-year Treasury

Note fell to 4.12%. Oil prices decreased to $61 per barrel, and the national average price of gasoline according to AAA remained at $3.13 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.