Executive Summary

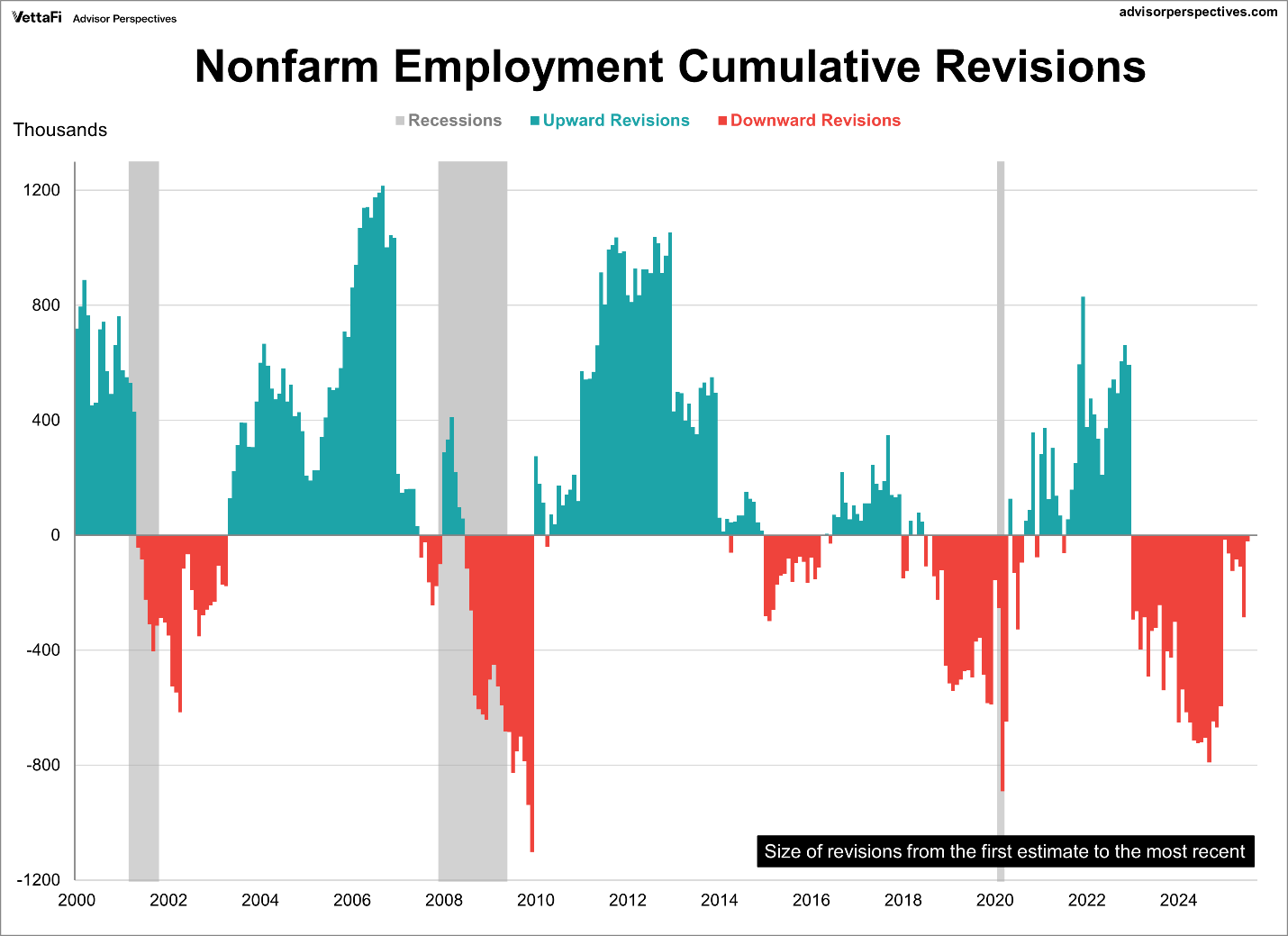

The one piece of the economic puzzle which had appeared to defy gravity was employment; however, the picture changed with last week’s revision. Between last week’s revision for the period April 2024-March 2025 and the prior revision for same period 2023-2024, 1.5 million previously reported jobs vanished. The two graphs below are before these revisions yet still reflect downward employment trends coinciding with recessionary data. That does not mean the U.S. is in recession, but it may be the last straw before one is declared. There are differing viewpoints, and additional data will make for a clearer picture.

For further analysis, continue to read The Details below for more information.

“An error doesn’t become a mistake until you refuse to correct it.”

–Orlando Aloysius Battista

The Details

The one piece of the economic puzzle which had appeared to defy gravity was the jobs data. I have been writing for a long time that the monthly jobs reports did not add up, something seemed amiss. While I was examining weak economic data, the Bureau of Labor Statistics (BLS) was issuing strong initial jobs reports. Then, as discussed in my missive last week, when no one was looking, the reports were revised lower. While I do not take any joy in reporting weak jobs numbers, at least the annual benchmark revision adds credence to my initial thesis.

Last week, the BLS announced its annual revision for the period April 2024 through March 2025. The adjustment wiped away 911,000 jobs, in the largest revision in history. The previous year’s adjustment (April 2023 through March 2024) was finalized down 598,000 jobs. These two adjustments eliminated over 1.5 million previously reported jobs. Obviously, the economy was much weaker than proclaimed. The graph below from VettaFi shows the impact of the cumulative revisions to nonfarm employment, before last weeks record setting downward adjustment. Notice the correlation with recessions (in gray).

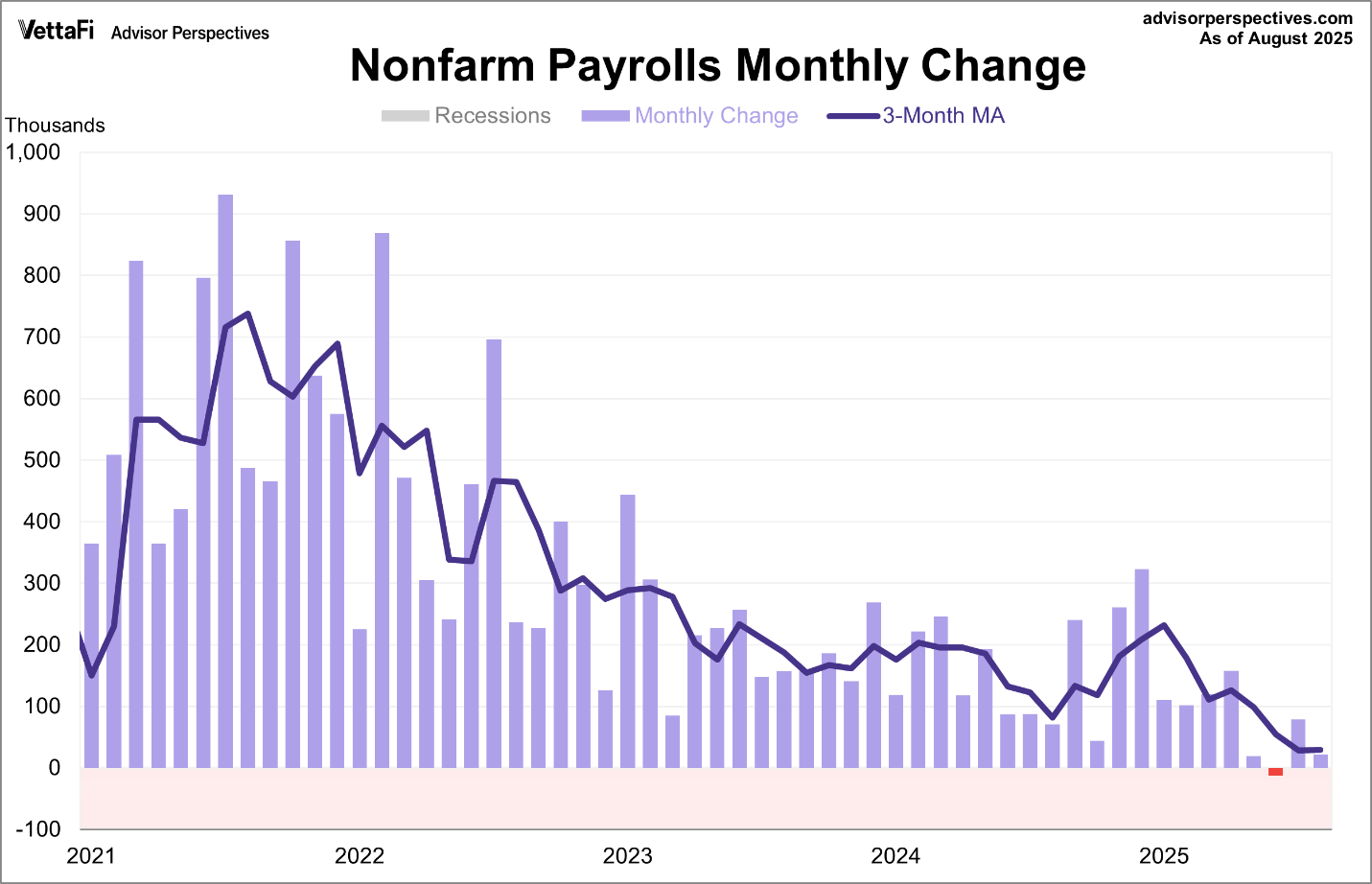

The following graph, also from VettaFi, illustrates the monthly change in employment over the last four years, including a line representing the three-month average. The current level of the three-month average is 29,000, which is the lowest level since the aftermath of the pandemic. And once again, this is before last week’s benchmark revision.

The downward trend in the employment data is evident in the graph above. With manufacturing in contraction, services slowing, and consumers loaded with debt, the one area touted as “strong” was employment. Now, after many revisions, it appears employment was much weaker than originally reported. Was that the last straw? Is a recession here? Some believe the U.S. has been in a recession for a while; others contend one has not begun. As more data is revised, the picture will become clearer. The data is pointing towards a recession.

The S&P 500 Index closed at 6,584, up 1.6% for the week. The yield on the 10-year Treasury

Note fell to 4.06%. Oil prices rose to $63 per barrel, and the national average price of gasoline according to AAA decreased to $3.18 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.