Executive Summary

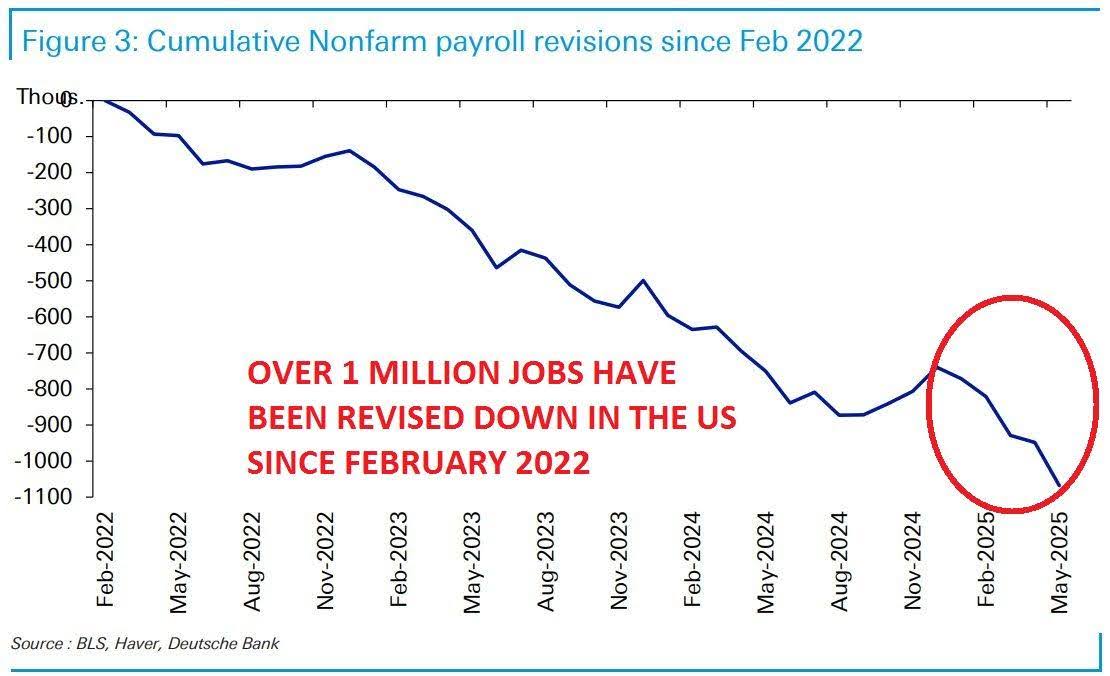

There have been discussions lately about the reliability of the monthly “new jobs” report released by the Bureau of Labor Statistics (BLS). The magnitude of subsequent monthly revisions is the source of the discussions. Each month the BLS uses the Establishment Survey combined with “seasonal adjustments” and a “birth/death” model of new and closed businesses, to produce employment numbers. One challenge is survey responses have dropped from about 61% down to 43%. Subsequent to initial monthly new jobs numbers, revisions are made based on more data. However, the negative trend of revisions to the data since 2022 (shown in the graph below) is concerning. Thus, should the BLS wait to release more accurate data?

For further analysis, continue to read The Details below for more information.

“Torture the data, and it will confess to anything.”

–Economist Ronald Coase

The Details

There have been many discussions lately about the reliability of the monthly new jobs report as released by the Bureau of Labor Statistics (BLS). The magnitude of the monthly revisions led the President to fire BLS Commissioner Erika McEntarfer. On Tuesday morning, September 9, the BLS will be issuing the Preliminary Annual Benchmark Revision for March 2025. Goldman Sachs estimates the annual revision will reduce previously announced new jobs by about 550,000-950,000. If the revision is anywhere within this range, expect more fireworks.

Each month, the BLS uses a statistical sample to survey approximately 121,000 businesses and government agencies representing about 631,000 individual worksites using the Current Employment Statistics (CES) survey (also known as the Establishment Survey). This is out of an estimated population of around 12.2 million businesses and 155.7 million employees. Using the responses, they develop the initial monthly estimate of new jobs created. Included in this estimate is a separate “guesstimate” of how many new businesses were created and how many stopped doing business. This is called the Birth/Death model.

One of the issues with the initial jobs estimate is the low survey response rate. The response rate has fallen from about 61% in 2015 to around 43% recently. The response rate increases in subsequent months, as late survey arrivals are received. The exorbitant downward revisions in the year-to-date jobs numbers have caused many analysts to question the validity of the data. During the year-to-date period through August 2025, 1,080,000 new jobs were initially reported. This was subsequently revised down to only 598,000 or about 75,000 per month on average. But to muddy the waters further, the Birth/Death adjustment year-to-date (before seasonal adjustments) totals about 961,000 new jobs or about 120,000 monthly. This number is truly a “guesstimate.” Notice that the Birth/Death adjustments are more than the revised new jobs numbers. Is this number accurate or merely a place to allow a “fudge factor”?

The graph below shows the downward trend in revisions since February 2022 (via Global Markets Investor on X).

Once a year, the monthly CES surveys are reconciled with the Quarterly Census of Employment and Wages (QCEW) report. The QCEW is a BLS report that provides data on employment and wages which it obtains from the state unemployment insurance reports. When the annual report is issued on Tuesday, it is possible that the adjustment will be greater than the number of new jobs created so far this year.

With such large monthly and annual revisions to the data, it makes one wonder whether the initial report is so unreliable it should not even be reported. Maybe only revised reports should be issued. Many economists and market participants seem to attribute too much weight to the monthly number which, after revisions, renders the initial reading useless. It seems to me that even if it is a little late, if it is more accurate, it might make sense to wait. Why release distorted data?

The S&P 500 Index closed at 6,482, up 0.3% for the week. The yield on the 10-year Treasury

Note fell to 4.09%. Oil prices dropped to $62 per barrel, and the national average price of gasoline according to AAA increased to $3.20 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.