Executive Summary

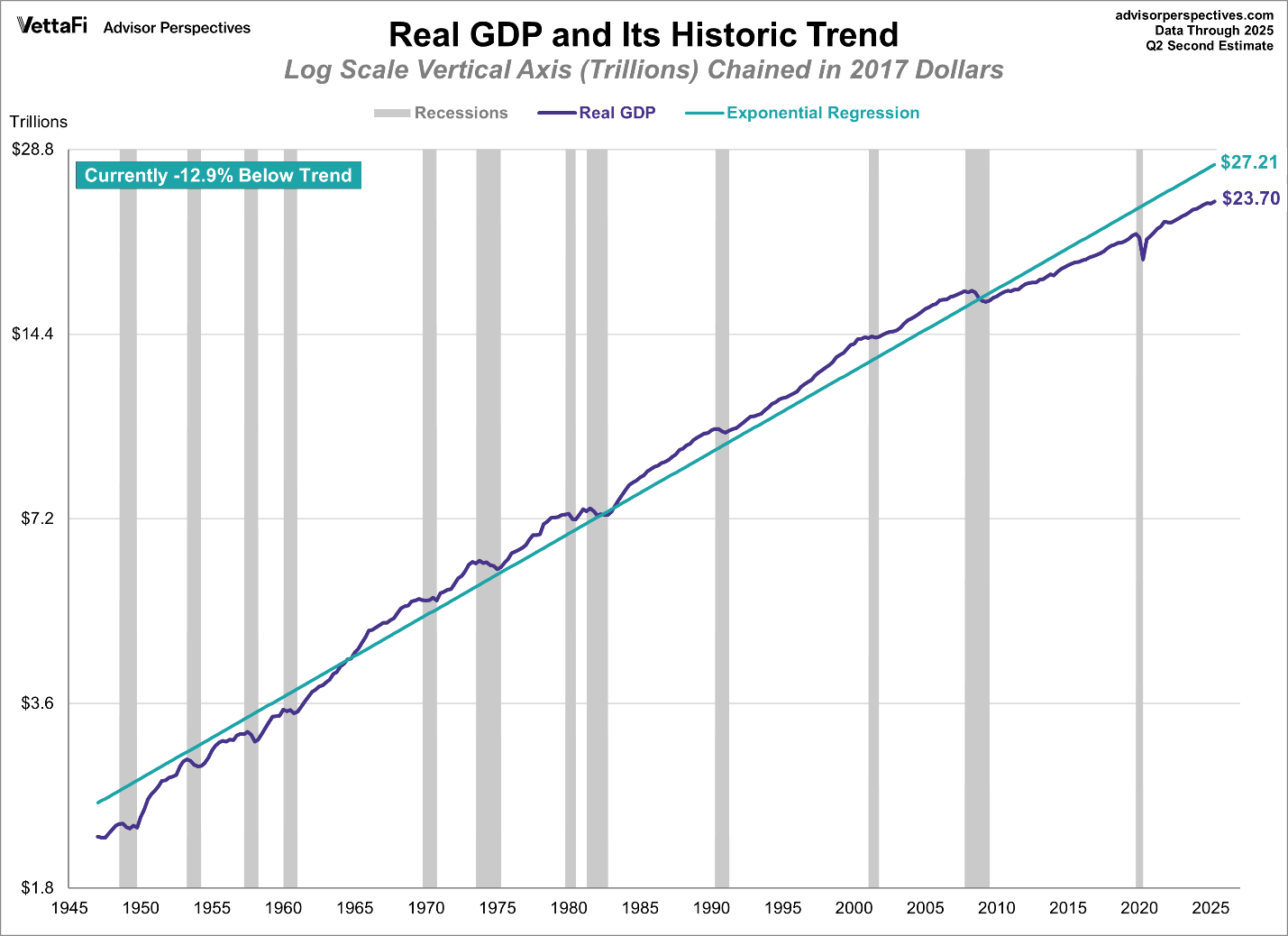

The U.S. Federal debt is now over $37 trillion. In the first graph below, one can see Real (inflation adjusted) GDP growth is now 12.9% below the long-term trend. Economist Lacy Hunt has stated studies indicate when Federal debt-to-GDP exceeds 90% for five consecutive years, economic growth falls by a third. Federal debt-to-GDP surpassed the 90% mark in 2010 (see yellow mark graph two) and continues to increase. From 2009 to mid-2025, the average annual increase in Federal debt was about 7.9% per year, while real economic growth averaged only 2.2% annually. In case one is still wondering the answer to the title question, it is debt.

For further analysis, continue to read The Details below for more information.

Government is the only institution that can take a valuable commodity like paper, and make it worthless by applying ink.”

–Ludwig von Mises

The Details

Federal debt is an anchor weighing down potential economic growth. Notice in the graph below from VettaFi, real (inflation-adjusted) economic growth has lagged the long-term trend since 2009. Currently, real GDP growth is 12.9% below the long-term trend. And the gap is getting wider, not narrower.

Economist Lacy Hunt has stated that studies indicate that when Federal debt-to-GDP exceeds 90% for five consecutive years, economic growth falls by a third. The chart below shows that Federal debt-to-GDP surpassed the 90% mark in 2010 and never looked back. Despite the brief pullback, after the Covid debt surge, the trend remains on an upward trajectory.

As shown in the first graph above, the last time real GDP growth fell below trend for any length of time was in the 1940’s through about 1965. The previous peak in debt-to-GDP was around 1946 at about 119%, due to the borrowing associated with World War II. After 1946, debt-to-GDP descended until the recession in 1974. By 1965, debt-to-GDP had fallen to 43%. Real GDP growth from 1950 to 1965 averaged about 4.6% per year.

Contrasting to more recent times, debt-to-GDP has been accelerating since the bursting of the Technology Bubble around 2001. However, the debt balance began to soar during the Great Recession (2007-2009). During the 16.5 year period, from 2009 to mid-2025, the average annual increase in Federal debt was about 7.9% per year, while real economic growth averaged only 2.2% annually. The dwindling Social Security Trust fund, rising Federal expenditures, and the significant increase in interest expense, means the gap-to-trend will not likely be filled anytime in the near future.

Until debt is taken more seriously, real economic growth will lag further from the long-term trend and debt will continue to soar. The higher the debt-to-GDP ratio, the heavier the anchor on real economic growth.

The S&P 500 Index closed at 6,460, down 0.1% for the week. The yield on the 10-year Treasury

Note fell to 4.23%. Oil prices remained at $64 per barrel, and the national average price of gasoline according to AAA increased to $3.19 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.