Executive Summary

Last Friday, Fed Chair Jerome Powell spoke at the now infamous Jackson Hole meeting. In The Details below are excerpts from his talk. However, the markets only appeared to care about the following quote: “…the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Even though he mentioned the Fed’s dual mandates were in tension, due to the apparent rising unemployment situation and the slowing economy, markets were optimistic. The first graph below displays the rise in long-term unemployment. And the second graph shows inflation higher than the 2% mandate. So now with the Fed boxed in, time will tell if the greater risk is rising inflation or rising unemployment.

For further analysis, continue to read The Details below for more information.

“I was reading in the paper today that Congress wants to replace the dollar bill with a coin. They’ve already done it. It’s called a nickel.”

–Jay Leno

The Details

Last Friday, Fed Chair Jerome Powell spoke at the now infamous Jackson Hole meeting. As expected, investors waited with bated breath to hear hints of looser monetary policy, specifically, lower interest rates. According to the market reaction, he must have delivered the hoped for signal. But is that really what he said? Below are excerpts from his speech.

“Changes in trade and immigration policies are affecting both demand and supply. In this environment, distinguishing cyclical developments from trend, or structural, developments is difficult. This distinction is critical because monetary policy can work to stabilize cyclical fluctuations but can do little to alter structural changes. […]

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

At the same time, GDP growth has slowed notably in the first half of this year to a pace of 1.2 percent, roughly half the 2.5 percent pace in 2024. The decline in growth has largely reflected a slowdown in consumer spending. As with the labor market, some of the slowing in GDP likely reflects slower growth of supply or potential output. […]

The effects of tariffs on consumer prices are now clearly visible. We expect those effects to accumulate over coming months, with high uncertainty about timing and amounts. The question that matters for monetary policy is whether these price increases are likely to materially raise the risk of an ongoing inflation problem. A reasonable base case is that the effects will be relatively short lived—a one-time shift in the price level. […]

In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

And that’s it! Merely saying, “may warrant” sent the market in a frenzy, soaring on the day. Overall, the speech highlighted the weakness seen in the jobs market. The past few months have shown little jobs growth, after revisions. The number of people unemployed long-term (over 27 weeks) remains high and rising.

Chairman Powell also highlighted the weakness seen in economic growth this year, with the growth rate about one-half of that seen last year. But the real uncertainty surrounds inflation. Not knowing the upcoming changes which could be implemented regarding tariffs, the impact on inflation is hard to predict. At current levels, the U.S. could expect to collect in the neighborhood of $300 billion annually in tariff revenue. But where does that come from? The newness of the tariffs makes it difficult to predict how much will be absorbed by exporters through lower prices, by domestic businesses resulting in compressed profit margins, or passed through to consumers in higher prices.

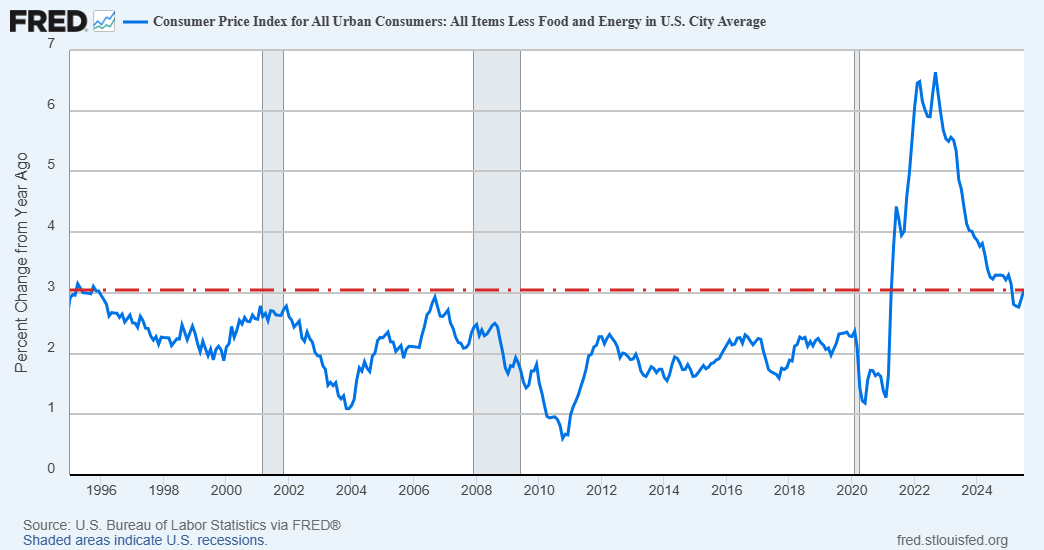

Some combination of the above will result. The magnitude of the numbers provides a reasonable basis for assuming inflation could escalate further. There will be a competing battle between a slowing economy and rising prices. Another word for this is stagflation. Notice in the graph below, before the major impact of tariffs has hit, core inflation is at the highest level (outside of Covid) since the mid 1990’s.

The Fed remains boxed in a corner. They want to project the image of adhering to their dual mandate of maximum employment and price stability. However, those metrics are moving in different directions. The response to one mandate could end up worsening the other. How they walk the tightrope remains unclear. Market participants seem to believe they will cave to political pressure and begin lowering interest rates. If so, this might not have the desired effect on long-term interest rates. The last time the Fed lowered rates, long-term interest rates rose. Higher long-term interest rates would slow the economy even further, something not desired, especially if tariffs push inflation upward.

It seems the Fed will begin lowering the Fed Funds Rate in September. Although, I believe any further hints at rising inflation could force the Fed to pause longer. Either way, a drop in the very short-term Fed Funds Rate might not have the desired impact on mortgage or other loan rates. If that were to happen, then both savers and borrowers could be punished. Savers through lower interest rates on savings and borrowers with higher borrowing costs. We will find out what the Fed chooses on September 17.

The S&P 500 Index closed at 6,467, up 0.3% for the week. The yield on the 10-year Treasury Note fell to 4.26%. Oil prices rose to $64 per barrel, and the national average price of gasoline according to AAA increased to $3.15 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.