Executive Summary

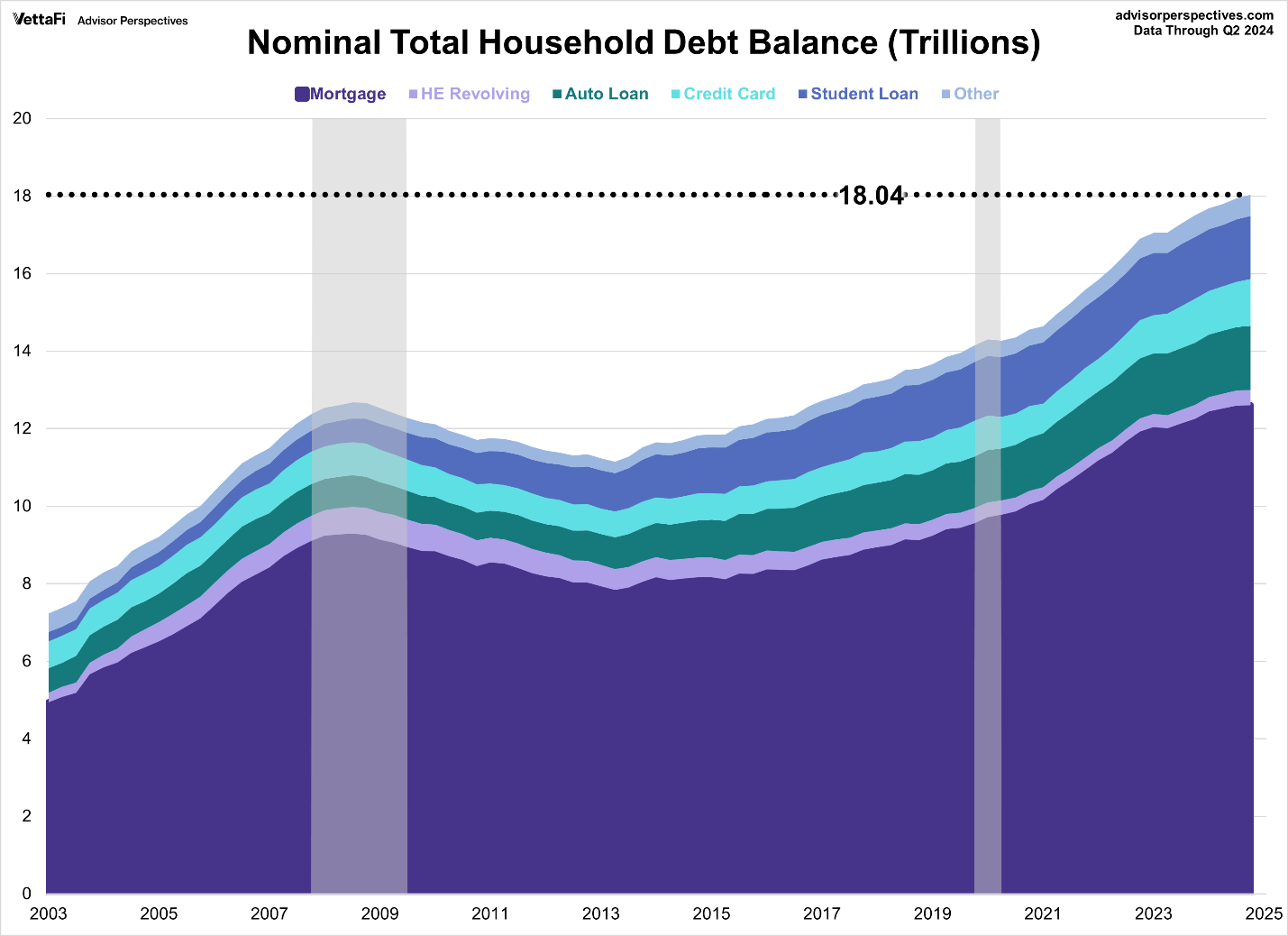

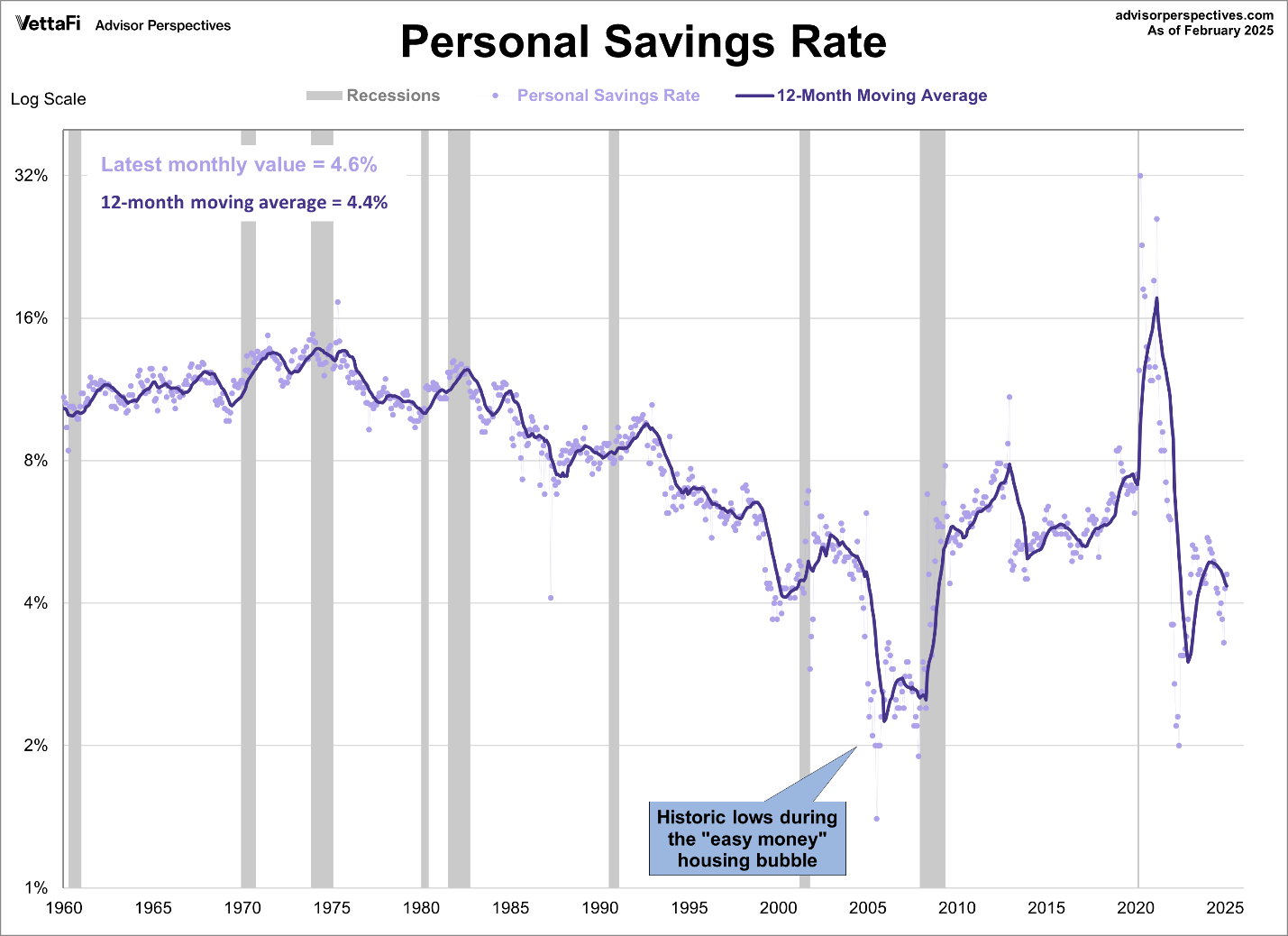

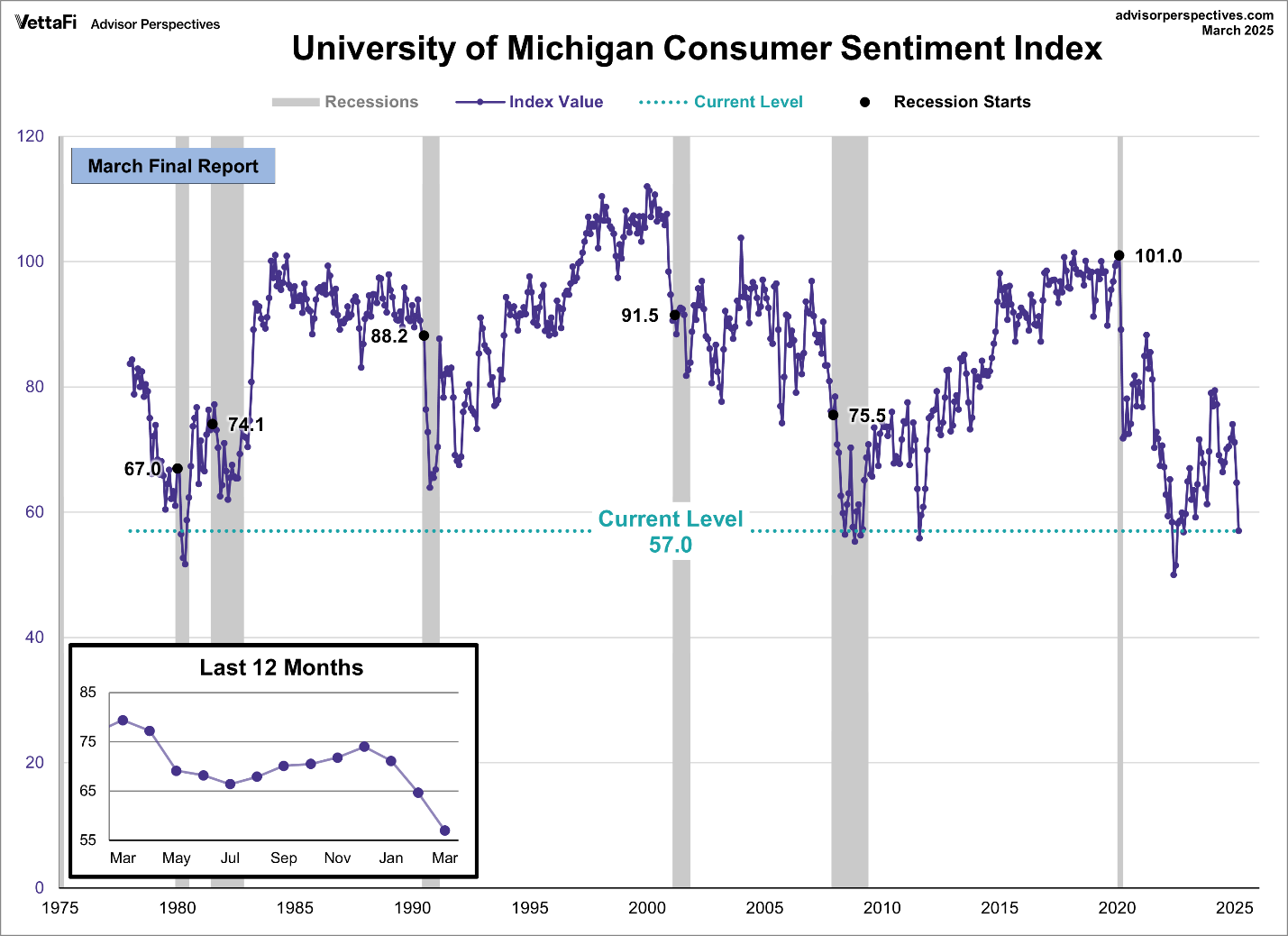

Estimates of growth for the first quarter of 2025 range from 0.3% to -2.8%. Consumer spending drives about 70% of economic growth, and consumers are covered in debt. The first graph shows that nominal total household debt has reached a high of $18 trillion, which explains why personal savings rates are dropping to near historic lows (second graph). The third graph shows consumer sentiment at levels comparable to that witnessed in previous recessions. Walmart is a bellwether for consumers, and in their most recent earnings call they state profit growth will slow. It appears a recession could be next.

For further analysis, continue to read The Details below for more information.

“In a consumer society there are inevitably two kinds of slaves: the prisoners of addiction and the prisoners of envy.”

–Ivan Illich

The Details

Consumer spending drives about 70% of economic growth. Estimates of growth for the first quarter of 2025 range from 0.3% to -2.8%, clearly recessionary territory. Consumers are struggling as prices have risen faster than wages, forcing many to utilize credit cards to make ends meet. The balance of credit cards has jumped to a record $1.21 trillion. The average household maintains $9,700 in credit card debt, with interest rates at around 22.8%. And credit card debt is just one small piece of the debt pie. Notice in the graph below, from VettaFi, that total consumer debt has reached a whopping $18.04 trillion.

Households now have fewer dollars to save for emergencies and retirement. The graph below shows that the personal saving rate has dropped to one of its lowest levels, outside of the easy money period leading up to the Financial Crisis.

Consumer sentiment, as shown in the University of Michigan Consumer Sentiment Index (shown below), is nearing its all-time low.

Walmart is a good barometer for how consumers are feeling. If consumers are struggling and are concerned about their finances, it is usually noticeable in Walmart’s results and outlook. In their last investor call, Walmart confirmed what the consumers are indicating. They stated that profit growth will slow. Consumers are reducing their spending on discretionary items and focusing on essentials. In the past six months, they closed 78 underperforming stores. They have reduced their 2025 expansion plans by 42%. And one of the tell-tale signs of trouble, in the fourth quarter there was a 48% increase in transactional volume using buy-now, pay-later. And while Walmart’s same store sales growth slowed to about 1.9%, Target’s fell 4.3% in the fourth quarter of 2024. In the investor call, the CEO of Walmart stated they are, “Preparing for a prolonged period of consumer pressure and economic uncertainty through at least 2026.” h/t Econofin

When consumers are overwhelmed with debt and high prices, their spending habits change as focus turns to necessities. If the main driver of economic growth is slowing at the same time the U.S. trade deficit is growing and deep cuts are being made to government spending, the logical conclusion is that a recession should follow. All of the signs today suggest that a recession is next. And no, this is not an April Fool’s joke.

The S&P 500 Index closed at 5,581, down 1.5% for the week. The yield on the 10-year Treasury Note rose slightly to 4.26%. Oil prices increased to $69 per barrel, and the national average price of gasoline according to AAA rose to $3.16 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.