Executive Summary

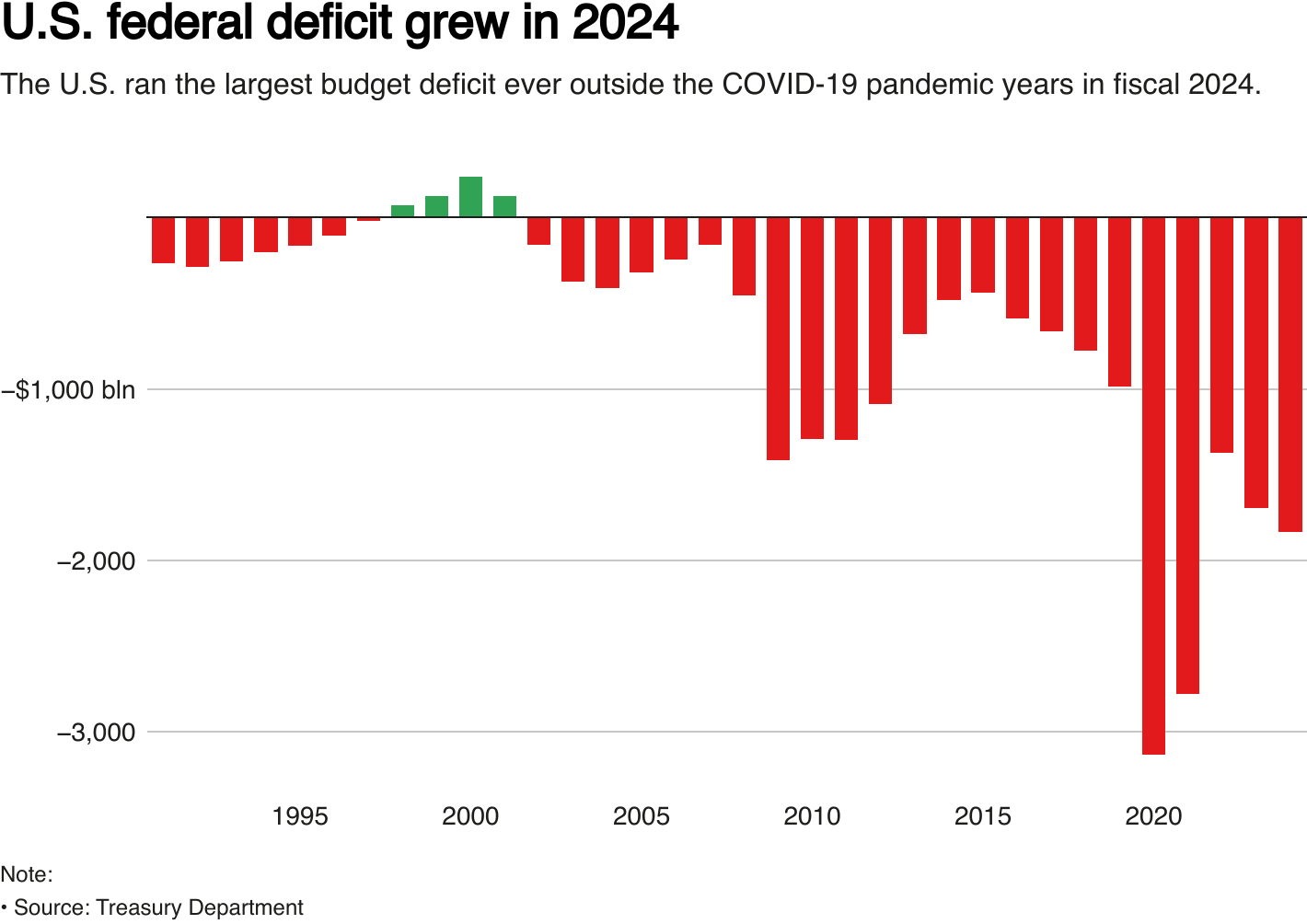

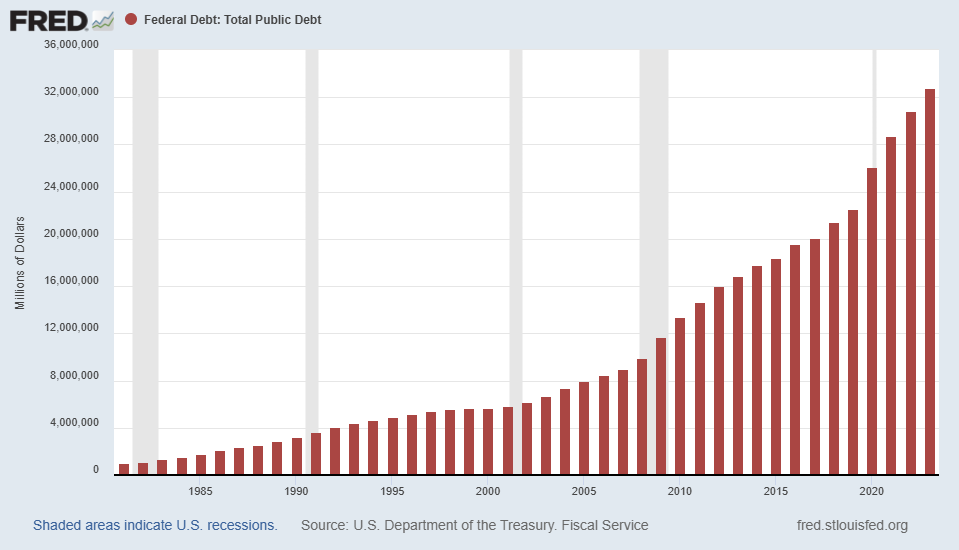

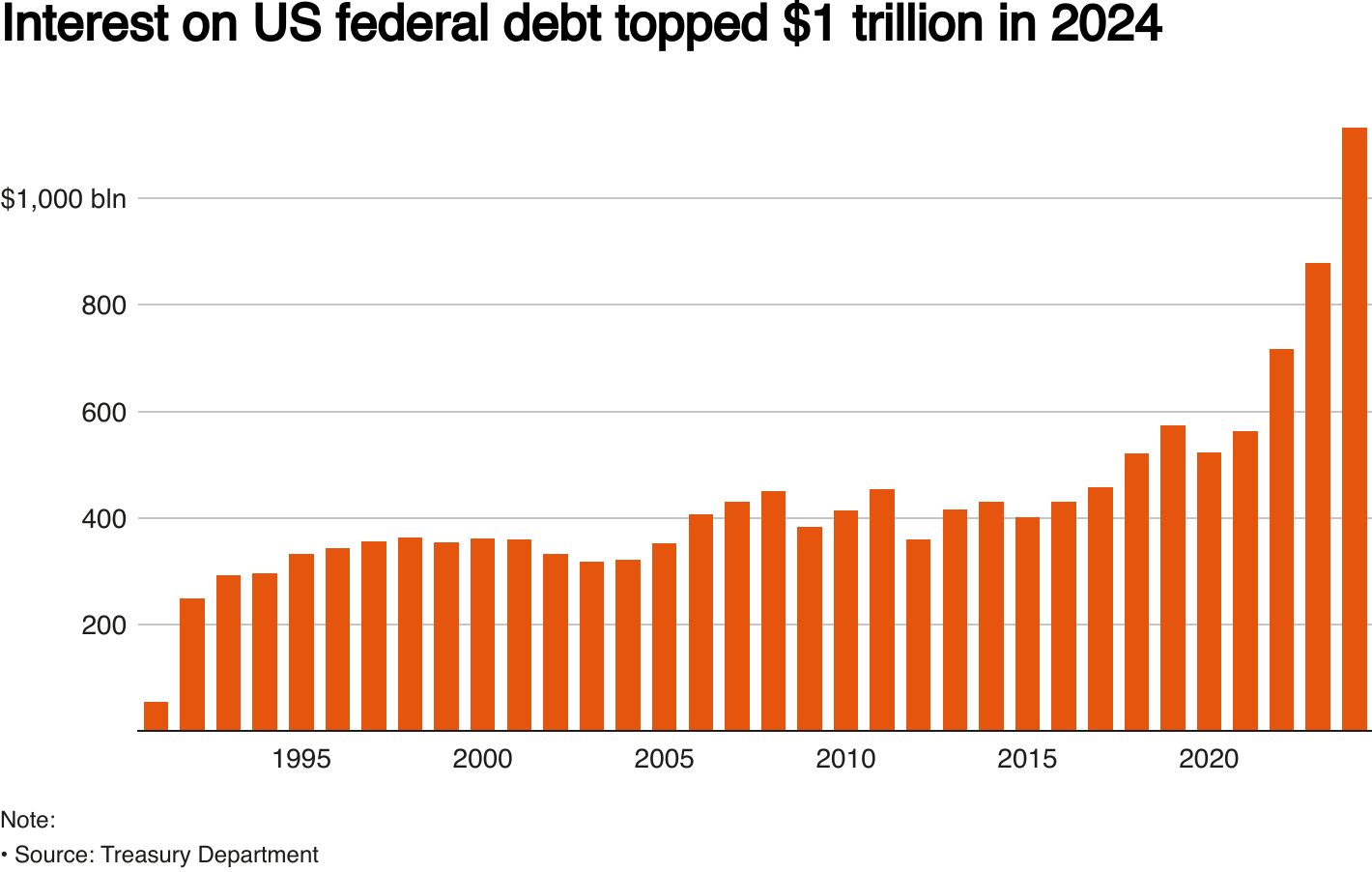

As we near the end of an election season, I find it intriguing that neither party is highlighting the dangerous debt predicament facing the U.S. After the 2007-2009 Financial Crisis, the U.S. annual budget deficit soared to over $1 trillion (see first graph). The rapid ascent of annual deficits is evidenced in the second graph. This has resulted in the U.S. Federal debt now totaling over $35.8 trillion. Since 2022 interest rates have rapidly risen, thus the interest payments on the $35.8 trillion now represent the second largest budget category, only behind Social Security and Medicare. The fourth graph shows interest expense is now over $1 trillion per year. The spiral of issuing more debt to pay interest is accelerating. The importance of this problem appears to be ignored.

Please proceed to read The Details below for more information.

“Chains of habit are too light to be felt until they are too heavy to be broken.”

–Warren Buffett

The Details

As we near the end of an election season, I find it intriguing that neither party is highlighting the most dangerous predicament facing the U.S. The U.S. is in a fiscal tailspin, and it appears the powers-that-be are afraid to confront it. Discussing how to avoid financial calamity must not be a top priority if it involves pain for the populus.

The toxic combination of exponential debt growth and rising interest rates is leading the country towards a financial crisis. The necessary steps to reverse course, if it is not already too late, are not “feel good” actions the public will cheerfully accept. Therefore, the politicians – of all stripes – just overlook the issue.

As a result of the Financial Crisis of 2007-2009, the annual Federal deficit soared to $1.4 trillion in 2009. The hit to the economy combined with Federal stimulus programs pushed the deficit over $1 trillion in the three following years. Everyone was stunned by the extent of the deficit spending “required” to save the economy. Then, the pandemic hit, and the stimulus implemented made the Financial Crisis look like small potatoes. The deficit for 2020 rose to an astounding $3.1 trillion. The following year, the deficit remained at unheard-of levels, coming in at $2.8 trillion. The drop in deficit spending in 2022 laughably had some politicians bragging about the reduction. The deficit in 2022 of $1.4 trillion was at the deepest level hit during the Financial Crisis, yet this seemed like a good thing. The sad part is that beginning in fiscal 2023, the deficit began rising again. Yes, even as the economy was supposedly “good,” the deficit was again out of control. The deficit for the last fiscal year ending September 30, 2024, was an astonishing $1.83 trillion. See a graph of deficits below from Reuters.

The tremendous deficits since the Financial Crisis have pushed the Federal debt up to $35.8 trillion. What is concerning is not the level of debt, but the rate of increase compared to prior years. Notice the rapid ascent in the debt balance in the graph below prepared using the St. Louis Fed FRED database.

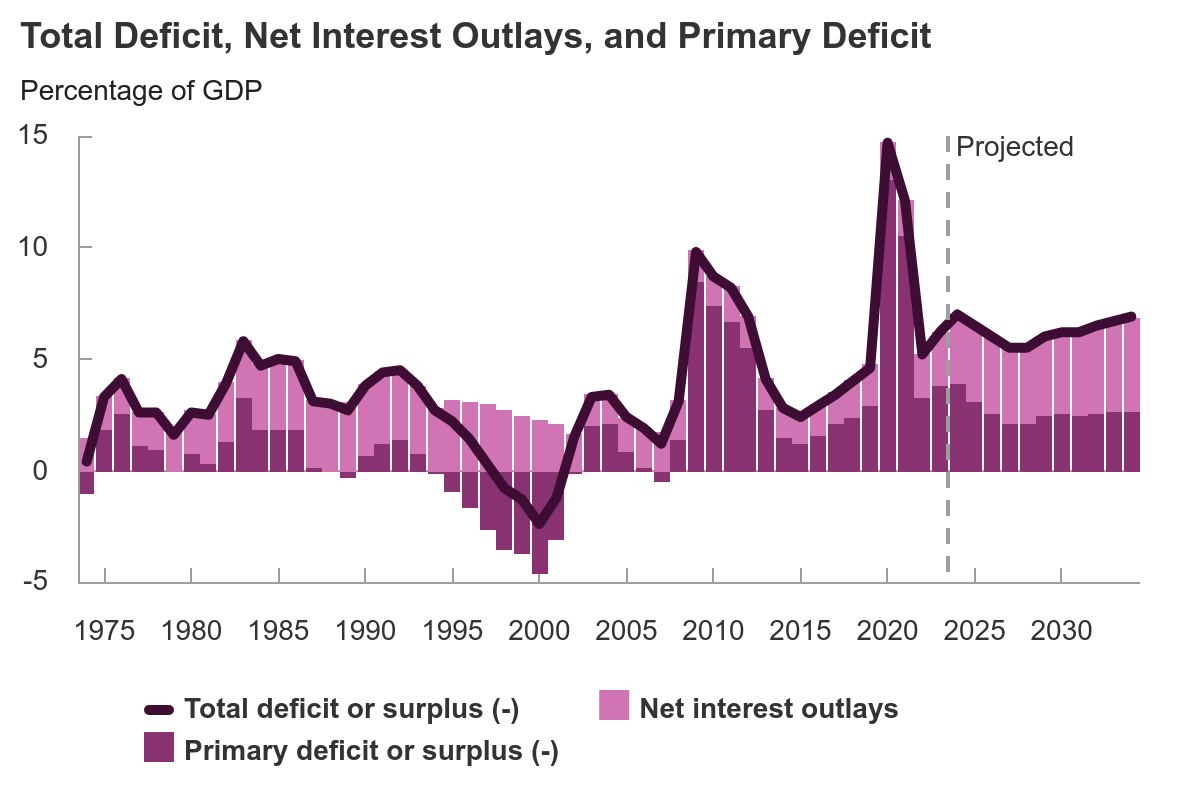

When interest rates were near the zero bound, they comprised a small portion of annual deficits. However, with the rapid rise in rates since 2022, combined with the skyrocketing debt, interest quickly rose to a place of extreme importance in the Federal budget. Notice the prominence of interest payments shown in light purple in the graph below from CBO.gov. In the footnotes to the graph, one can see “primary deficit.” If one wants to downplay the size of the deficit, they refer to the primary deficit or the deficit excluding interest payments. If interest payments are an insignificant portion of the deficit, then it would not matter. But interest expenditures now represent the second largest budget category, only behind Social Security and Medicare.

To illustrate the significance of the exponential increase in interest payments as a budget item, the graph below, also from Reuters, shows how annual interest payments have almost tripled since the end of the Financial Crisis.

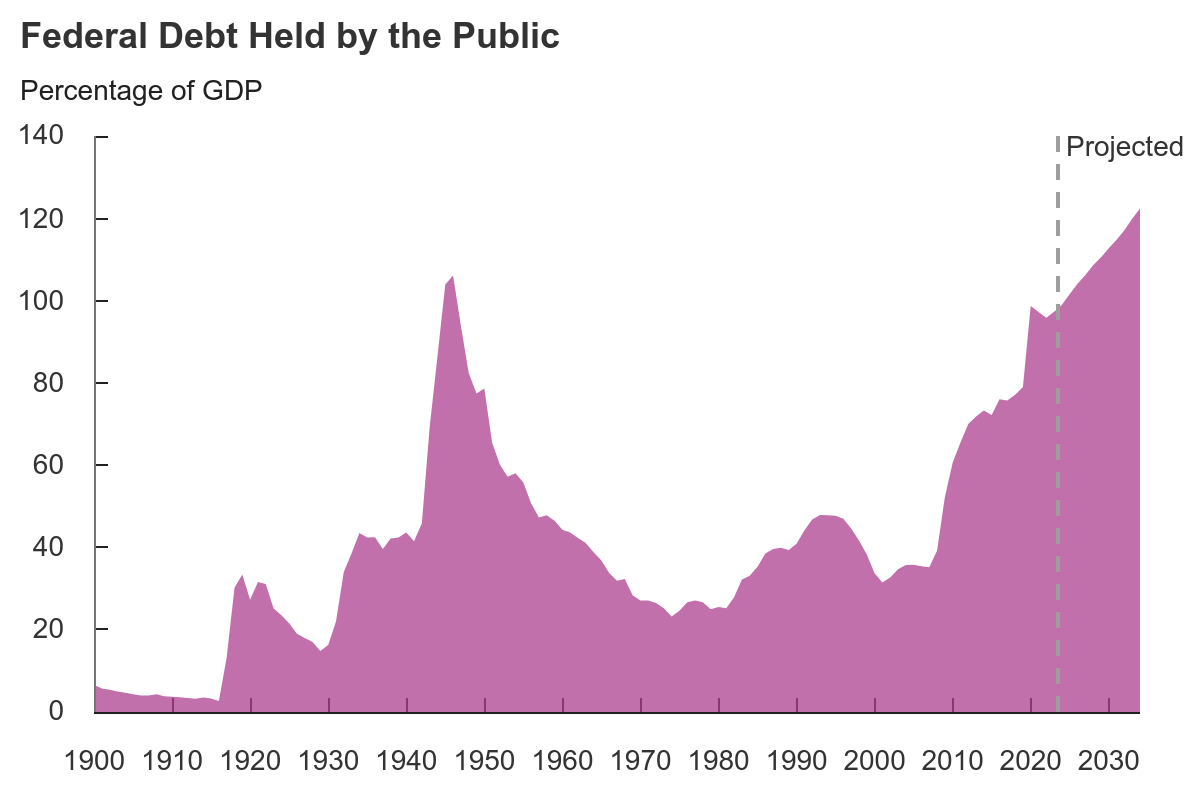

Unfortunately, even the 10-year projections below from the CBO (Congressional Budget Office) show the debt as a percentage of GDP rocketing higher. These calculations do not consider potential future recessions, financial crises or possible higher interest rates. Any of these items would only compound the debt problem.

There is a point where interest on the debt rises so fast that the Treasury won’t be able to issue new debt fast enough to cover the debt service. The Fed will have to jump in and purchase the bonds, running the risk of rapidly rising inflation. This could then push interest rates even higher, requiring more debt to service. Well, I think the problem is obvious.

I realize there are many issues facing our nation; however, I am just surprised that our fiscal dilemma is not near the top of the list. Yet, I have not heard any solutions to remedy the problem.

The S&P 500 Index closed at 5,808, down 1.0% for the week. The yield on the 10-year Treasury Note rose to 4.23%. Oil prices increased to $72 per barrel, and the national average price of gasoline according to AAA fell to $3.13 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.