Executive Summary

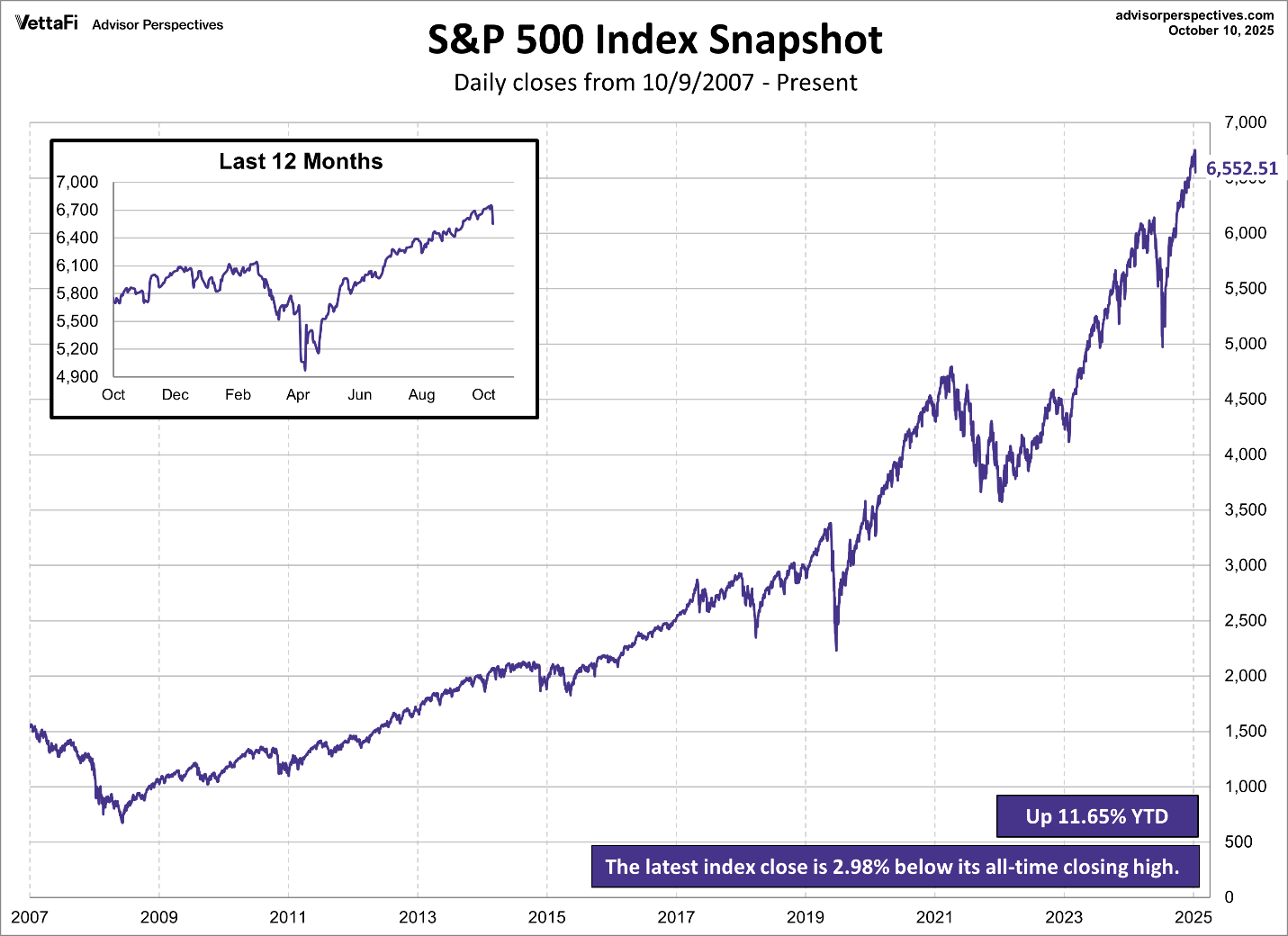

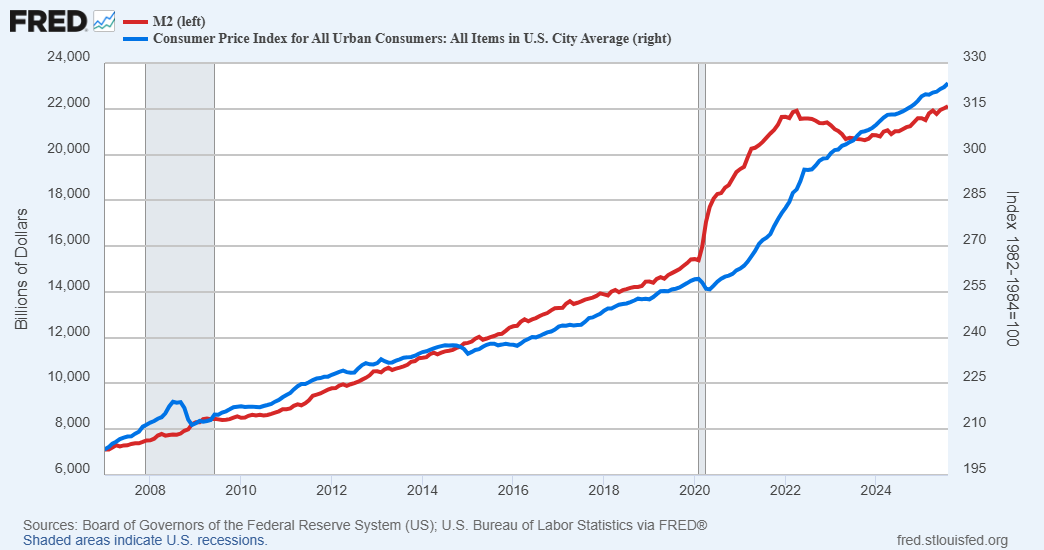

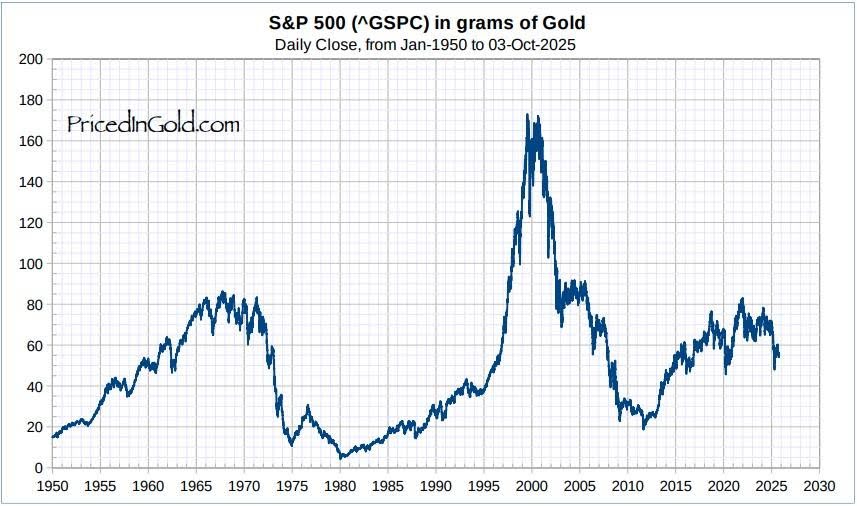

From the bottom of the Financial Crisis in March of 2009, the S&P 500 climbed to a recent high of around 6700. Along the way from 2009 to current, the Federal Government over tripled the money supply and created numerous programs to give away money. This process (shown in second graph) increased the money supply and inflation. The question arises: has this been an economic recovery or a dollar debasement? According to the last graph depicting the S&P 500 in gold, the recovery is not reflected by this measure. Does the stock market reflect economic reality?

For further analysis, continue to read The Details below for more information.

“One of the great mistakes is to judge policies and programs by their intentions rather than their results.”

–Milton Friedman

The Details

Since the S&P 500 bottomed after the Financial Crisis, around March 2009, it has climbed, albeit with a few bumps and bruises along the way, to a recent high of around 6,700. Most investors believe that this incredible runup is proof that the economy and markets have been good, and the recession experienced during the Financial Crisis has been left in the rear view mirror. A graph of the S&P 500 Index is below.

However, the solution to both the Financial Crisis and the Pandemic were the same…trillions in Quantitative Easing, money creation and Federal giveaways. The following graph illustrates the over tripling of the money supply (M2), shown in red, and the tremendous increase in prices as shown in blue by the CPI (Consumer Price Index) from 2007 to now. Many analysts have lost faith in the CPI, as a true measurement of inflation as the formula has undergone enormous changes and manipulation over the years.

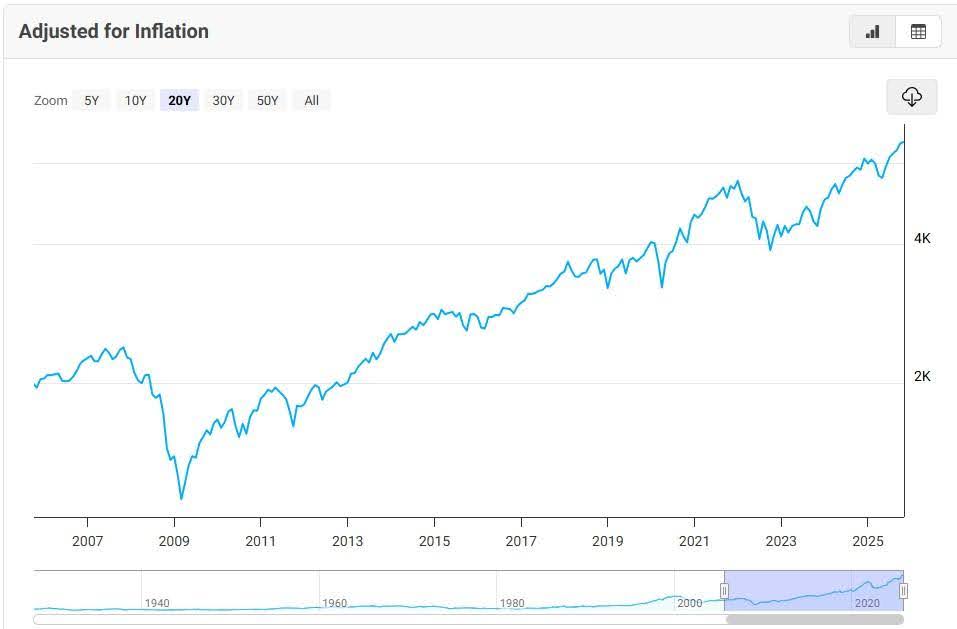

So, how much of the return of the S&P 500 is attributable to inflation. According to the graph below from Macrotrends.net, about 2.5% annually represents inflation built into the nominal return of the S&P 500 from 2007 to present.

Considering the incredible increase in the money supply over the past couple of decades, does the CPI accurately reflect inflation? Federal debt has soared to untenable levels. The Fed has purchased trillions of dollars of Treasury and Agency debt, helping to keep the economy running. Has the economy really recovered since the Financial Crisis or is it an illusion created by tremendous dollar debasement?

Let’s take a look at the S&P 500 priced in gold. As shown in the graph below from PricedInGold.com, the Real return of the S&P 500 from 2007 to present, in gold terms, is a loss of 1.3% annually. Since the gold-priced S&P 500 peaked in 1999, it remains down by about 68%! Is this an indication that the economy has actually been a Potemkin Village created by fiat money and debt?

As written in recent newsletters, the debt crisis is spiraling out of control. The consequences could be severe. The question now is when will the pigeons come home to roost? Are the markets reflective of reality?

The S&P 500 Index closed at 6,553, down 2.4% for the week. The yield on the 10-year Treasury

Note fell to 4.06%. Oil prices decreased to $59 per barrel, and the national average price of gasoline according to AAA dropped to $3.08 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.