Executive Summary

The one piece of the economic puzzle which had appeared to defy gravity was employment; however, the picture changed with last week’s revision. Between last week’s revision for the period April 2024-March 2025 and the prior revision for same period 2023-2024, 1.5 million previously reported jobs vanished. The two graphs below are before these revisions yet still reflect downward employment trends coinciding with recessionary data. That does not mean the U.S. is in recession, but it may be the last straw before one is declared. There are differing viewpoints, and additional data will make for a clearer picture.

For further analysis, continue to read The Details below for more information.

“The permanent temptation of life is to confuse dreams with reality. The permanent defeat of life comes when dreams are surrendered to reality.”

–James A. Michener

The Details

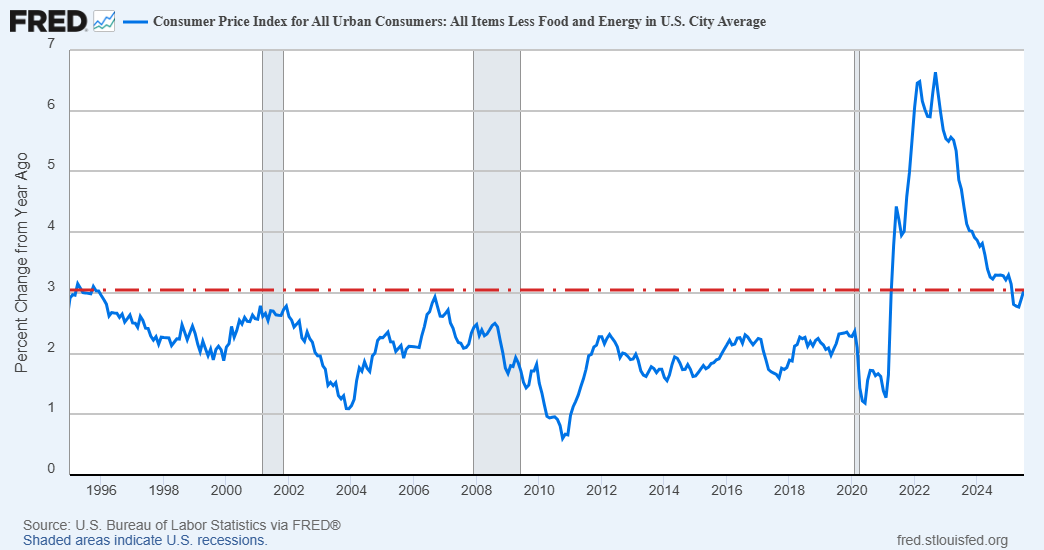

Last Wednesday, the FOMC (Federal Open Market Committee) of the Fed lowered the short-term Federal Funds Rate (FFR) by 0.25%. Many analysts were hoping for a 0.50% drop, with evidence of a weakening economy becoming more apparent, especially with the large downward adjustments in the employment numbers. I discussed the payroll data in my two prior newsletters. The dilemma facing the Fed is conflicting results in their two mandates, full employment and stable prices. The weakening employment situation highlights the fragility in the economy, while the rise in the CPI underscores the risk of higher inflation.

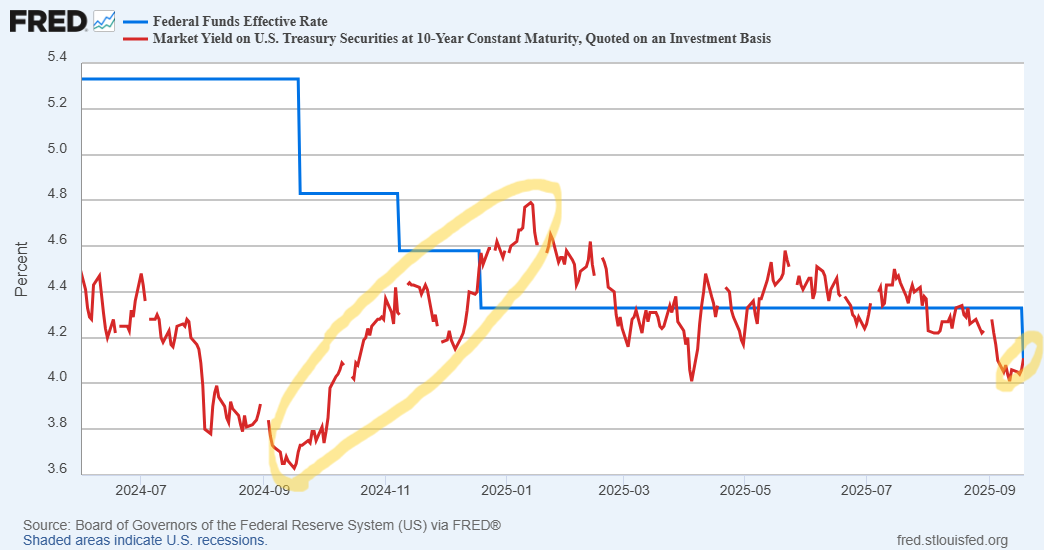

The Fed’s action was intended to lower interest rates to spur economic activity, especially in the housing market. However, last year when the Fed embarked on a path of lowering the FFR, longer-term rates surprised many by rising, as is seen in the following graph. This time, most analysts expected long-term rates to track the drop in the FFR announced last week. However, since last Wednesday, the yield on the 10-year Treasury Note has risen from 4.03% on September 16 to around 4.14% on September 22.

The rise in both the 10 & 30 year Treasury yields indicates that bondholders expect inflation to tick higher. Fed Chair, Jerome Powell, stated he thinks any rise in inflation would be a “one-time” adjustment as a result of the newly implemented tariffs. Will this “one-time” adjustment have the same result as previous statements about inflation being “transitory”? Note in the graph below that inflation – outside of the pandemic – is higher than it has been since the mid-1990’s.

Jerome Powell said the Fed plans two more 0.25% rate cuts this year and at least one next year. If inflation continues to rise, the Fed could be forced to stop the rate cuts. But more importantly, if long-term rates continue to move in the opposite direction of the FFR, the expected positive economic impact will likely not occur. Also, the Fed and the Treasury were hoping to be able to issue new Treasury securities to replace those maturing, and for deficit funding, to be at lower rates. Higher long-term rates mean higher interest costs resulting in higher deficits. It is critical to the Fed for inflation to recede and for long-term rates to fall. Any other result will further impair the financial stability of the U.S.

On a side note, the irrational exuberance in the stock market has pushed valuations even higher. The Shiller P/E, or PE10, surpassed 40 during the day on September 22. The last time this happened was at the height of the Technology Bubble. This puts the ratio over 149% above the median of 16.05, or more than three standard deviations above the median. This is an extreme rarity. Once again, just because it is this high does not mean it cannot go higher. What it does mean is that once speculators have had enough, and the selling begins, there is more downside necessary to return to the median.

The Fed is in a precarious position with the economy weakening, employment slowing, long-term interest rates rising, inflation rising, and the stock market hitting all-time highs with unjustifiable valuations. Only time will tell what the Fed does from here.

The S&P 500 Index closed at 6,664, up 1.2% for the week. The yield on the 10-year Treasury Note rose to 4.14%. Oil prices remained at $63 per barrel, and the national average price of gasoline according to AAA stayed at $3.18 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.