Executive Summary

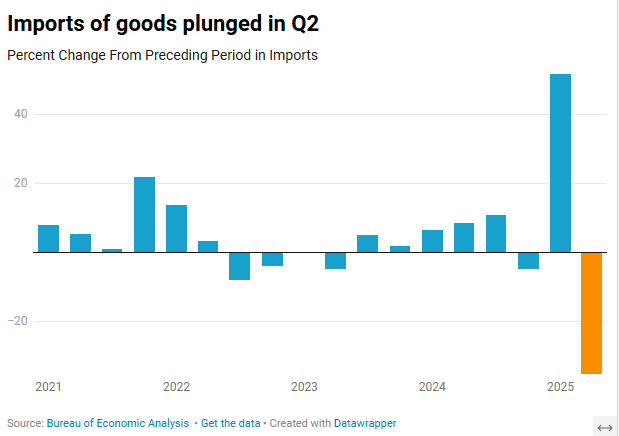

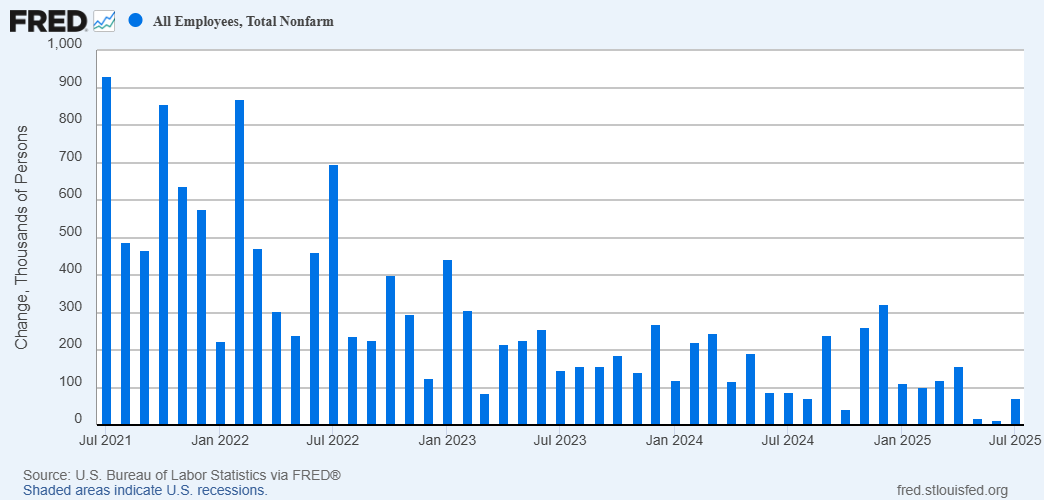

In this week’s missive, I follow up on the GDP report released after last week’s issue and then cover the employment numbers from last week. The first graph shows the surge in imports in the first quarter (frontrunning tariffs) reversed in the second quarter. The reversal added 5% to GDP; however, growth would have been negative otherwise. Last week’s Establishment Survey results showed 73,000 new jobs – less than the 100,000 expected. Most disturbing though were the revisions to the previously released May and June numbers. These revisions eliminated 258,000 jobs previously reported. The current numbers are in recession territory. All these revisions are making many question the reliability of the data.

For further analysis, continue to read The Details below for more information.

“The only function of economic forecasting is to make astrology look respectable.”

–Kenneth Galbraith

The Details

In last week’s missive, I stated, “And, I always say, the numbers are only as good as the data behind them.” Subsequently, the advance reading of second quarter GDP growth was announced. Additionally, the controversial July Employment Situation Summary along with prior month’s revisions was reported. The weak Employment report created quite an uproar as the prior two months’ revisions were incredibly large, causing many to question the credibility of the data. Even President Trump chimed in, accusing the agency of political bias, and then firing BLS Commissioner, Erika McEntarfer. I will stay clear of the political argument and focus on the numbers released.

First, briefly on the GDP report, the Bureau of Economic Analysis reported second quarter annualized GDP growth to be 3%. However, after a surge in imports in Q1 as companies rushed to beat the implementation of new tariffs, imports plunged in Q2. This drop in imports boosted net exports, thereby increasing GDP. The huge drop in imports added almost 5% to GDP growth. Without that drop, growth would have been negative.

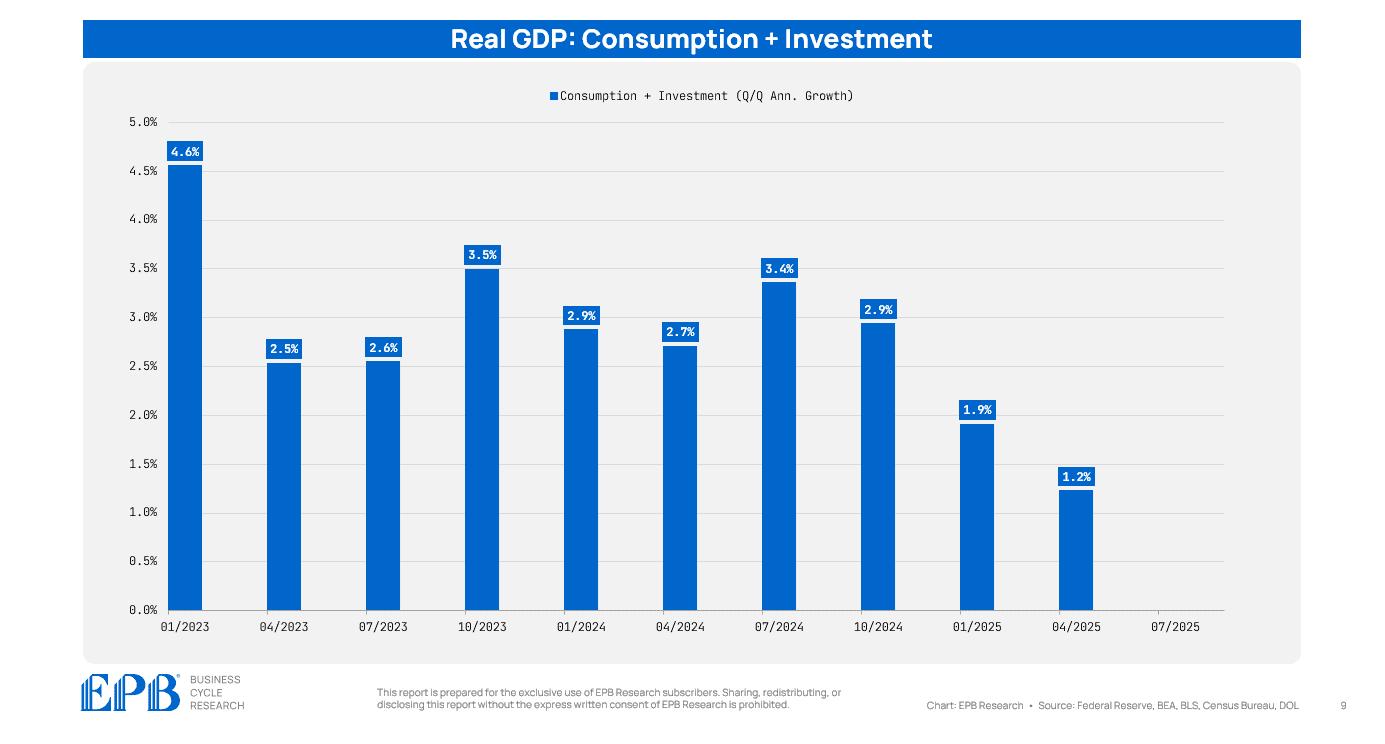

According to Eric Basmajian, @EPBResearch, “Consumption + investment (87% of GDP) decelerated to 1.2% growth in Q2.” See graph below.

The bottom line is that consumption is weak; therefore, the economy is weak.

Now on to the payroll report which came in below expectations, with new jobs reported (via the Establishment Survey) of 73,000. This was below the Dow Jones low estimate of 100,000 new jobs. But that is not the disturbing part. The May report was revised down from 144,000 to only 19,000. And the June report was revised down from 147,000 to a mere 14,000. These revisions eliminated 258,000 jobs previously reported. The Household Survey showed employment dropping by 260,000 in July. The current numbers are in recession territory.

The preponderance of data seems to support an economy that is either in recession or about to enter a recession. It would be nice to have reliable, unbiased data. Unfortunately, the significant revisions to previously released numbers cause many to question the validity of the data. Yet every month market participants continue to wait with bated breath on the unrevised new jobs number, only to find out the following month how unrealistic it was.

The S&P 500 Index closed at 6,238, down 2.4% for the week. The yield on the 10-year Treasury Note fell to 4.22%. Oil prices increased to $67 per barrel, and the national average price of gasoline according to AAA rose to $3.15 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.