Executive Summary

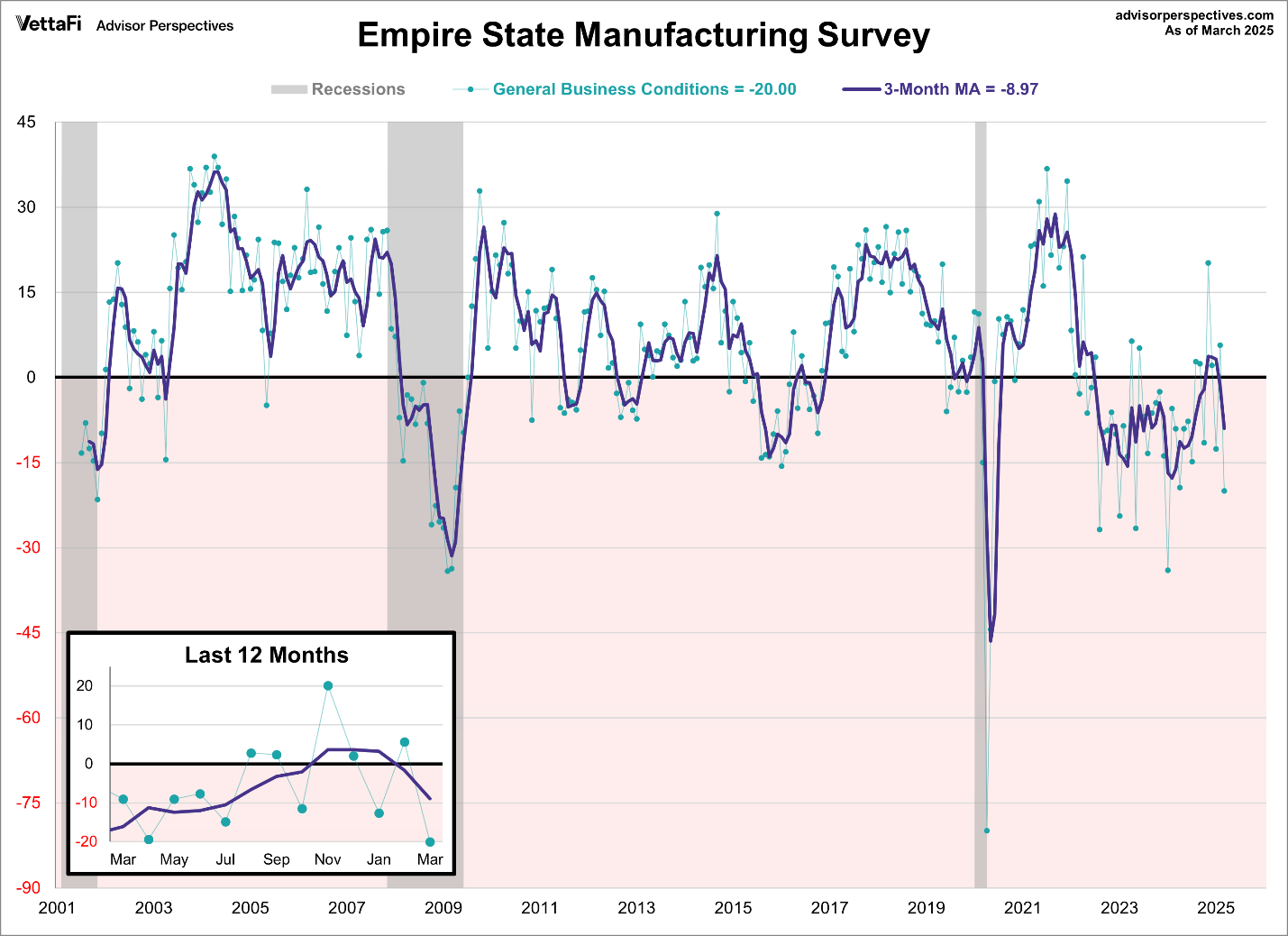

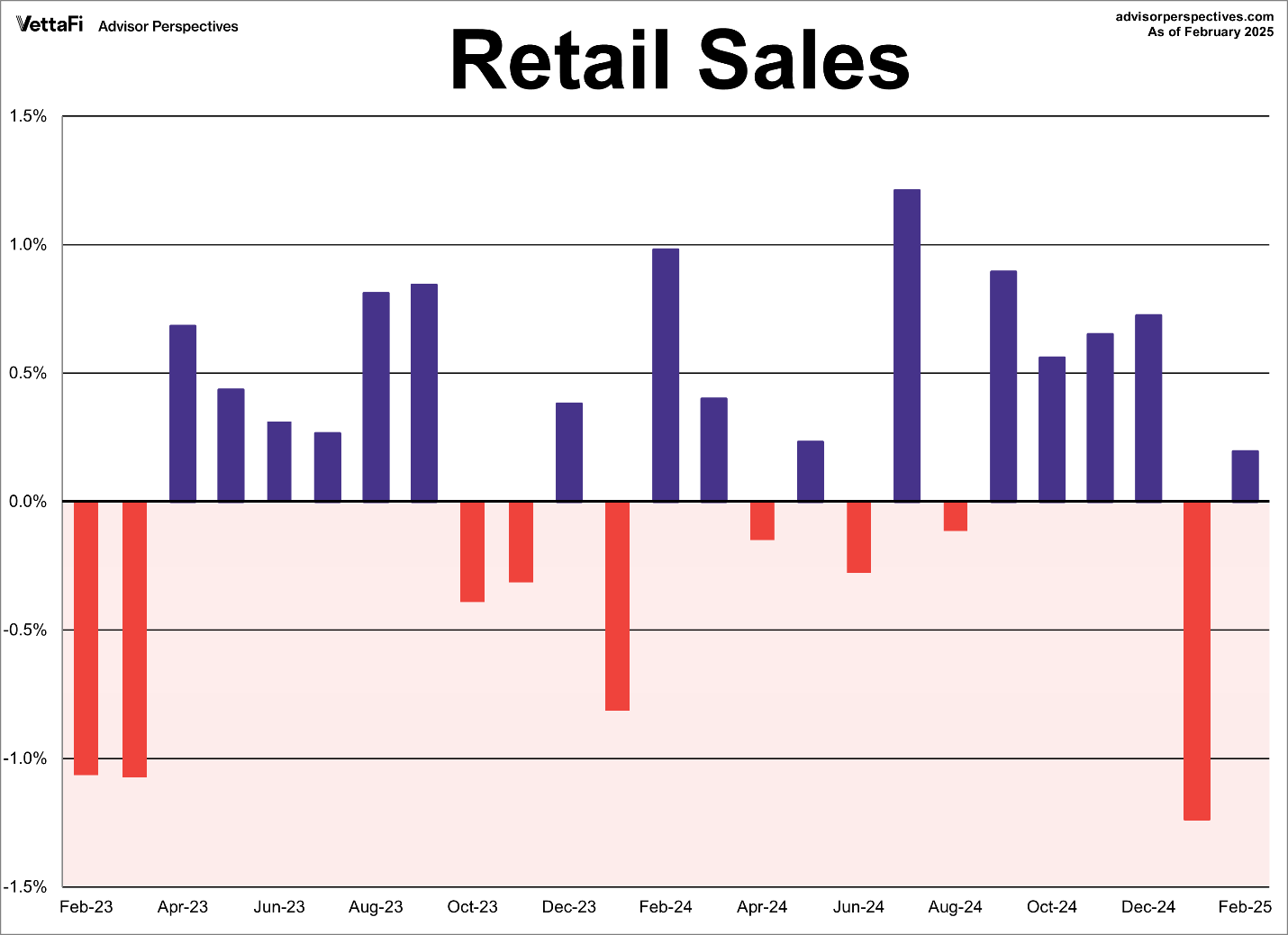

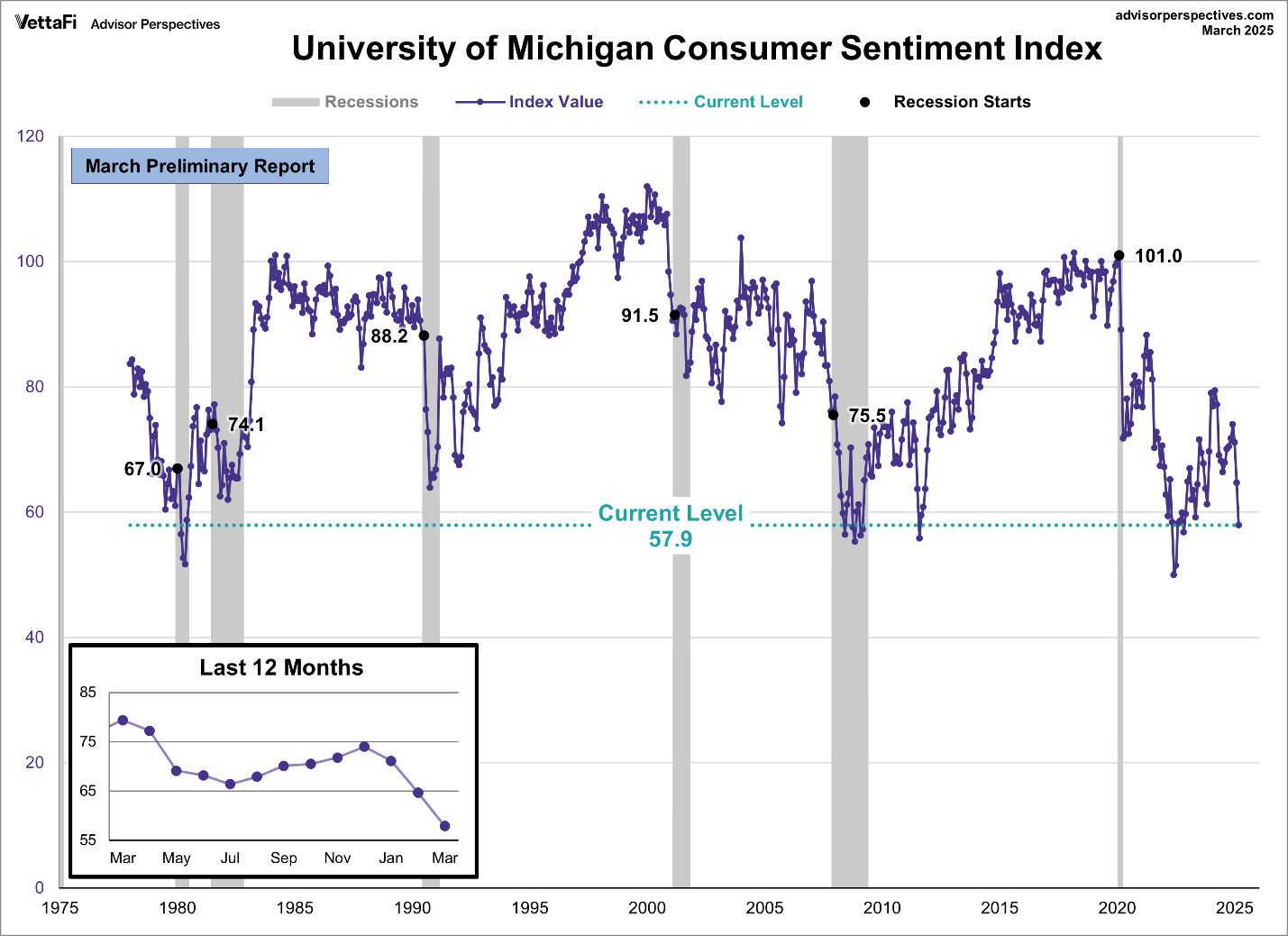

The Empire State Manufacturing Survey shows a 25.5 point drop in General Business Conditions (first graph), much lower than expected and in recessionary territory. Additionally, the Census Bureau released February’s Advanced Retail Sales Report which was .2% month-over-month, below expectations of .6%. And on top of that, January 2025 was revised down to -1.2%. The University of Michigan’s Consumer Sentiment Index fell to 57.9 or to the lowest level since November 2022. As illustrated in the third graph below, the current reading is near the levels seen at the bottom of the Great Recession. Higher prices, inflation and too much debt have forced consumers to re-think their spending habits, which is now reflected in the Atlanta Fed’s GDPNow forecast (last graph).

For further analysis, continue to read The Details below for more information.

“Borrow money from pessimists-they don’t expect it back.”

–Steven Wright

The Details

Many economic indicators are suggesting growing weakness in the economy. In today’s missive I will review several data points, utilizing graphs from VettaFi. Examining manufacturing, the diffusion index produced by the Empire State (New York) Manufacturing Survey shows a drop of 25.7 points to -20.0 for General Business Conditions. The results were far worse than expectations of -1.9. The New Orders Index fell 26 to -14.9. The Shipments Index fell 23 points to -8.5. Overall, the survey displays economic weakness. As shown in the graph below, the three-month average of the General Business Conditions Index is well into recessionary territory.

The Census Bureau released February’s Advanced Retail Sales Report on Monday, March 17. Retail sales for February disappointed, coming in at 0.2% month-over-month, below expectations of 0.6%. On top of that, January’s results were revised down to -1.2% as shown in the chart below. Consumer spending appears to be slowing.

The slowdown in consumer spending was verified by the University of Michigan’s Consumer Sentiment Index. The Index fell to 57.9 or to the lowest level since November 2022. Consumer Sentiment has fallen over 27% on a year-over-year basis to the lowest level since May 2022. As illustrated in the graph below, the current reading is near the levels produced at the bottom of the Great Recession.

Over-indebted consumers are slowing down their spending. This slowdown is working its way into the manufacturing sector. The recent Retail Sales Report described above is responsible for the Atlanta Fed’s GDPNow model reducing their first quarter estimate of GDP growth, from -1.6% to -2.1% as of March 17. This is a recessionary reading. See below from the Atlanta Fed.

The preponderance of evidence suggests that the consumer is reducing their spending. Higher prices, inflation and too much debt have forced consumers to re-think their spending habits. Currently, this impacts the middle and lower class consumers the most. However, if the stock market correction picks up steam over the year, wealthier citizens will also begin to alter their spending. If this continues, it becomes likely that a recession rears its head sometime this year.

The S&P 500 Index closed at 5,639, down 2.3% for the week. The yield on the 10-year Treasury Note fell to 4.31%. Oil prices remained at $67 per barrel, and the national average price of gasoline according to AAA decreased to $3.08 per gallon.

© 2024. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Prudent Financial and Cambridge are not affiliated.

The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this message in error, please reply to the sender to inform them of this fact.

We cannot accept trade orders through email. Important letters, email or fax messages should be confirmed by calling (901) 820-4406. This email service may not be monitored every day, or after normal business hours.