Executive Summary

In this week’s newsletter, I outline investment risk verses fear of missing out. Investor risk is the risk of loss, which is increased when stock prices disconnect from corporate profits. Fear of missing out involves continuing to hold overvalued stock, speculating that one will still be able to sell to someone else at a higher price. Many advisors encourage this mentality and justify it by relying on portfolio diversification to manage risk. However, in past down markets, the increase in asset class correlation did not effectively reduce losses. Stock prices continue to rise based on tweets and other media soundbites, further disconnecting from broad economic data. Please proceed to The Details for the charts and more in-depth explanation. See if you can see what is clearly in front of our eyes today?

“It’s better to walk alone than with a crowd going in the wrong direction.”

— Gandhi

The Details

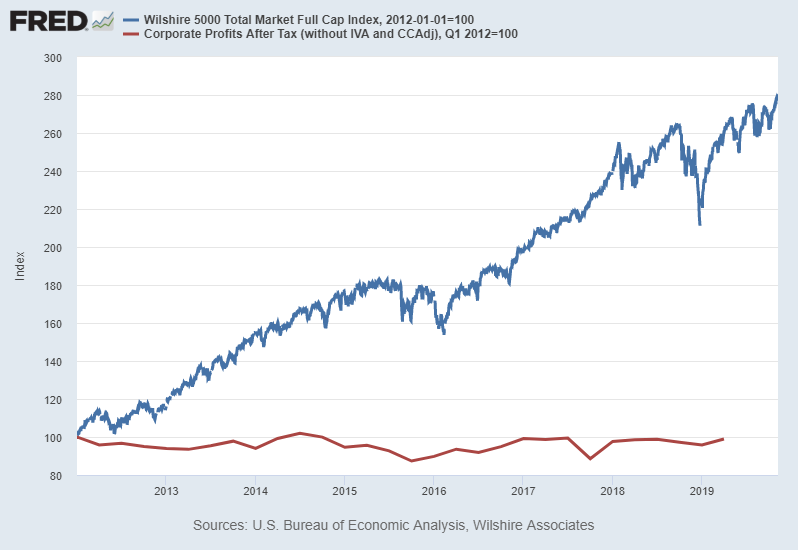

Lately, due to tweets from the President and euphoric media coverage, record high stock prices are being confused with a strong economy. In reality, the stock market is not the economy; although, it should reflect the state of corporate earnings growth. With all the focus on stock prices, the message of earnings and the real economy is lost. Investors are led to believe if they are not reaping the benefits of record stock prices, they are “missing out.” The lessons of past cycles get buried in the cheerleading.

The father of value investing and mentor to Warren Buffett, Benjamin Graham, once said, “The essence of investment management is the management of risk, not the management of returns.” The vast majority of advisors either don’t understand this statement or choose to ignore it. With career risk on the line, most succumb to the pressure of FOMO (fear of missing out), turning a blind eye to risk. In this missive I will attempt to outline “risk” and the historical result of ignoring it.

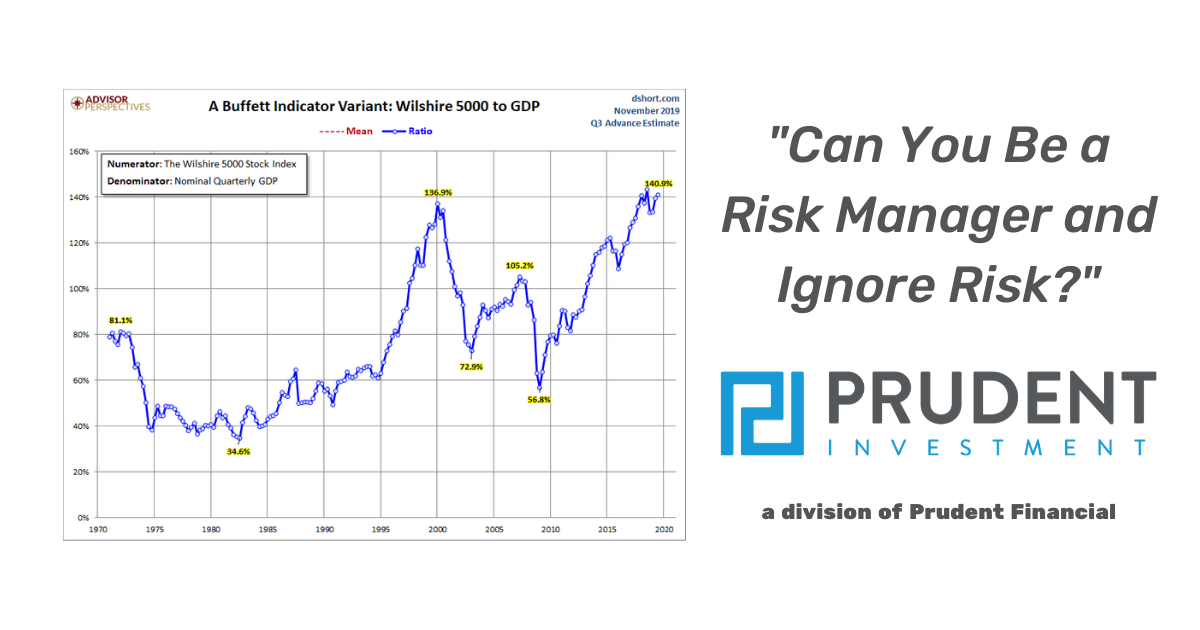

First, I will repeat a graph from last week’s Update illustrating the “record-setting” multiple expansion (paying more for the same amount of earnings) imbedded in today’s stock market.

I ask, does the above chart highlight any “risk” in the stock market? It does sort of smack one in the face. What exactly is “risk”? Some define risk as volatility in stock prices. Actually, it is volatility to the downside, or losses that investors are concerned about. And, that gets back to Benjamin Graham’s distinction between an investor and a speculator. Investors’ being those who study market cycles and valuations in order to determine if stock prices make sense. Once prices become disconnected from earnings growth, “risk of subsequent loss” is enhanced. The chart above demonstrates the massive disconnect in today’s stock prices versus earnings growth.

“Investors” choosing to ignore such disconnect have morphed into speculators. Speculators own stocks hoping they will eventually be able to sell to someone else at a higher price no matter the price-to-earnings multiple. FOMO is based upon this sentiment. FOMO is where individuals are convinced, they need to buy stocks so as not to “miss out” on further moves upward, even though prices relative to earnings have never been so disconnected.

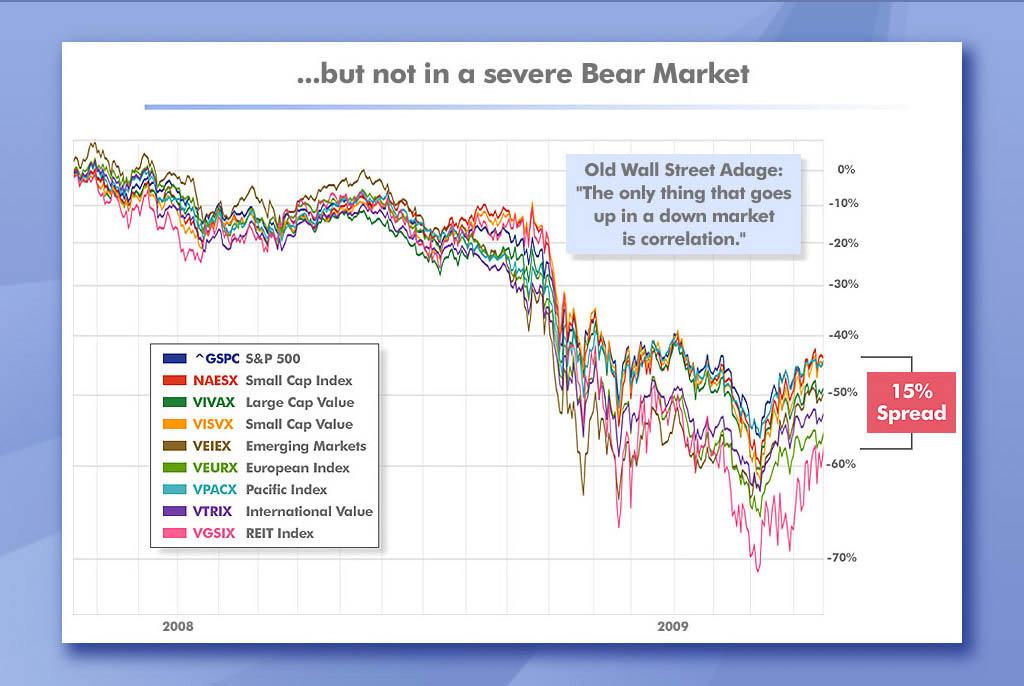

This is where the majority of advisors fall back on “diversification” as the “risk-management” strategy. This, despite the old Wall Street adage “the only thing that goes up in a down market is correlation.” As witnessed in the two prior bear markets, diversification loses its luster as almost all asset classes plummet in bear markets. The asset classes that benefit the most from bear markets include Treasury Securities, gold and sometimes the dollar. Often, these asset classes are absent from client portfolios or represent such a minor allocation as not to provide any real relief from a market plunge. Look at the correlation of diverse equity classes during the previous bear market.

Although, the diversification strategy (using Harry Markowitz’s Modern Portfolio Theory) sounds good on the front-end, experience has shown it lacks the benefits expected once the bear market arrives. Very few advisors highlight what has happened in prior market cycles, and they only listen to the propaganda put out by financial media and investment firms with an inherent bias. For instance, imagine if the late Jack Bogle, founder of The Vanguard Group had made the following statement when stocks were priced at record high valuations as seen in 2000, 2007 or now. “Due to unprecedented valuations, there is a serious risk that stock prices could plummet up to 50% or more; therefore, investors [speculators] should sell their stock and purchase Treasury Securities and gold.” Imagine the impact that would have had not only on Vanguard funds, but the markets as a whole. Hence the inherent bias.

The current valuation level, calculated by economist John Hussman utilizing the methodology most correlated with subsequent 12-year returns, indicates the stock market would need to correct 55-60% to bring prices back to long-term average valuation levels. However, periods such as the 1930’s-40’s and1970’s in the U.S., or the 1990’s forward in Japan illustrate that sometimes markets don’t stop their descent at the mean. They fall below the mean. I don’t think I need to explain what that would do to prices. The crash in the U.S. markets beginning in 1929 did not recover until the early 1950’s. In Japan the stock market sell-off starting in 1989 is still 40% below its pre-crash level.

Post-plunge stock prices did not snap back in the 1930’s-40’s or 1970’s. Diversification amongst various equity asset classes and corporate bonds did little to prevent major losses. Just a note regarding corporate debt today, the vast majority of investment-grade debt is rated BBB or one-rung above “junk bond” status. A recession at this time could result in many corporate bond funds suffering due to corporate defaults.

Why is it one has to hunt and search for true “risk managers”? It is because career risk and FOMO force most advisors to throw caution to the wind. As investors become speculators, history is temporarily forgotten. The history of stock market cycles paints a clear picture of what happens when fundamentals are ignored forever, and FOMO becomes the majorities’ strategy. The prior two corrections, 2000-2002 and 2007-2009, both spurred losses of close to 50% in the S&P 500. However, each of these cycles were led by specific sectors, leading to an even greater crash in those sectors. For instance, it was technology in the 2000-2002 crash that led the way. The technology-heavy NASDAQ 100 Index fell roughly 83%. In 2007-2009, mortgage-backed debt suffered the greatest, although a 50% drop in the S&P 500 could be considered quite sizable. Today’s bubble is known as the “Everything Bubble,” meaning excesses are spread across the board and not congregated in specific sectors.

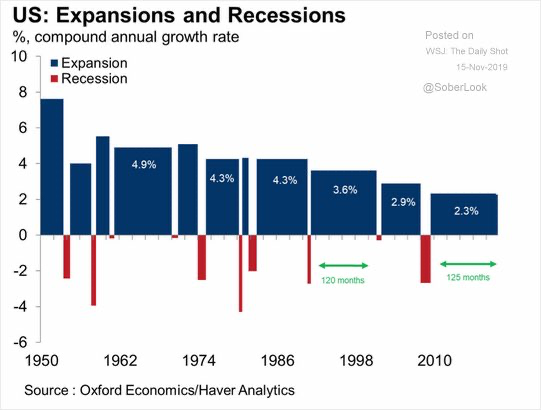

Presently, many believe the implementation of experimental monetary policy will prevent the cycle from completing. Though it has done nothing to boost fundamentals in a meaningful way to justify stock prices, I believe some think the bubble can be supported infinitely. The chart below highlights that even though this has been the longest expansion in history, it has also been the weakest. And the little growth shown was only achieved with trillions of dollars in printed money and debt-financed consumption, the result of near-zero percent interest rates.

Does it really make sense for stock prices to continually push to higher levels when growth of both earnings and the economy are lackluster or even declining? The disconnect from fundamentals can clearly be seen by examining action last Friday. It was announced that industrial production fell 1.13% year-over-year, while headline retail sales growth slowed to about 3%. On this data, the Atlanta Fed GDPNow forecast for the fourth quarter 2019 plunged to 0.30% as the New York Fed’s GDP NowCast model fell to 0.39%. Hedgeye Risk Management, LLC dropped their forecast to 0.31%. With this recessionary data revealed, the market surged over 0.75%.

Why the surge, you might ask? Larry Kudlow, Director of the U.S. National Economic Council, made unsubstantiated comments inciting optimism about a Phase One trade deal with China. This was purely a market boosting move by Larry Kudlow. Just what the FOMO crowd wanted.

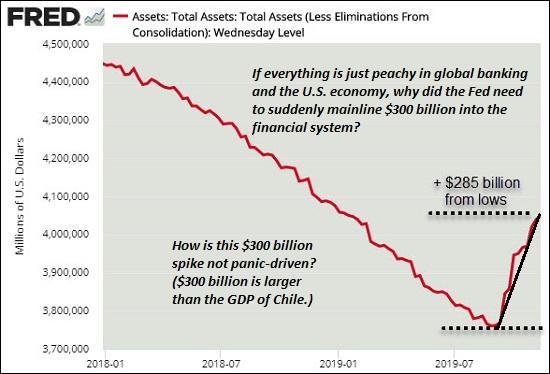

There is another culprit behind “record high” moves in the market, and that is recent Fed action. In order to keep this Update from getting too long, I will discuss this topic in a future newsletter. But suffice it to say, the Fed balance sheet is surging again, despite their public denials about implementing another QE program. More deception? See the chart below from Charles Hugh Smith via OfTwoMinds blog.

If Benjamin Graham is right in suggesting investment management involves the management of risk versus returns, how do advisors justify the level of risk in today’s markets? Historical data and market cycles clearly highlight the risk prevalent in today’s market. It appears that most advisors defer to “hindsight” which encourages FOMO as a strategy. “Diversification” is the espoused claim to keep exposure to assets priced over double their inherent value. Unfortunately, it will take the ultimate reconnection of prices to earnings for many to see what is clearly in front of our eyes today. I refer you to the first chart above. Do risk managers see the risk?

The S&P 500 Index closed at 3,120 up 0.9% for the week. The yield on the 10-year Treasury rose to 1.83%. Oil prices increased to $58 per barrel, and the national average price of gasoline according to AAA fell to $2.60 per gallon.

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Cremerius Wealth Management, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Cremerius Wealth Management is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.