Executive Summary

Are investors being duped into believing that low interest rates justify higher stock valuations? Are they being told that high stock prices are the result of a strong economic recovery? In this week’s newsletter, I explain the fallacy of low interest rates, and how central bank policies and corporate stock buybacks are the basis for current record stock prices. Central bank liquidity infusions were intended to prompt people to spend money and get corporations to expand operations and create jobs resulting in higher wages. Instead, the largest wealth gap in history was created. Wealthy people with assets are richer because of bubble asset prices, while the majority of people sink further into debt. Stock buybacks have allowed corporations to appear more profitable by boosting earnings per share. However, real economic growth is still around 2 percent while stock prices have skyrocketed. The charts below illustrate the true culprit of bubble-priced stocks. Please proceed to The Details for the full picture, and to avoid being duped.

“It is the fool who thinks he cannot be fooled.”

— Joey Skaggs

The Details

While financial media pundits convince investors the market ascent since the Great Recession is due to a recovering economy, corporate profit growth, and low interest rates, the true explanations for ever-increasing stock price multiples eludes the masses. In this missive, I attempt to outline the real causes for present near-record bubble prices in stocks and other assets.

The architects for today’s bubble have been the Federal Reserve Bank (Fed) together with its global central bank counterparts. Understand, almost 70% of the fuel for the U.S. economy comes from personal consumption. With little savings, the only way to fuel consumption is with debt-financing. Therefore, the Fed lowered interest rates to near zero-percent to encourage more debt-based consumption. Additionally, the hope was that corporations would use these low rates to finance expansion resulting in more hiring and rising wages. Providing over $3.5 trillion in liquidity to banks would supposedly provide the funds to foster such lending. Knowing such actions would also push asset prices higher, the Fed explicitly stated their intention for asset-owners to “feel” wealthier and therefore spend more.

The goal of raising asset prices was a success. However, the desired corporate expansion and rising wages did not occur, making the true beneficiaries of Fed action the top few percent of individuals who are the greatest asset owners. The vast majority of the population “benefited” by expanding their debt levels to record highs, with lower interest rates on mortgages and car loans. Yet, credit card interest rates never seemed to track other rates and remain exorbitant.

I will attempt to summarize the consequences of central bank actions and how stock prices became so overvalued as concisely as possible, although in the future books will be written about this subject.

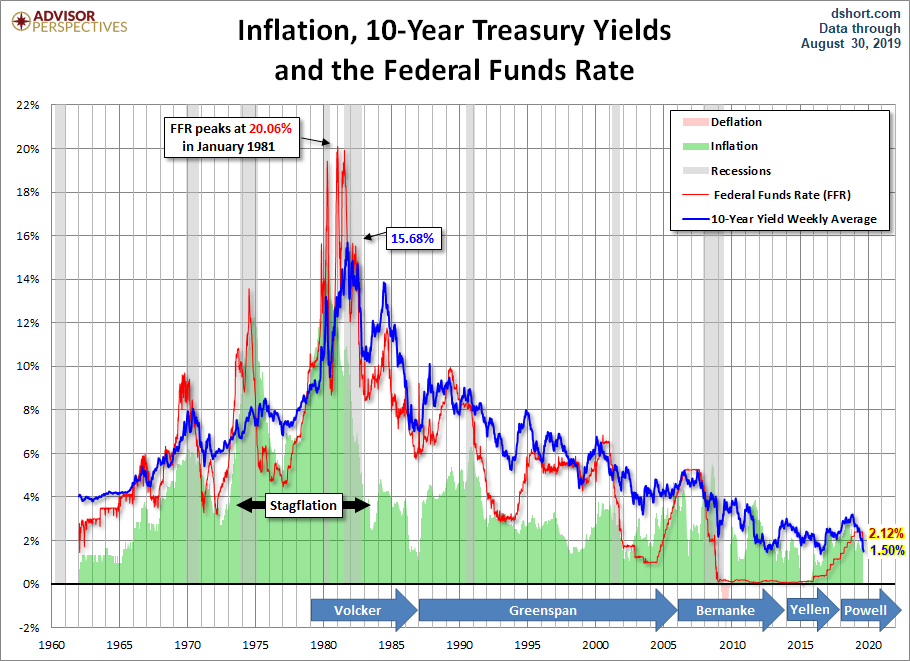

First, almost every analyst I hear or read indicates that low interest rates justify higher stock valuations. The fact is they don’t. It is important to understand why interest rates are low in the first place. Short-term rates set by the Fed are low because they are trying to spur economic growth in a weak, and now possibly recessionary, environment. Long-term interest rates track economic growth and inflation. Though the Fed has tried to get both of these numbers up, they have been unsuccessful as real GDP growth has, and continues to, hover around 2%. In a battle against demographics, currency wars, and excess capacity, the Fed is struggling to avoid deflation.

If the reason interest rates are low is because the economy is weak, why would that justify higher stock prices? Also, stock prices should represent the present value of a long-term stream of income. Utilizing a low discount rate does result in a higher current value; however, it also implies a long-term period of low growth. We should see the beginnings of this as third-quarter corporate earnings results begin to be reported this week. Economist Gary Shilling recently wrote in his monthly Insight newsletter,

“…forces apart from inflation and interest rates dominate stock P/E’s. Think about the dot com stock speculation of the late 1990s and the subprime mortgage bubble of the mid-2000s. So don’t rest easy, believing that low interest rates make stocks cheap. Quite the contrary, low yields are probably foretelling economic weakness and possible deflation that will dramatically slash corporate earnings and P/Es.”

Secondly, the true cause of higher stock prices has been corporate stock buybacks. In my opinion, this is one of the greatest abuses of shareholder assets. Corporations buy their stock back at times when valuations are off the charts and cash is flush. Then they discontinue these operations when prices have plummeted and cash is tight, likely during a recession. Furthermore, it is when share prices are low and conditions are tough that corporations often look to issue more shares to raise funds. How is spending cash on overpriced stocks or issuing shares after prices have plunged, in the best interest of shareholders?

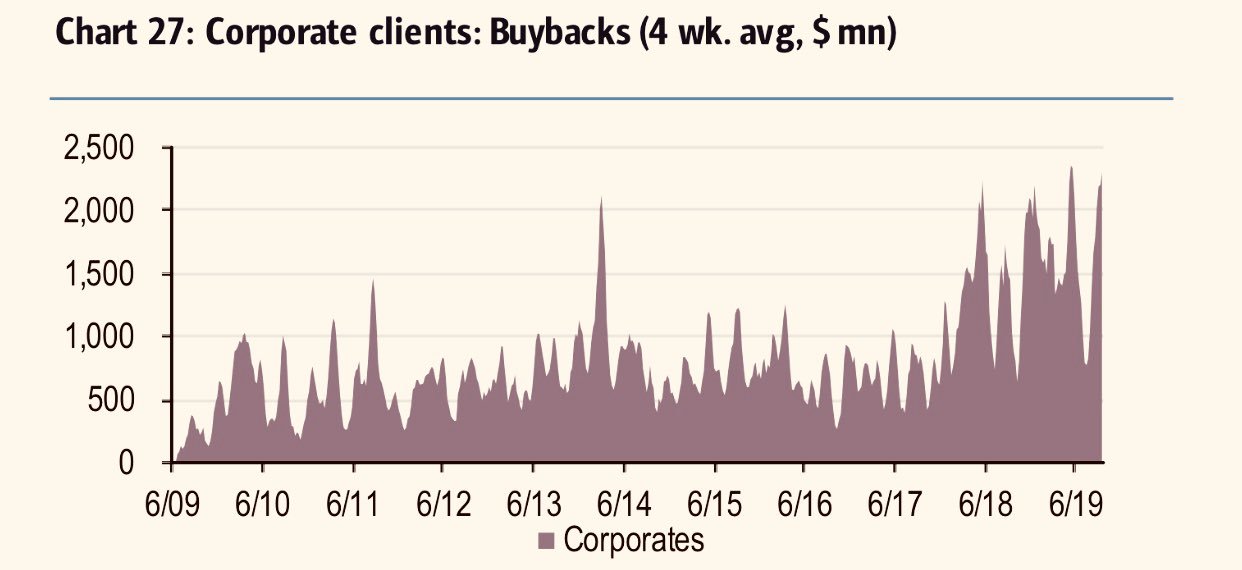

The following is from a recent blog by economist Lance Roberts of Real Investment Advice.

“As shown by BofA, in 2019, cumulative buybacks are up +20% on an annualized basis, with the 4-week average reaching some of the highest levels on record. This is occurring at a time when earnings continue to come under pressure due to tariffs, slower consumption, and weaker economic growth.”

So, why do corporations employ buybacks at what appears to be the opposite time one would expect? Lance continued,

“As the Financial Times recently penned: ‘Corporate executives give several reasons for stock buybacks but none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay and in the short-term buybacks drive up stock prices.’”

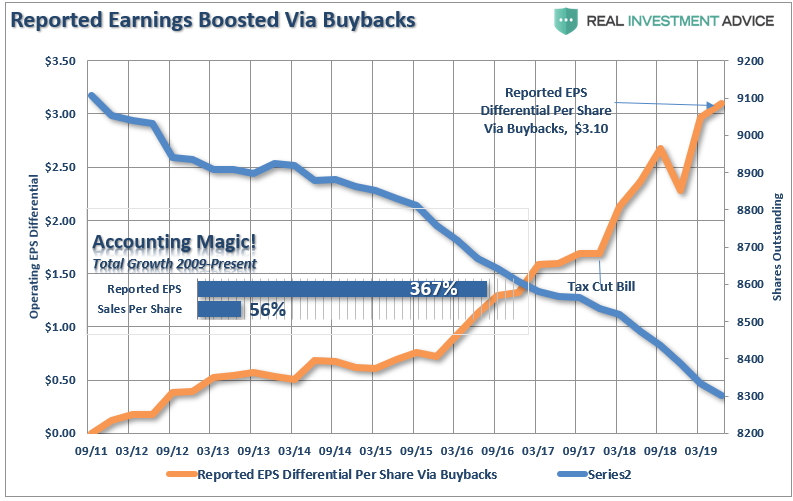

Reducing the number of shares outstanding boosts the appearance of earnings. Since earnings are typically examined on an “earnings-per-share” (EPS) basis, simple math reveals that if you decrease the number of shares the EPS increases. This has been done to the extreme since the Great Recession giving corporations with lackluster revenue growth the look of stronger progress. The following chart illustrates the operating earnings “per share” boost given to corporations as a result of stock buybacks.

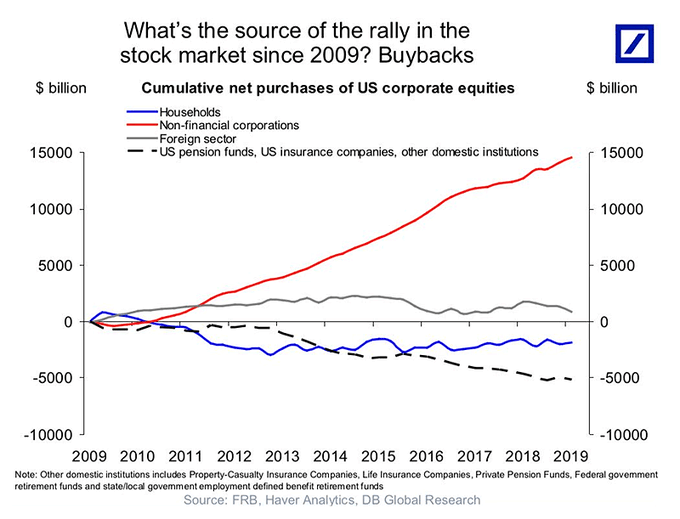

The next chart is probably the most revealing. This graph shows the dramatic contribution to stock price increases provided through corporate stock buybacks. As described in Lance Roberts blog,

“What is clear, is that the misuse, and abuse, of share buybacks to manipulate earnings and reward insiders has become problematic. As John Authers recently pointed out:

‘For much of the last decade, companies buying their own shares have accounted for all net purchases. The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices.’

In other words, between the Federal Reserve injecting a massive amount of liquidity into the financial markets, and corporations buying back their own shares, there have been effectively no other real buyers in the market.”

Those believing the low level of interest rates and massive quantitative easing liquidity programs justify high stock price valuations are being duped by most media pundits. And while the actions of central bankers have provided the fuel for pushing stock prices higher, they do not justify the level of prices versus economic and corporate profit growth. As with all bubbles created by policies which prompt investors to think “this time is different,” eventually they discover the cause might be different, but the end result is the same.

Current stock prices portend a decade of close to net zero growth in stock prices. Don’t misread this statement. It doesn’t mean stock prices will not change for a decade. It means there will likely be a significant drop followed by an extended recovery. One point most investors forget from history is: if the average stock valuation is correct, and prices have been “overvalued” or above the average for the better part of three to four decades, at some point investors are in for an extended period below the average.

The following chart illustrates the number of years it has taken on an inflation-adjusted basis to recover from prior bear markets. Avoiding big losses is more important than capturing bubble-market gains.

Most investors do not realize what has caused, by some measures, the largest stock market bubble in history. Or what policies created one of the largest wealth gaps in history. There has always been an inherent bias for higher stock prices no matter the reason. The media and others always find a way to justify outrageous stock price valuations. The question is, are investors being duped?

The S&P 500 Index closed at 2,962 down 1.01% for the week. The yield on the 10-year Treasury fell to 1.68%. Oil prices decreased to $56 per barrel, and the national average price of gasoline according to AAA dropped to $2.65 per gallon.

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.