Executive Summary

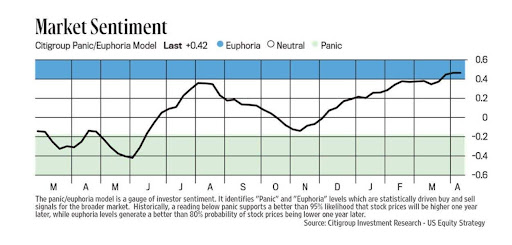

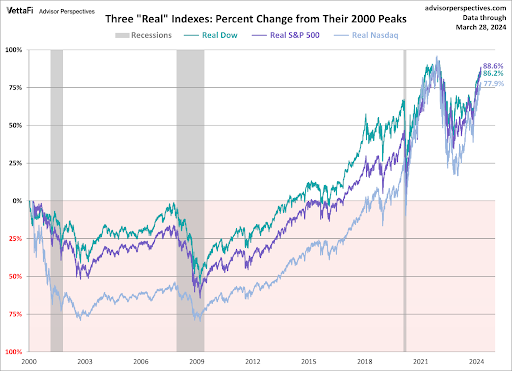

The bear market rally since October 2023 appears to have been based on exorbitant speculation on hopes of six or more Fed rate cuts. According to Citigroup, when market euphoria reaches current levels (see first graph), this sets up an 80% probability markets will be lower in one year. Since inflation is now back on the rise, interest rate cut expectations have dwindled to one or two. Now the bears may be back in charge. The second graph illustrates none of the three indices are higher than their 2021 peak, on an inflation-adjusted basis. Even with the six-month speculative bear market rally, the impact of inflation has prevented new inflation-adjusted (real) highs.

Please continue to The Details for more of my analysis.

“The history of the stock market shows many periods of twenty years or more when stock prices ended up precisely where they began.”

–Peter Bernstein

The Details

The current bear market began in January 2022. During 2022, the major indices tanked between 18% and about 33%. In October 2023, a massive bear market rally began pushing markets to all-time highs and leading many to declare a new bull market had begun. In reality, the bear market rally was nothing more than an exorbitant speculative period founded, to some degree, on hopes of six or more interest rate cuts in 2024. Reality has since set in as inflation has reversed course and is now increasing again. Hopes of six rate cuts have dwindled to maybe one or two. Some economists are even calling for more rate hikes.

I obtained the following Edwin Lefevre quote from the Minsky Moment on X.

“In the beginning of a stock market boom it is ever the ‘dear public,’ the fleecy lambs, the most guileless victims, who make the most money. They really do not know when to stop winning, and so in the end they lose profit and principal.”

The euphoria of speculators over the past six months has been nothing short of incredible. The following chart from Citigroup, obtained from Christian Fromhertz via X indicates, that “…historically when [the] model flashes ‘Euphoria’ this generates [an] 80% probability that stock prices will be lower a year from now.”

And now a lesson in how inflation matters. Most people think of inflation when they make purchases. Prices at the grocery store are higher, gasoline costs more, it is more expensive to go out to dinner, etc. However, many don’t think about the impact inflation has on one’s investment portfolio. The graph below from Advisor Perspectives shows the “real” after inflation, returns of three major stock indices since their 2000 technology bubble peaks.

The S&P 500’s 88.6% real return over the past roughly 23 years might seem lower than one expected. This is the effect of inflation. And these returns are at the peak of the largest bubble in history. Notice that none of the three indices are higher than their 2021 peak on an inflation-adjusted basis. Even with the incredible six month speculative bear market rally from October 2023 to now, the impact of inflation has prevented new real highs.

The euphoria in market sentiment has incentivized speculators to ignore fundamentals and continue widening the disconnect between prices and revenue and earnings. Additionally, higher inflation is reducing the speculative returns temporarily achieved.

Now it appears the bear market rally could be coming to an end, and the bear market might re-take control. The combination of a return to reasonable prices and high inflation could leave many speculators scratching their heads wondering why they allowed that to happen.

The S&P 500 Index closed at 5,123, down 1.6% for the week. The yield on the 10-year Treasury

Note rose to 4.50%. Oil prices decreased to $86 per barrel, and the national average price of gasoline according to AAA rose to $3.63 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.