Executive Summary

The U.S. Federal debt skyrocketed from $8.8 trillion in 2007 to $34 trillion currently. Additionally, the average interest rate on that debt has gone from a low of 1.56% in 2022 to 3.22% – and new debt issued is even higher. Studies show that once debt reaches the current level relative to GDP, it poses a significant drag on growth. Currently U.S. debt is at 122% of GDP, and it costs over one trillion dollars in interest each year (second graph). The fiscal situation is even worse because the Medicare and Social Security deficits are not fully accounted for. Interest payments for 2024 will likely exceed 40% of income tax receipts. The predicament is not being addressed, as neither party wants the pain on their watch. The current predicament is serious.

Please continue to The Details for more of my analysis.

“You cannot escape the responsibility of tomorrow by evading it today.”

–Abraham Lincoln

The Details

The U.S. Treasury is getting hit with a double whammy. The balance of the Federal debt is soaring with massive annual Federal deficits, at the same time interest rates are rising. The average interest rate on outstanding Treasury debt, according to fiscaldata.treasury.gov, has jumped from a low of 1.56% in early 2022 to 3.22% currently. While 3.22% might seem low, as Treasuries mature, they are replaced with new debt at even higher rates.

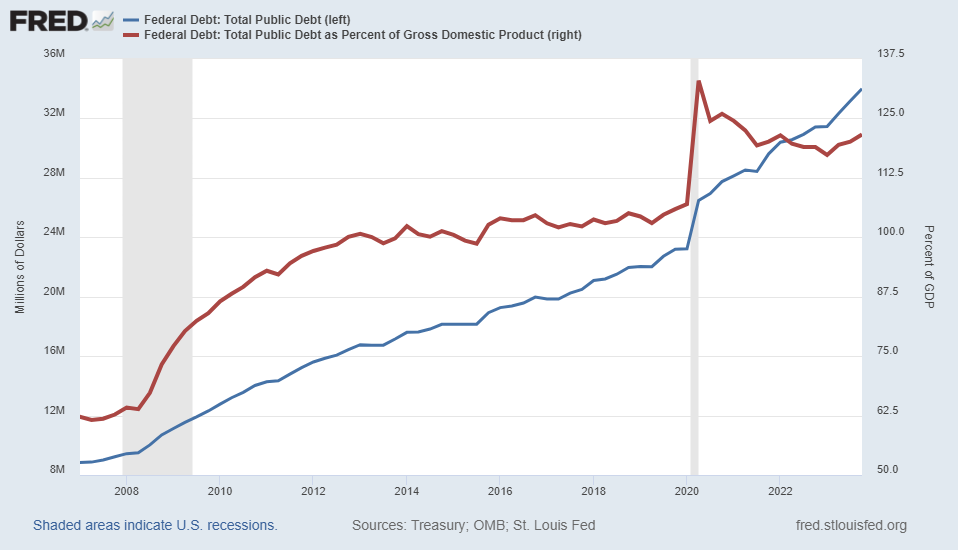

The Federal debt balance skyrocketed from $8.8 trillion in 2007 to a whopping $34 trillion currently. This almost quadrupling of debt is shown in blue (left side) in the graph below. The red line (right side) illustrates that debt as a percentage of Gross Domestic Product (GDP) has jumped from 62% to 122%. Debt has reached a point where econometric studies indicate it will have a noticeable drag on economic growth.

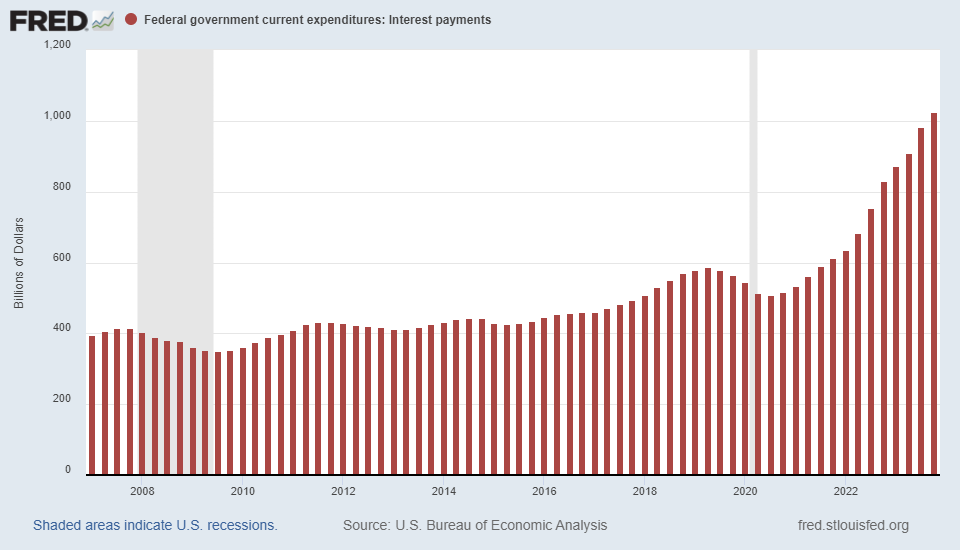

The cost of maintaining such an exorbitant amount of debt is becoming quite visible. The chart below shows quarterly, annualized interest payments on the debt. It now requires over $1 trillion per year and growing to service this debt load.

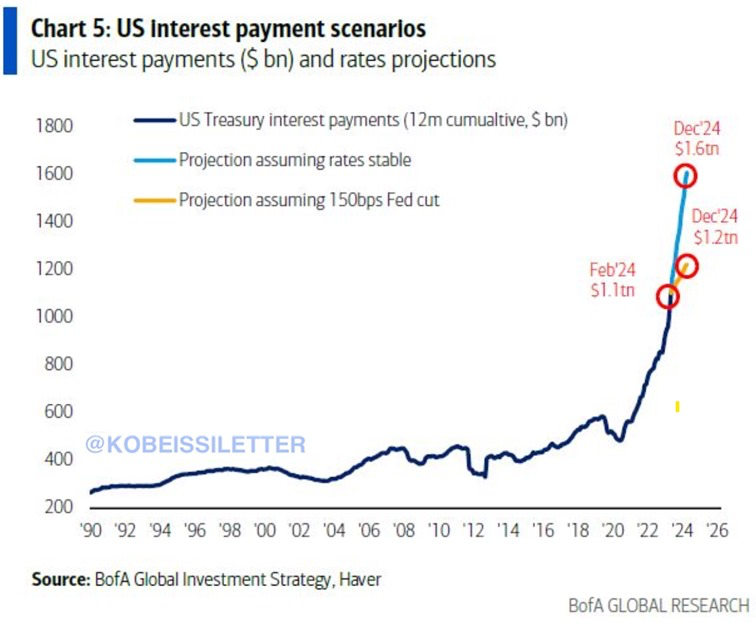

The graph below from Bank of America shows how interest expense will increase to $1.6 trillion by the end of the year if interest rates are held at current levels. The graph does not even illustrate what would happen if inflation remains high, and the Fed determines that rates need to increase further.

To provide some perspective on how this massive expense will impact the Federal budget, the current level of interest expense consumes 42% of total income taxes collected. The Federal Government has annual receipts of around $4.4 trillion. Of this about $2.6 trillion comes from income taxes. The remaining $1.8 trillion is derived from Social Security (SS), Medicare and other taxes. With SS and Medicare expenditures already more than their related tax receipts, the remaining roughly $4.3 trillion in Federal expenses must be covered by income taxes and debt issuance.

If income tax receipts total approximately $2.6 trillion, that leaves a $1.7 trillion shortfall in addition to the shortfall from SS and Medicare. Total Federal expenditures, including SS and Medicare, are about $6.5 trillion. The total of just three categories, SS/Medicare, defense, and interest on the debt is approximately $5.1 trillion (using the projected $1.6 trillion in interest expense from the above graph). Remember, total annual receipts are about $4.4 trillion. So, the U.S. is running a $700 billion deficit just on these three categories of expenditures. Any other spending merely increases the annual deficit and Federal debt balance.

The fiscal picture of the Federal Government was already precarious before the rise in interest rates. Now with exponential growth in the Federal debt and rising interest rates, the fiscal crisis should be clear. And this picture ignores the “off-balance sheet” debt needed to make SS and Medicare sustainable.

The U.S. financial situation is approaching uncharted waters. No one in charge seems to even be concerned about the rapidly rising debt and deficits. At least not enough to actually propose realistic solutions. If not attended to soon, the Federal financial predicament will spiral beyond the ability to regain control. The situation is serious, yet it is not being treated as such.

The S&P 500 Index closed at 4,967, down 3.0% for the week. The yield on the 10-year Treasury Note rose to 4.62%. Oil prices decreased to $83 per barrel, and the national average price of gasoline according to AAA rose to $3.68 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.