Executive Summary

Last week the monthly jobs report showed 303,000 new jobs created, exceeding expectations. However, the details reveal substantial increases in part-time jobs with significant losses in full-time jobs. According to one economist, part-time job growth over the last year has been 1.888 million versus a 1.347 million decrease of full-time jobs. Historically this trend has been an indicator of recession. This time could be different, or the full-time jobs decrease could be indicating a slowing economy.

Please continue to The Details for more of my analysis.

“Quality is more important than quantity. One home run is much better than two doubles.”

–Steve Jobs

The Details

As I have pointed out in several recent newsletters, if one obtains financial information from financial media or headlines, then one is probably not getting the complete picture. For instance, last week the monthly jobs report was released, to the abundant praise of the media because new jobs increased by 303,000, far beating expectations. This number was obtained from the Bureau of Labor Statistics’ Establishment Survey in the Employment Situation Summary for March 2024. Additionally, the Household Survey indicated the Unemployment Rate ticked down 0.1% to 3.8%.

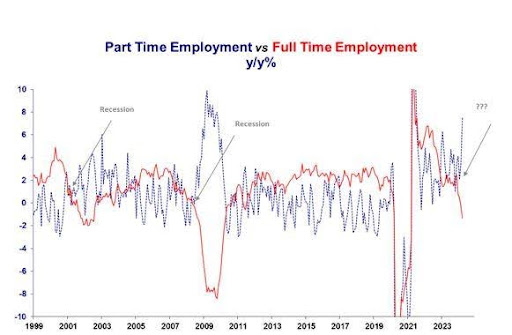

On the surface, these look like positive results. And, if this is the only data examined, one would draw the conclusion that the employment situation remains strong. However, a look into the details reveals some disturbing information. Financial analyst Stephanie Pomboy stated the following in a Tweet on X, “Nothing about this chart suggests we have a ‘strong’ labor market. Far from it. FT [Full Time] jobs down -1.3% y/y [year-over-year] …PT [Part Time] jobs up 7.5%y/y.”

More specifically, Strider Elass, Senior Economist at First Trust Portfolios, Tweeted, “No one is reporting this. Part-time job growth over the past year (+1,888,000) has outpaced full-time job growth over the past year (-1,347,000) for the fourth consecutive month. Historically (as can been seen in the charts), a sustained period of such a trend has often signaled an impending recession or indicated that we were already in one. As of today, we are not in a recession, but something to keep an eye on.”

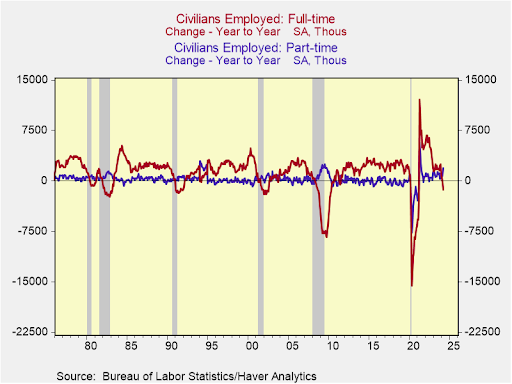

In the graph above, every time from 1975 forward, when full-time jobs fell below zero, the U.S. was in a recession. This is another indicator – along with the LEI (Leading Economic Indicators) – that suggests the economy is in recession. Remember, the NBER (National Bureau of Economic Research) is the official arbiter of when a recession begins and ends. They typically do not call the start of a recession until it has been occurring for at least six months. This is because they want to examine data subsequent to the start date to confirm the cycle has indeed turned.

Like many abnormalities witnessed over the past decade, it may be different this time. However, the preponderance of evidence indicates that the employment picture is not strong, and the economy could likely be in a recession.

The replacement of full-time jobs with part-time jobs is a well-established indicator that the economy is slowing into recession.

The S&P 500 Index closed at 5,204, down 1.0% for the week. The yield on the 10-year Treasury

Note rose to 4.38%. Oil prices increased to $87 per barrel, and the national average price of gasoline according to AAA rose to $3.59 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.