Executive Summary

This week’s Update shares Warren Buffett’s comment regarding the current stock market exhibiting casino-like behavior. However, most of this week’s discussion includes excerpts from Economist Dr. John Hussman’s March 21 Market Commentary (link to full comment below). He points out that current market valuation extreme matches those only seen twice in U.S. financial history, that of 1929 and December 31,2021. While he states markets could continue to higher extremes, the risk for future market losses should be of concern to investors.

Please continue to The Details for more of my analysis.

“If you can’t spot the sucker in the first half hour at the table, then you are the sucker.”

–Mike McDermott – Rounders

The Details

In the last few newsletters, I highlighted the extent to which the stock market is extremely overvalued. I shared similarities to the Technology Bubble and the “New Era” just prior to the Great Depression. Even renowned investor Warren Buffett has jumped on the bandwagon informing investors of the danger in the current stock market. In his annual Berkshire Hathaway letter, Mr. Buffet drew a comparison of today’s stock market to a casino, saying, “For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young,” he wrote. “The casino now resides in many homes and daily tempts the occupants.”

Economist Dr. John Hussman provided a thorough review of the current state of markets in his recent Market Comment. The following is from his Market Comment. I encourage you to review the entire article here, https://www.hussmanfunds.com/comment/mc240321/.

“This is the longest period of practically uninterrupted rise in security prices in our history… The psychological illusion upon which it is based, though not essentially new, has been stronger and more widespread than has ever been the case in this country in the past. This illusion is summed up in the phrase ‘the new era.’ The phrase itself is not new. Every period of speculation rediscovers it… During every preceding period of stock speculation and subsequent collapse business conditions have been discussed in the same unrealistic fashion as in recent years. There has been the same widespread idea that in some miraculous way, endlessly elaborated but never actually defined, the fundamental conditions and requirements of progress and prosperity have changed, that old economic principles have been abrogated… that business profits are destined to grow faster and without limit, and that the expansion of credit can have no end.”

– The Business Week, November 2, 1929

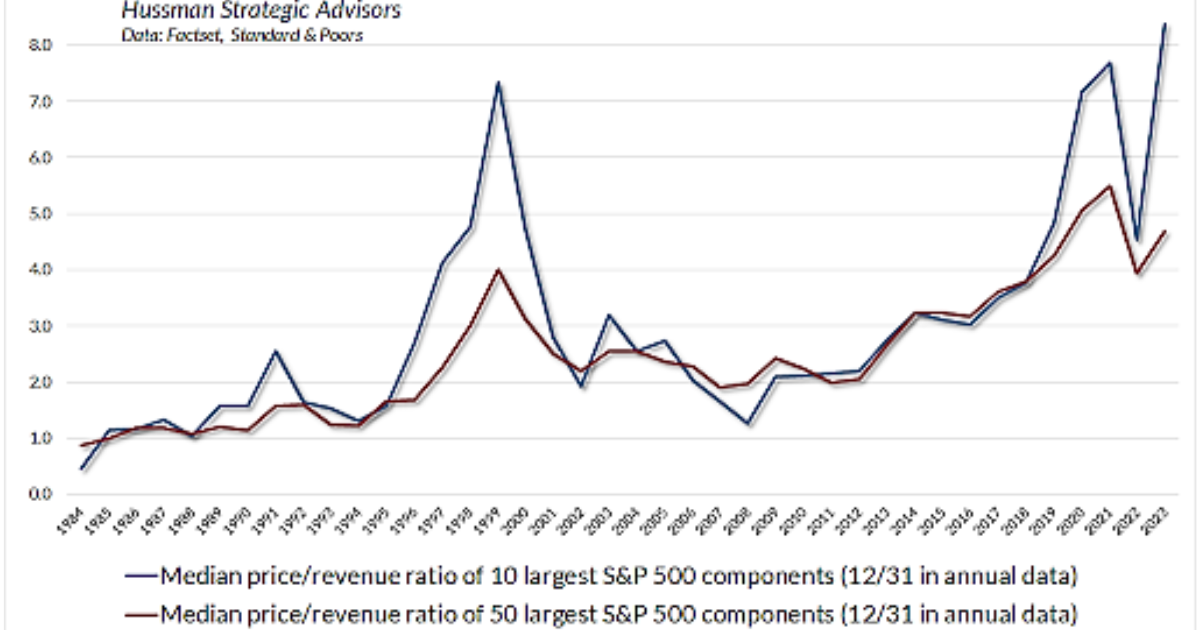

“Based on the valuation measures we find best-correlated with actual subsequent S&P 500 total returns across a century of market cycles, the stock market presently stands at valuation extremes matched only twice in U.S. financial history: the week ended December 31, 2021 (the 2022 peak occurred the next trading day) and the bubble peak in the week ended August 26, 1929. While our investment discipline is to align our outlook with prevailing, observable market conditions, my impression is that investors are presently enjoying the double-top of the most extreme speculative bubble in U.S. financial history.

Present valuation extremes might only be a long-term concern if our measures of market internals were not also divergent and unfavorable here. It seems popular to imagine that ‘this time is different’ – that the economy has entered a new era of permanently high profit margins and credit expansion; that a narrow, selective, two-tier frenzy among large capitalization glamour stocks is enough to carry the market ever higher. History is not friendly to these ideas, but no forecasts are required. Our outlook will change as observable conditions change.

This month’s comment offers an expansive and data-rich dive into profit margins and market composition. The objective is not to argue, or convince, or urge investors to do anything. We share our research, and we ask nothing in return. Still, if there is one suggestion that might be useful to investors here, it is simply to allow the possibility that market conditions will change. Whether your outlook is bullish or bearish, the notion that the current situation is permanent is exactly what will make you suffer.”

[…]

It’s notable that our most reliable valuation gauge matches extremes seen only at the 1929 and 2022 market peaks. Personally, I believe that these extremes should be of great concern to long-term investors, but that doesn’t prevent valuations from breaching those extremes in the short run. We do believe that 10-12 year S&P 500 total returns are likely to be negative, and we do estimate that the S&P 500 is likely to lose something on the order of 50-70% from current highs over the completion of this market cycle.”

The preponderance of evidence clearly illustrates that the current detachment from reality is almost as great as has been witnessed in all of market history. Those who choose to ignore such realities do so at their own peril. As Warren Buffett said, markets presently exhibit casino-like behavior. We agree. And the outcome this time should resemble those times following prior great stock market bubbles.

The S&P 500 Index closed at 5,234, up 2.3% for the week. The yield on the 10-year Treasury

Note fell to 4.22%. Oil prices remained at $81 per barrel, and the national average price of gasoline according to AAA rose to $3.53 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.