Executive Summary

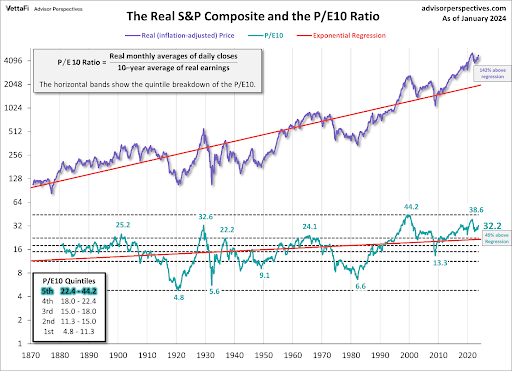

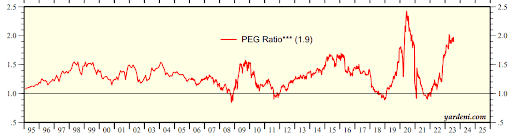

Markets are again extremely overvalued in relation to long-term norms. In this issue, I provide several methodologies to explain the situation. First the trailing twelve-month P/E ratio is 27.2, with the long-term median being about 15. Next is the Shiller P/E or the (CAPE) which uses 10-year inflation-adjusted, average earnings to smooth fluctuations in cycles. Currently the CAPE sits at 33.7, which as shown in the first graph below, is in the top quintile. And finally, the PEG ratio in order to consider future earnings growth rates. The PEG ratio is 2.6, with the 30-year average being 1.2. Realizing that valuation methodologies are not predictors for timing of corrections, but rather indicators of the extent of possible corrections. Speculators may continue to draw retail investors into overvalued markets; however, one should take note of the risk involved.

Please continue to The Details for more of my analysis.

“Gambling: The sure way of getting nothing from something.”

–Wilson Mizner

The Details

Frequent readers of these Weekly Market Updates know that I have been illustrating the extent of market overvaluation relative to long-term norms for a long time. Please understand that fundamentals and valuations are not good at forecasting when markets will correct; however, they can be good predictors of the magnitude of the disconnect and possible future correction. History proves that eventually overvalued markets revert to their mean or below. Over the past three decades markets have been held artificially high through a combination of Federal Reserve monetary policies and Federal Government fiscal policies. The consequences of these policies include record debt at all levels – personal, corporate and government; perpetually overvalued stock market now pushing all-time record overvaluation; high inflation; higher interest rates; and record Federal deficits.

The purpose of this missive is to review several valuation methodologies to show how market participants no longer fall under the category of investors, but instead have morphed into speculators, despite the financial media providing a contrary message. The current status of debt, deficits, inflation and interest rates leads me to believe that the ultimate denouement of three decades of radical policies could be near. If so, what do valuation calculations indicate reversion to the mean would entail?

The most common and simple valuation methodology is the price-to-earnings ratio (P/E). Using the S&P 500, one would take the price, 5,006 as of last Friday, and divide by trailing twelve month earnings, approximately $184, giving a P/E of 27.2. The long-term median P/E ratio is about 15. When a crisis or deep recession occurs, normally earnings plummet more than price, therefore, the P/E ratio will very briefly skyrocket higher. The only time the P/E has been higher than today was around the Tech Bubble and crash, the Financial Crisis and the COVID pandemic.

Yale Professor Robert Shiller, utilizing the methodology of Benjamin Graham, calculates the cyclically adjusted price-to-earnings ratio (CAPE) also nicknamed the Shiller P/E or PE10. The CAPE is designed to eliminate some of the business cycle fluctuations by using 10-year inflation-adjusted average of earnings for the denominator. The current CAPE is 33.7. At the time the following graph was prepared by VettaFi, the CAPE was 32.2. Notice in the graph below that the CAPE has remained in the highest (5th) quintile for almost three decades, with a few exceptions around the periods of crisis and/or recession noted previously. Extreme monetary policy has been able to kick the can down the road and has prevented markets from truly correcting. In the graph, the CAPE has not fallen into the first quintile since the 1970s to 1980s. Normally, loose monetary policy allows excesses to build, creating extremely overvalued markets, which then correct by selling-off until the CAPE reaches single digits, becoming extremely undervalued.

The Fed lowered interest rates to encourage the accumulation of debt to finance consumption. Additionally, when rates reached the zero-bound, people felt compelled to pour their savings into the stock market to achieve a return. This became known as TINA or “There Is No Alternative” to the stock market. The Fed is largely responsible for fostering the largest bubble in stock market history.

Some analysts point to the P/E ratio’s deficiency, stating it does not account for differences in earnings growth rates. If long-term forecasted growth rates are higher than normal, a higher P/E might be justified. Of course, as Yogi Berra said, “It’s tough to make predictions, especially about the future.” The accuracy of long-term forecasts has been less than stellar. That said, the PEG ratio or PE-to-Growth ratio was designed to eliminate the “future growth” shortcoming. The typical calculation uses the P/E ratio described above and divides it by the 5-year forecasted earnings growth rate. The current P/E as stated above is 27.2. According to FactSet, analysts are projecting S&P 500 2024 earnings growth of 10.9%. The five-year forecasted growth rate used in the graph below is 10.5%. Suffice it to say that looking ahead at a possible recession, massive debt service and slowing economic growth, using 10.5% as an estimate of 5-year growth is being generous and likely understating the PEG. The estimate for the PEG is 2.6. According to an analysis by Yardeni the historical 30-year average of the S&P 500 PEG is 1.2. A graph of historical PEG ratios created by Yardeni and obtained from an article on SeekingAlpha.com is shown below.

The current PEG ratio of 2.6 (the graph above was created in August 2023 and showed a current PEG of 1.9) is the highest PEG ratio in data I have reviewed back to 1985, almost 40 years. The only time that was even close was during the pandemic when earnings growth forecasts plummeted. Considering the state of debt, deficits, inflation and interest rates, I believe that the earnings forecast is not only generous but probably unlikely. Assuming the 5-year earnings growth rate falls to an average of 8% per year, that would result in a PEG of 3.4 or 2.83 times the long-term mean.

Any way one slices it, the stock market is in record overvaluation territory. Speculators using 0dte (zero days to expiration) option contracts have lured retail investors to push prices to silly valuation levels. Yes, prices could continue higher as long as there are speculators willing to risk their capital. The higher this bubble rises, the more it will have to fall to reach reasonable valuations. The CAPE ratio has not spent any significant time in the first or second quintile (as shown previously in the graph from VettaFi) since the 1970s to mid-1980s. There is only so much debt that can be accumulated to keep the party going before growth comes to a halt.

The stock market has definitely reached extreme exuberance (again).

The S&P 500 Index closed at 5,006, down 0.4% for the week. The yield on the 10-year Treasury

Note rose to 4.28%. Oil prices increased to $79 per barrel, and the national average price of gasoline according to AAA rose to $3.28 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.