Executive Summary

In this week’s newsletter, I review the salient points relating to market conditions in Dr. John Hussman’s Interim Comment: February 25, 2024, entitled “Speculative Euphoria and the Fear of Missing Out”. Highlights include elements driving FOMO such as new market highs, possible “soft landing,” a Fed “pivot” and euphoria surrounding artificial intelligence. One can link below to his full comment or continue to my selected excerpts. One quote of his is: So is this a market peak? No idea. Do present conditions mirror a market peak? Absolutely.” For which he then concludes: “Our discipline is just our discipline. We’re not going to abandon it because someone else has FOMO…”

Please continue to The Details for more of my analysis.

“There is nothing new, except what has been forgotten.”

–Marie Antoinette

The Details

In this week’s newsletter, I will review the salient points relating to market conditions in Dr. John Hussman’s Interim Comment: February 25, 2024, entitled “Speculative Euphoria and the Fear of Missing Out”. If you would like to read the full article, a link is here… https://www.hussmanfunds.com/comment/observations/obs240225/.

The comment begins with a quote from Barron’s Magazine, February 3, 1969; however, if you didn’t look at the date you would swear it was from a current issue.

“The failure of the general market to decline during the past year despite its obvious vulnerability, as well as the emergence of new investment characteristics, has caused investors to believe that the U.S. has entered a new investment era to which the old guidelines no longer apply. Many have now come to believe that market risk is no longer a realistic consideration, while the risk of being underinvested or in cash and missing opportunities exceeds any other.”

Hussman proceeded to state, “The S&P 500, having peaked a few weeks earlier, was down 36% by May 1970.”

The reason for providing an Interim Comment for readers “…is that even though the S&P 500 and Nasdaq 100 have struggled to match Treasury bill returns for over two years, investors seem to be developing an excruciating and nearly frantic ‘fear of missing out.’ Lots of pressures are driving that fear: the recent push to nominal record highs, enthusiasm about an economic ‘soft landing,’ an expected ‘pivot’ to lower interest rates, and most recently, euphoria about the prospects for artificial intelligence.”

He goes on to say his “… impression is that the Fed will indeed pivot to lower rates late this year, though the pivot may be more consistent with the Fed’s aggressive easing during the 2000-2002 and 2007-2009 collapses than with quantitative easing and the recent zero-interest rate bubble. I do believe that current market valuations, whatever metric one chooses, are likely to be followed by weak-to-dismal 10-12 year total returns and deep full-cycle losses.”

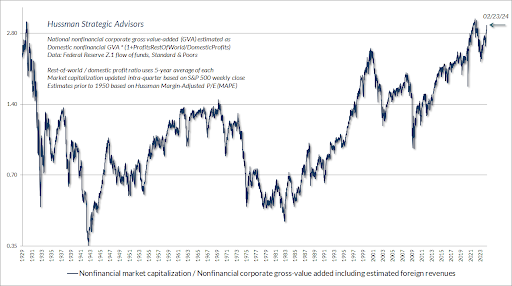

In the article, Hussman shows the following graph as his favored measure of stock market valuation, which he has determined is best-correlated with subsequent 10-12 year S&P 500 total returns. “Presently, this measure is higher than at any point prior to June 2021, with the exception of three weeks surrounding the 1929 peak.”

This current valuation measurement suggests that the estimated forward 12-year return for a “balanced” portfolio (60% S&P 500, 30% Treasury Bonds & 10% Treasury Bills) would average below 0%!

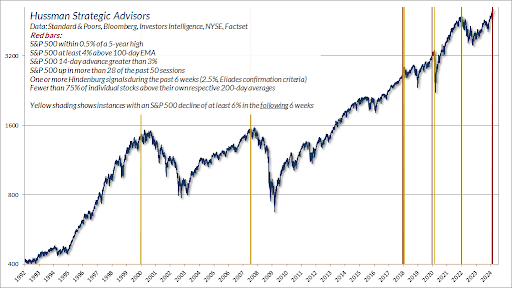

The present environment represents one of the most hostile for market return/risk profiles. These arise when “…unfavorable valuations are joined by unfavorable market internals and overextended market action.”

It is almost impossible to call the peak of the market as it occurs. However, it is possible to study history and examine situations that have marked prior peaks. “Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than 99.9% of instances across history. As I noted in our February comment, I call this subset of history the Cluster of Woe.”

– “We can’t say with any certainty at all that stocks are at a market peak. We can also say with complete certainty that present conditions mirror what a market peak looks like.”

“The last time we saw a preponderance of warning signs similar to today was on the approach to the early 2022 peak (see my late-November 2021 comment Motherlode for a discussion of these syndromes).”

“The chart text [below]shows the conditions that define this particular syndrome. The yellow shading shows which of these instances were followed by declines in the S&P 500 of at least 6% over the following 6 weeks. I prefer to view these outcomes not as ‘forecasts’ but simply as ‘regularities’.

“So is this a market peak? No idea. Do present conditions mirror a market peak? Absolutely.”

“Our discipline is just our discipline. We’re not going to abandon it because someone else has FOMO…”

The S&P 500 Index closed at 5,089, up 1.7% for the week. The yield on the 10-year Treasury

Note fell to 4.26%. Oil prices decreased to $76 per barrel, and the national average price of gasoline according to AAA dropped to $3.26 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.