Executive Summary

Many respected economic analysts have been questioning the numbers being reported by the Federal Government. For example, the “new jobs” numbers reported through November 2023 were strong. However, they were just revised down by 439,000, leaving analysts to question the initial reports. Along those same lines, last week the Bureau of Economic Analysis (BEA) announced the economy grew at an annualized 3.3% rate in the fourth quarter of 2023. When comparing the adjustment made to get to inflation-adjusted growth, or “real” GDP, one sees something puzzling. The third quarter 2023 inflation adjustment was 3.3% compared to fourth quarter of 1.5%! If the same adjustment had been made in the fourth quarter as the third, growth would have been around 1.5%. Call me a cynic, but things seem questionable at best.

Please continue to The Details for more of my analysis.

“Cynicism is reality with an alternate spelling.”

–Woody Allen

The Details

Many respected economic analysts have been scratching their heads lately as the numbers being reported by the Federal Government seem to contradict what appears to be occurring in the real world. One example is the reporting of new jobs created. Over the past year, one of the anomalies has been how employment can remain so robust in an inflationary, weakening economic environment. Some of the discrepancies can be attributed to the sharp rise in part-time workers and those working two jobs to make ends meet. Also, governmental hiring has increased pushing up new hires. However, the “strong” monthly new jobs reports through November of last year were recently “adjusted” down by 439,000. In other words, the monthly new jobs celebrations surrounding strong hiring were a little premature. However, the market and pundits only seem to care about the initial reports, not the revised numbers.

Most readers of this missive can likely attest to the rise in prices over the past couple of years. In fact, I would bet most would say that inflation is higher than that claimed by the Government. Last week, the Bureau of Economic Analysis (BEA) announced the economy grew at an annualized 3.3% rate in the fourth quarter of 2023. This result surprised most people and was a 5-sigma (standard deviation) beat versus expectations. A 5-sigma result is so implausible that it only occurs 0.00003% of the time. Scientists would attribute such a deviation to a “new phenomenon” instead of a statistical variation. That “new phenomenon” is not hard to identify in the recent GDP report.

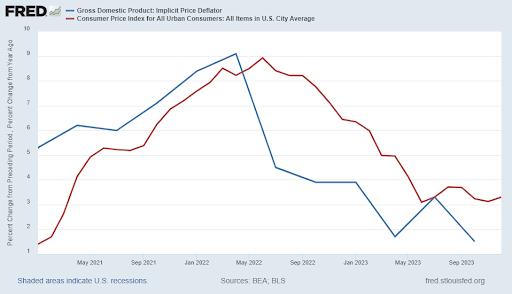

Nominal economic growth is adjusted for the impact of inflation to get “real” GDP growth. The inflation adjustment is called the GDP Implicit Price Deflator. Notice in the graph below, the deflator has been consistently below the CPI (Consumer Price Index) inflation reading since about May of 2022.

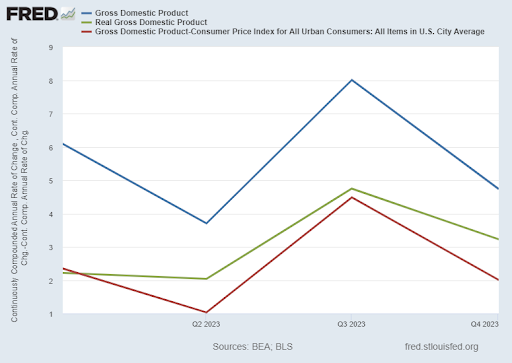

The GDP deflator used in the third quarter of 2023 was 3.3%. The deflator used in the fourth quarter was 1.5%! Yes, the annualized inflation adjustment used to determine real GDP in the fourth quarter was only 1.5%. Hence, the “new phenomenon” – phony inflation numbers. In the chart below, I show nominal GDP growth in blue and the reported real GDP growth in green. If the nominal GDP result was reduced by the CPI, the real GDP result would have been about 2% or what most analysts expected. This is shown in red in the graph below.

If nominal GDP growth was reduced by the 3.3% deflator used in the third quarter, real GDP growth would have been about 1.5%.

Something appears amiss in the recent GDP report as 5-sigma deviations are extremely unlikely. The impression given is that the inflation adjustment (deflator) was understated in order to produce a “blowout” economic report in the middle of an election year. Call me a cynic.

Just like the payroll numbers were subsequently adjusted downward, I expect real GDP for 2023 will also be revised lower in the future. But by that time no one will care as it will be called “old data.”

In my opinion there are adequate reasons to question the veracity of the government data being reported to the public.

The S&P 500 Index closed at 4,891, up 1.1% for the week. The yield on the 10-year Treasury

Note rose to 4.16%. Oil prices increased to $78 per barrel, and the national average price of gasoline according to AAA increased to $3.10 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.