Executive Summary

The S&P500 has been pushed back to speculative highs. The 0dte options activity, discussed in previous newsletters, by large investment firms creates a very risky environment for individual retail investors. Pundits point to excess liquidity in the market as the reason for the highs; however, as shown in the first graph below, the Fed is reducing liquidity. According to FactSet, S&P500 fourth quarter 2023 earnings are projected to drop 1.7%. So currently corporate earnings are falling, while prices are rising. Market valuations currently are like other bubble periods, as evidenced by the Shiller P/E of 33. There is a saying that while history does not repeat, it does rhyme. If history is any warning, current market risks could be detrimental to many retail investors.

Please continue to The Details for more of my analysis.

“What goes up must come down.”

–Isaac Newton

The Details

Over the past couple of weeks, speculators took back control of the stock market, engaging in as much speculative activity as possible to push the S&P 500 to new highs. The actions of large investment firms partaking in exceptionally risky behavior, especially involving the use of 0dte (zero days to expiration) option contracts, have transformed markets into gambling casinos. It boils down to attempting to manipulate the markets higher by betting on the direction of the market in four-hour increments. The ones ultimately hurt by these actions are retail investors. Seeing the market rise, not understanding what is behind it, and being told by the financial press that a new “bull market” has arrived, retail investors jump all-in. As almost always occurs in bubbles, retail investors go all-in at the top.

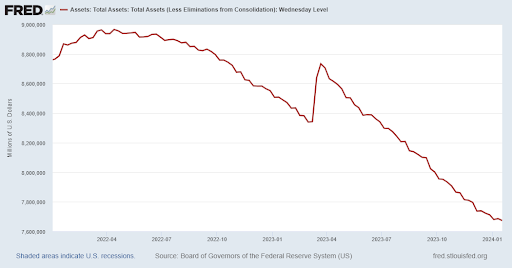

When markets rise for no obvious fundamental reason, financial pundits seek out all types of “experts” to explain why markets are rising. There are always plenty of explanations to justify bubbles. Today many attribute the rise to excess liquidity in the markets. I will be polite and say: “I believe that is a bunch of bunk.” The Fed has raised interest rates considerably in a short period of time, and they continue to implement QT (Quantitative Tightening). QT is allowing the Fed’s balance sheet to shrink (reducing liquidity) by allowing their bond holdings to roll-off at maturity. The graph below shows that liquidity has decreased from a peak of about $9 trillion to about $7.7 trillion today.

What is pushing the market higher is not liquidity, but instead the speculative mindset of large investment firms. Using techniques such as 0dte, they attempt to convince others the market will continue to rise. Retail investors take the bait. So, why not jump on the band wagon? Looking back at history, when the economy enters recession and corporate earnings are falling, the stock market also declines. The extent of the decline can depend upon the degree of overvaluation built into the bubble. Today, the Shiller P/E ratio (S&P 500 price divided by 10-year average inflation-adjusted earnings) is about 33. The only time valuations were higher were at the top of the Technology Bubble in 2000 and the stimulus inspired bubble of the pandemic. Historically, every time the market became this overvalued, the subsequent bear market pushed the market down by at least 50%.

According to FactSet, S&P 500 earnings for the fourth quarter, 2023, are projected to fall 1.7% versus the prior year. They also stated, “If -1.7% is the actual decline for the quarter, it will mark the fourth time in the past five quarters that the index has reported a year-over-year decline in earnings.”

At the same time, despite the rhetoric coming from many financial pundits, the U.S. economy, by many measures, is either in or near a recession. Therefore, it is my conclusion that the bear market which began January 1, 2022, continues, despite the recent speculative rise in the stock market.

Risk in the stock market has returned to one of the riskiest levels in history. As Mark Twain has stated, “History doesn’t repeat itself, but it often rhymes.” Although the Fed has engaged in a plethora of actions over the past decade to “prevent” a downturn in the markets and the economy, they have merely created a bigger monster.

Wall Street veteran and author John Rubino recently provided the following metaphor for the Fed’s actions in a recent interview. I am paraphrasing. The Fed is an arsonist who sets fire to your house. Then the Fed is called to come and put the fire out. If they put the fire out, we tell them they did a good job. But they set the fire in the first place. Then, they will set an even bigger fire, because they are arsonists. In John’s opinion, the Fed hasn’t done a good job since the 1980’s under Paul Volcker. Since then, he believes the Fed has been catastrophically incompetent or even corrupt.

I too have been a big critic of Fed policies over the past couple of decades. I believe their actions have fueled several of the largest stock market bubbles in history and encouraged debt at all levels to fund consumption. The economy has needed a “clearing” of unserviceable debt for a long time. Now, with higher interest rates and record debt, the Fed could be running out of options. This could be the year the chickens come home to roost. When the Fed runs out of matches, the debt will begin to unravel. This unraveling will drastically impact both the economy and the stock market.

Risk is present at extreme levels. History will likely rhyme.

The S&P 500 Index closed at 4,840, up 1.2% for the week. The yield on the 10-year Treasury

Note rose to 4.15%. Oil prices remained at $73 per barrel, and the national average price of gasoline according to AAA increased to $3.08 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.