Executive Summary

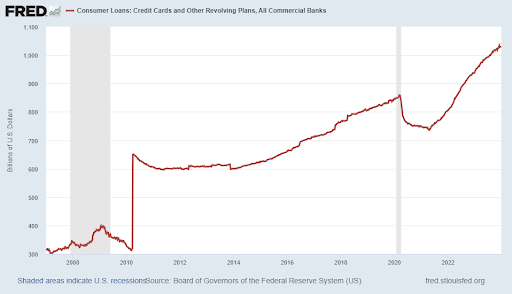

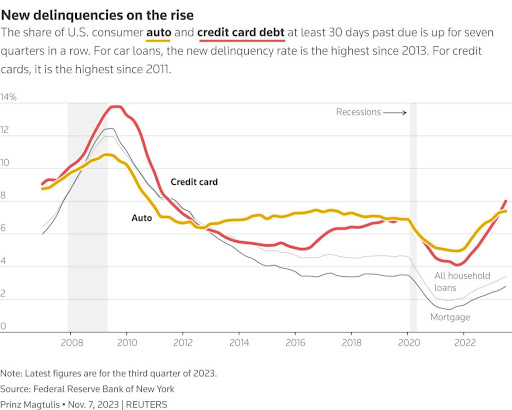

Consumer loans, credit cards and other revolving debt now exceed $1 trillion, far above the pre-Financial Crisis and pre-COVID balances (see first graph). Whenever consumers need to borrow money, those who extend credit create new methods to fulfill the need. The latest method is called “Buy Now, Pay Later” (BNPL). While they advertise no interest, failure to meet payment terms can result in as high as 36% interest and late fees. Many who utilize these types of loans are already struggling financially. The second graph shows delinquencies on the rise for consumer auto and credit card loans. BNPL businesses are less regulated, and thus there is less data available to gauge the potential negative financial impact.

Please continue to The Details for more of my analysis.

“Chains of habit are too light to be felt until they are too heavy to be broken.”

–Warren Buffett

The Details

As discussed in previous newsletters, now that the Covid-related stimulus funds have been spent, consumers have turned to debt to make ends meet. The amount of credit card and revolving debt has surpassed $1 trillion, far exceeding the pre-Financial Crisis and pre-Covid balances, as shown in the graph below.

Whenever consumers need to borrow money, those extending credit learn to derive new, and often more-risky, methods of delivering. There has recently been a surge in the latest method of borrowing funds called “Buy Now, Pay Later” (BNPL). This is a derivation of the old layaway programs. Currently, with little regulation to protect consumers, use of BNPL programs is soaring. Because there is little regulation, it is less transparent and more difficult to determine the extent of exposure to both individuals as well as the overall economy.

One of the draws to this new type of loan is the fact that they are marketed as having no interest. Typically, a purchase is made, and the consumer pays 25% of the cost at purchase. Then the balance is paid in three installments over six weeks. Why pay over 20% in credit card interest when one can finance purchases with no interest? Sounds great, right? In fact, it sounds so great, some consumers are even taking out BNPL loans to purchase groceries. The kicker is in the details. And the details vary by lender. But, for the most part, if the consumer misses a payment, then interest as high as 36% could be applied, plus late fees. And some lenders offer longer terms but can also attach interest as high as 36%.

It is easy to see how consumers can get sucked in and quickly build debt balances far beyond their ability to pay. Studies show that the largest percentage of users of BNPL are those already struggling with debt and are in financially precarious positions.

Delinquencies on credit cards and auto loans are rising significantly as shown in the graph below from Reuters.

If the principal users of BNPL loans are vulnerable families, many contributing to the rise in delinquencies shown above, this will only add to the obligations weighing them down. While this is a multi-billion dollar business, the fact that there is little regulation means there also is little data as to the overall risk to the economy. Suffice it to say that there are significant risks in lending programs designed for the most financially exposed, in a weakening economy where inflation has already inflicted tremendous damage to the average household.

I expect this growing form of lending to result in substantial losses on top of the losses embedded in existing credit card and revolving debt, and other consumer loans. When offered “free credit,” needy consumers will jump. Unfortunately, the extent of the potential damage cannot be fully determined.

The S&P 500 Index closed at 4,697, down 1.5% for the week. The yield on the 10-year Treasury

Note rose to 4.04%. Oil prices increased to $74 per barrel, and the national average price of gasoline according to AAA decreased to $3.08 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.