Executive Summary

2024 will present significant obstacles for regional banks. Simply stated, regional banks use depositors’ funds to make loans or invest in Treasury and Agency securities. The sharp rise in interest rates in 2023 created significant unrealized losses from Treasury securities. During 2024 and 2025, over $1.2 trillion of commercial real estate loans are coming due (see first graph). In some cities, commercial real estate values have declined by as much as 40%. With higher interest rates and lower values, some owners may choose default as the best option. This one-two punch could be a double whammy for the regional banks.

Please continue to The Details for more of my analysis.

“Debts are like children – begot with pleasure, but brought forth with pain.”

–Moliere

The Details

2024 will present significant obstacles for regional banks. Simply stated, regional banks use depositors’ funds to make loans or invest in Treasury and Agency securities, including Agency mortgage-backed securities (MBS). Banks ran into difficulty in 2023 when the value of their Treasury holdings fell significantly due to the rise in interest rates. Securities not designated as “held to maturity” must be marked-to-market, thus producing unrealized losses for the banks. To compound the challenges for the banks, there are a significant amount of commercial loans, including commercial real estate loans, which must be refinanced in 2024.

According to data analytics firm, CRED iQ, there are approximately $659 billion in commercial mortgages coming due this year and another $539 billion in 2025. See graph below.

According to the Financial Times, there are approximately $117 billion office real estate loans due this year. About two-thirds of these loans are held by banks. The risk to banks is the loan collateral (real estate) has or could drop significantly in value. In some large cities such as San Francisco, commercial real estate values have fallen as much as 40%. On top of the drop in value, the renewal interest rate will be tremendously higher than the maturing loan. So, borrowers will face higher debt-service payments on properties with declining values.

Under these circumstances, some borrowers might determine it is more beneficial to default on the mortgage. According to a group of economists, about 40% of the office real estate mortgages held by banks are already under water, meaning the loan balance is greater than the value of the mortgaged property.

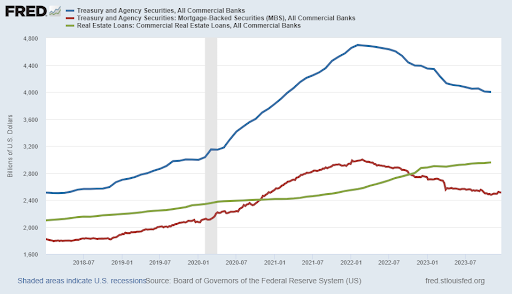

The graph below shows that commercial banks currently own about $4 trillion in Treasury and Agency securities (blue), $2.5 trillion in MBS (red), and about $3 trillion in commercial real estate loans (green). The risk imbedded in the real estate related loans outlined above, combined with the reduced values of the Treasury securities portends potential problems in the near future for regional banks.

According to The Wall Street Journal, “A new survey report reveals concerns about the state of the economy, sentiments that will likely continue to be a primary factor in global real estate leaders’ decision-making through 2024 and beyond.

The report, based on Deloitte’s 2024 Global Real Estate Outlook Survey, includes strategic insights from 750 CFOs and their direct reports at major real estate owner and investor firms in 11 countries.

The survey resulted in the highest percentage of respondents expecting the real estate property sector’s fundamental conditions to worsen since the survey began in 2018.”

This year, regional banks will have to contend with a Treasury portfolio already down in value, due to the rise in interest rates, and significant potential losses on commercial real estate mortgages coming due. Will a banking crisis emerge in 2024 due to this double whammy?

The S&P 500 Index closed at 4,770, up 0.3% for the week. The yield on the 10-year Treasury

Note fell to 3.86%. Oil prices fell to $72 per barrel, and the national average price of gasoline according to AAA decreased to $3.11 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.