Executive Summary

The stock market move this year has primarily been a result of the Magnificent 7 stocks, as well as the change in options trading. The options market is now 11% bigger than the stock market in terms of assets deployed. Utilizing zero days to expiration options (0DTE) to bet on the movement of stocks or indexes in very short-term time frames is more akin to gambling. While corporate earnings declined, stock prices have risen. This speculation and overvaluation translate to elevated risk in the market. Warren Buffett’s favorite valuation methodology (Buffett Indicator in 2nd graph) is the second highest in history, and over double its long-term average. The last chart shows the peak-to-trough drop in the stock market during recessionary bear markets. Given the weakening economy, overvaluation, and the use of 0DTE speculation investors need to be aware of their corresponding risk.

Please continue to The Details for more of my analysis.

“I am not young enough to know everything.”

–James M. Barrie

The Details

Investors holding equity indices, who are excited because the indices have soared this year, might want to gain an understanding of the massive amount of risk they are undertaking. In this missive, I will attempt to outline the activities that have given rise to the speculative gains in 2023. These activities have transformed a stock market where one invests in reasonably valued companies hoping their stock prices will rise as earnings grow, into a tremendous gambling casino where speculators literally are betting on one-day movements in the market.

As outlined in previous newsletters, much of the market activity this year is the result of speculation in the Magnificent 7, or seven overpriced stocks with huge market caps including: Amazon, Apple, Facebook (Meta), Google (Alphabet), Microsoft, Nvidia and Tesla. Although these mega-cap companies have been responsible for a large portion of the market gains this year, it is gambling in the options market which has transformed the stock market. The options market is now 11% bigger than the stock market in terms of assets deployed.

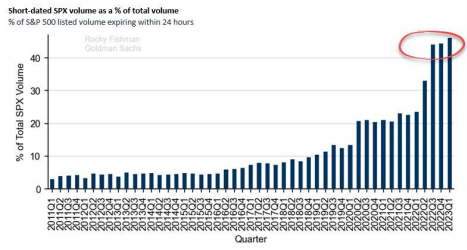

The use of 0DTE (zero days to expiration options) has exploded. These are derivatives, usually put and call options, which normally expire within 24 hours. These derivatives now represent about 45% of all option trades, as shown in the graph below from Goldman Sachs. With these options, speculators are betting on the movement within one day of a particular stock or index. This is pure gambling and has nothing to do with the long-term growth in earnings of a corporation.

To add even more risk to these one-day bets, many are using leverage or borrowing to increase their potential gains (or losses). There are estimates that 0DTE leverage averages 8-to-1.

The options takeover of the stock market, especially the short-term nature of many options contracts, defies traditional explanations of what happened in the markets this year. Fundamentals, like interest rates, and profit margins, at one time drove stock prices. Based on 2023, that is no longer true. As testimony, stocks rose while earnings declined. Stock market analysis is becoming an exercise in trying to assemble analysis on millions of four hour long trades.

So, what happened in 2023? The stock market was taken over by the options market. In general, we saw crowded trades on leverage, occasionally offset by macro shocks that caught derivatives positioning offside. Short-termism dominated thinking, and a few (seven) crowded trades powered the stock market averages.

These gambling activities have pushed prices back into massively overvalued territory. When market averages reach current levels of overvaluation, the risk of sudden and significant losses becomes exponentially greater. There are no legs to current stock prices. Gambling activity in

options has given false comfort to many who are unaware of the driver of stock prices. These are the investors who will suffer the most when the music is turned off. Reversion to the mean would send prices tumbling over 50% just to reach long-term averages. And this at a time when the economy is slowing drastically. The worst enemy of the average investor is listening to financial

business channels. These programs tend to justify the current actions of gamblers and encourage novice investors to join the party.

The graph below shows the well-known Buffett Indicator. This represents Warren Buffett’s favorite valuation methodology: market capitalization divided by nominal (before inflation) gross domestic product. At over 180%, this indicator is the second highest in history and over double its long-term average.

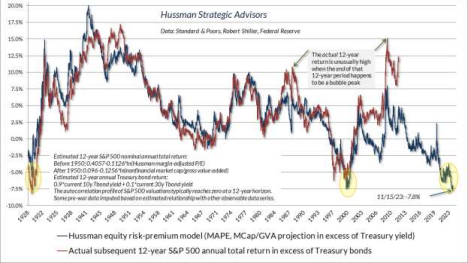

And, as illustrated in this newsletter previously, the following analysis by economist John Hussman, shows that based upon current valuations, those holding the S&P 500 Index could expect a long-term 12-year return averaging -7.8% per year. Of course, actual results will vary and will come with massive losses and volatile markets.

The speculation in the stock market is more significant today than I have ever witnessed in over 25 years in this business. Another example is shown below. The Russell 2000 small cap index has jumped massively with speculation in the markets recently. But notice in the chart below that 40% (or more) of these 2000 companies have negative earnings (or stated differently: losses)! Yet gamblers push the price higher.

The following chart was obtained from Peru Saxena, via X. This chart shows the peak-to-trough drop in the stock market during recessionary bear markets. Based upon current economic data, this could come to fruition next year.

And based upon the extreme overvaluation today, losses in line or greater than those experienced during the Tech Bubble (2000-2002) bust and Financial Crisis (2007-2009) are not out of the question.

A lack of understanding as to what is propelling the stock market today, combined with a lot of false information provided by the financial media, could lead unaware investors to massive losses in the next year or two. The rapid recovery in stock prices this year, despite a weakening economy, high interest rates and record debt levels is the direct result of using the options market for gambling. This activity has pushed stock prices to extremely risky levels compared to fundamentals and set up investors for potentially horrendous losses in the near term. Even so, the bear market continues.

The S&P 500 Index closed at 4,719, up 2.5% for the week. The yield on the 10-year Treasury Note fell to 3.93%. Oil prices remained at $71 per barrel, and the national average price of gasoline according to AAA decreased to $3.07 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.