Executive Summary

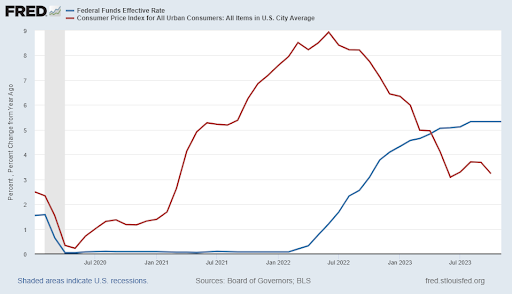

Speculators in the stock market are betting on the Federal Reserve Bank lowering the Federal Funds Rate. Although, Jerome Powell has said rates will not be lowered until inflation reaches their 2% target. The first graph below compares the inflation rate of 3.2% (measured by CPI) and the effective Fed Funds Rate. History shows that in the Technology Bubble, the Great Financial Crisis, and during COVID, the stock markets fell all while the Fed was cutting rates (2nd graph). Potential rate cuts could signal a slowing economy and recession. Or government policy changes could impact the outcomes. Eventually fundamentals will matter.

Please continue to The Details for more of my analysis.

“You can’t always get what you want

But if you try sometimes, well, you just might find

You get what you need.”

–The Rolling Stones

The Details

The general consensus among mainstream economists is that inflation is on the decline; and therefore, the Fed will soon begin lowering the Federal Funds Rate (FFR). The current effective FFR is 5.33% as shown in blue in the graph below. The market is expecting rate decreases beginning sometime next year. Inflation has moderated from its high of close to 9% but remains above the Fed’s desired 2% rate. Fed Chairman Jerome Powell has explicitly stated the Fed will not lower rates as long as inflation remains above 2%. The graph below shows inflation (red line) as measured by the CPI (year-over-year) is 3.2%.

Speculators have been pushing stock prices back to nosebleed valuations since the start of November on hopes the Fed will soon pivot and begin lowering interest rates. However, looking at history, they might not get what they are hoping for. Prior to the last three recessions (shaded in gray in the graph below), the Fed began lowering the Fed Funds Rate (red line). Notice that during each of these periods, the stock market, shown by the Wilshire 5000 Index in blue below, plummeted. The stock markets tumbled close to 50% during the busting of the Tech Bubble – 2000-2002, and the Great Financial Crisis – 2008-2009. The market also sold-off during the pandemic in 2020. Each of these major stock market declines were marked by persistent cuts in the FFR.

The potential upcoming rate cuts by the Fed could signal a significantly slowing economy about to enter recession. If history is any guide, the bear market in stocks could accelerate to the downside. In almost every extended bear market, the worst occurs near the end of the bear market cycle. This is when speculators and investors capitulate and begin panic selling.

Of course, major policy changes by the Federal Government or the Fed could delay the ultimate outcome. As such it will be important to closely monitor the economy, Fed actions and Federal Government responses to determine the short-term possibilities. Any strong loosening by the Fed could feed the inflation fire causing more severe damage in the future.

November CPI results will be released Tuesday, December 12 and the Fed will announce on Wednesday, December 13 their decision on interest rates and potential policy changes. Stock market speculators are back into FOMO mode (Fear of Missing Out), with little concern about the lessons of the past.

This week could result in quite a ride in the stock market. Short-term movements by speculators will eventually give way to fundamental moves by investors. It is just a matter of time.

The S&P 500 Index closed at 4,604, up 0.2% for the week. The yield on the 10-year Treasury

Note rose to 4.25%. Oil prices dropped to $71 per barrel, and the national average price of gasoline according to AAA decreased to $3.16 per gallon.

Last weekend was a success for both St. Jude and me. The St. Jude Memphis Marathon event is the largest fundraiser of the year for St. Jude Children’s Research Hospital. Thanks to so many of you, I was able to contribute to this cause. Thank you to all who contributed to my Hero page.

The weather was perfect for running and I was able to set a personal record for the Half Marathon at this race! So, all-in-all it was a great weekend!

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.