Executive Summary

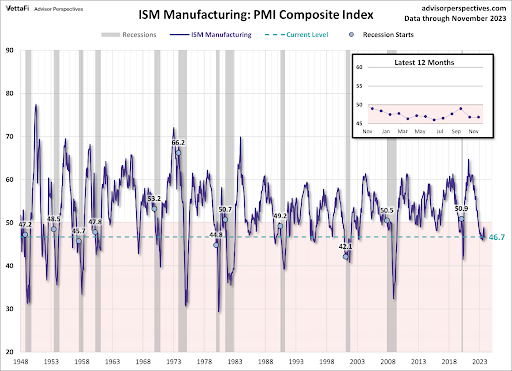

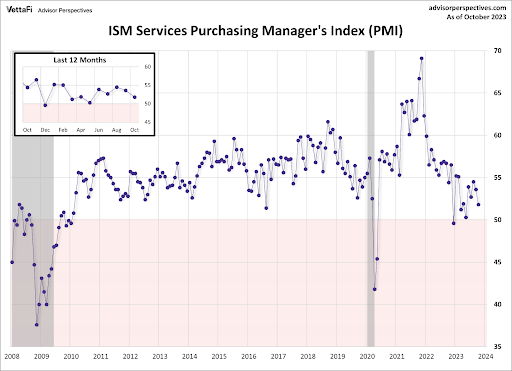

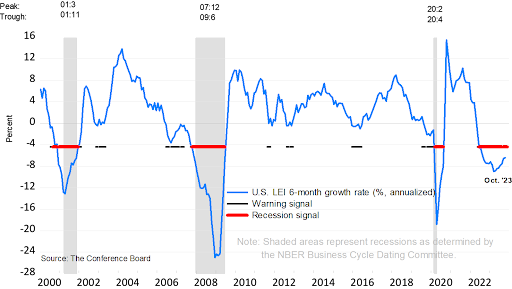

With last quarter’s credit and government-spending inspired 5.2% annualized GDP print, combined with the Atlanta Fed’s November 22 GDPNow estimate for annualized fourth quarter GDP growth at 2.1%, calls for a recession have moved to calls for a “soft landing.” The ISM November Manufacturing PMI Survey came in below expectations at 46.7. Over 50 in the ISM is expansionary and under 50 indicates contraction. The current reading is below the level at the start of 9 of the 12 recessions since 1948 (first graph). While the ISM Services PMI survey is expansionary, it is near previous recessionary start levels (2nd graph). Also, another indicator is The Conference Board’s Leading Economic Indicator (LEI), (3rd graph), which paused in September and resumed recession warning in October. It seems the consensus of “soft landing” calls may not agree with recessionary economic data available.

Please continue to The Details for more of my analysis.

“The hardest assumption to challenge is the one you don’t even know you are making.”

–Douglas Adams

The Details

With last quarter’s credit and government-spending inspired 5.2% annualized GDP print, combined with the Atlanta Fed’s November 22 GDPNow estimate for annualized fourth quarter GDP growth at 2.1%, most mainstream pundits have dropped the recession talk from their repertoire. Recession has morphed into “soft landing.” However, as of December 1, the GDPNow model projection dropped to 1.2%, or as economist David Rosenberg labeled it “stall speed.” In this missive, I will review two Institute for Supply Management (ISM) surveys to see if they support the no-recession consensus.

The ISM breaks the economy into two sectors, manufacturing and services, and surveys purchasing managers to see if activity is growing or contracting. These are diffusion indices where a reading above 50 indicates expansion and below 50 indicates contraction. The services index is relatively new, dating back to around 2008, whereas the manufacturing index provides much more history. Also, the services sector makes over four times the contribution to GDP than the manufacturing sector.

The ISM November Manufacturing PMI Survey came in below expectations at 46.7. This was the 13th consecutive month of contraction. This is the longest contraction streak since the Great Recession in 2008-2009. Below is an excerpt from the report via Advisor Perspectives,

“Fiore continues, ‘The U.S. manufacturing sector continued to contract at the same rate in November as compared to October, again posting a reading of 46.7 percent. Companies are still managing outputs appropriately as order softness continues. Demand eased, with the (1) New Orders Index contracting but at a slower rate, (2) New Export Orders Index dropping further into contraction territory, and (3) Backlog of Orders Index dropping below 40 percent (39.3 percent) to remain in strong contraction territory. The Customers’ Inventories Index reading moved into expansion, toward the upper end of “about right” territory, not accommodative for future production. Output/Consumption (measured by the Production and Employment indexes) was negative, with a combined 2.9-percentage point downward impact on the Manufacturing PMI® calculation. Panelists’ companies slightly reduced month-over-month production and took more actions to reduce head counts, primarily using layoffs and attrition. Inputs — defined as supplier deliveries, inventories, prices and imports — continued to accommodate future demand growth. The Supplier Deliveries Index indicated faster deliveries for the 14th straight month, at a faster rate compared to October, and the Inventories Index moved upward while remaining in moderate contraction territory. The Prices Index remained in “decreasing” territory (but just barely), signifying price stability as a result of energy markets easing, though offset by increases in the steel markets. Manufacturing supplier lead times continue to decrease, a positive for future economic activity.’”

The graph below shows the current reading is below the level at the start of 9 of the 12 recessions (gray shading) since 1948.

The ISM Services PMI Survey produced a reading of 51.8, also below expectations. The services index has been above 50 for 10 consecutive months. However, the most recent reading is only slightly in expansion territory. Below is an excerpt from the Services report, via Advisor Perspectives,

“Nieves continues, ‘The services sector continues to slow, with decreases in the Business Activity and Employment indexes. Sentiment among Business Survey Committee respondents’ comments is mixed, with some optimistic about the current steady and stable business conditions and others concerned about such economic factors as inflation, interest rates and geopolitical events. Employment-related challenges are also prevalent, with comments about increasing labor costs, as well as shortages.’”

The graph below shows the current reading compared to data from 2008, the start of the Index.

Examining the ISM surveys along with The Conference Board’s Leading Economic Indicator (LEI), shown in the graph below, calls for a “soft landing” instead of a recession – seem extremely premature.

After a pause in September, the LEI resumed signaling recession in October

The abundance of economic data showing recessionary or near-recessionary data at the same time interest rates remain high in a debt-based economy, indicates that an officially declared recession is not only possible, but likely.

The S&P 500 Index closed at 4,595, up 0.8% for the week. The yield on the 10-year Treasury

Note fell to 4.22%. Oil prices dropped to $74 per barrel, and the national average price of gasoline according to AAA decreased to $3.24 per gallon.

Last Saturday was a successful day for both St. Jude and me. The St. Jude Memphis Marathon event is the largest fundraiser of the year for St. Jude Children’s Research Hospital. Thanks to so many of you, I was able to contribute to this cause. Thank you to all who contributed to my Hero page.

The weather was perfect for running and I was able to set a personal record for the Half Marathon at this race! So, all-in-all it was a great weekend!

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.