Executive Summary

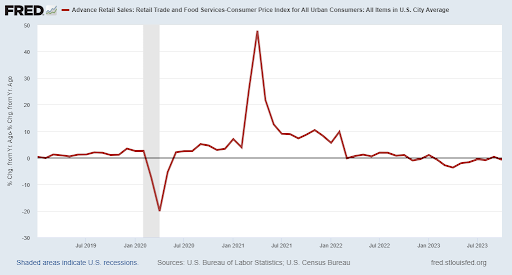

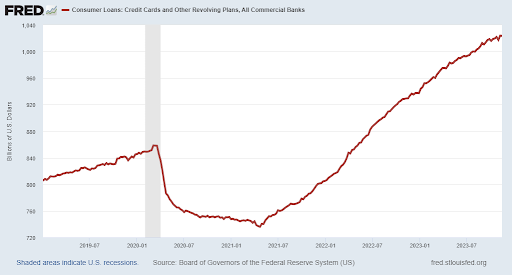

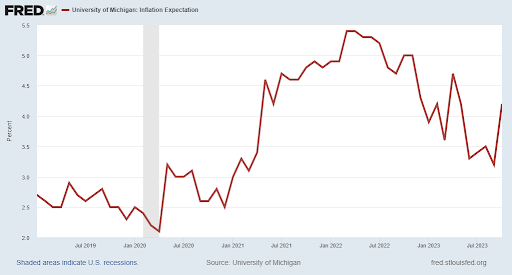

Citing strong retail sales, financial pundits are espousing a strong consumer. However, they appear to be omitting the impact of inflation. “Real” or inflation-adjusted sales have been flat or down compared to last year (see first graph). Many, who had paid down credit card balances with government stimulus, are relying on credit card balances again for purchases. Credit card balances are up 39% from the April 2021 low (see 2nd graph). An article in Forbes magazine recently stated many consumers are relying on other “buy now, pay later” options as well. While many are hoping inflation is contained, the recent University of Michigan Survey of Inflation Expectations jumped from 3.2% in September to 4.2% in October (see last graph). It seems the consumer may be hurting more than financial pundits would like to proclaim.

Please continue to The Details for more of my analysis.

“A fool and his money are soon parted.”

–Dr. John Bridges

The Details

This year, financial pundits have been spouting the false assertion that the consumer is strong. As the holiday season approaches, to prove themselves correct, they point to retail sales figures. Focusing on retail sales excludes a couple of important factors, thereby giving a false conclusion. When inflation was non-existent, retail sales might reflect the strength of the consumer. However, when inflation is high, this adds to the price of goods. One might think that the volume of goods sold has increased, but in reality, the price has risen to compensate for the increased cost of goods and services. Sales volume often has fallen.

During the pandemic, the amount of government stimulus distributed was unprecedented. Consumers used these handouts to purchase goods and services they wanted but did not previously have the resources to buy. According to a study by the Federal Reserve, the excess savings accumulated during this period were depleted by the end of the third quarter of this year. “Real” or inflation-adjusted sales have been flat or down compared to last year as shown in the graph below.

With the intent of spinning the news with a positive bias, the tales of last week’s Black Friday sales are already being told. Some focus attention on online sales. But online sales could merely be replacing previous in-store purchases. Although inflation provides the appearance of higher sales volume, the increased cost of goods, combined with normal holiday discounting, might actually leave the retailer with a smaller profit margin.

With excess savings depleted and higher prices taking their toll on consumers, how are families able to purchase items, thereby boosting gross retail sales? Consumers are reverting back to credit card use, as they lever up at the same time interest rates on credit cards reach record levels. The graph below shows credit card balances, now over $1 trillion, are up 21% compared to pre-pandemic levels and up 39% from the low in April 2021, after consumers had used some of their government stimulus funds to pay down balances.

Another way families are continuing their purchases was outlined in a recent Forbes article, “As interest rates for credit cards and revolving credit continue upward, consumers are turning to other payment tools like Buy Now Pay Later (BNPL). Online orders using BNPL have risen by a significant 72% for the week leading up to and including Black Friday compared to last year. BNPL revenue is up 47% YoY, according to Adobe Analytics.”

Attempting to put a positive spin on the situation, the same Forbes article continued, “Consumer spending has continued through the year, and sales projections for the holiday season remain about 4% over last year.” Of course, that increase is almost entirely due to inflation.

Currently, the majority of financial pundits and economists are projecting that inflation is about to turn the corner into deflation. To their surprise, the recent University of Michigan Survey of Inflation Expectations jumped from 3.2% in September to a whopping 4.2% in October. The inflation genie might not be back in the bottle yet.

Consumers are again resorting to debt to make ends meet. The financial media ignores this aspect, as well as the inflation built into prices, and extols “sales are rising.” The reality of the situation is consumers are hurting again with the personal savings rate having dipped to 3.4%. High interest rates on credit cards, houses, and automobiles will put a major dent in future sales. The economy will likely slow significantly, with a recession officially acknowledged next year.

The S&P 500 Index closed at 4,559, up 1.0% for the week. The yield on the 10-year Treasury

Note rose to 4.48%. Oil prices remained at $76 per barrel, and the national average price of gasoline according to AAA decreased to $3.25 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.