Executive Summary

The bear market rally of the last three weeks reversed the previous three-month downturn. Technically speaking the markets were very oversold and now have flipped to overbought territory. The reason for the speculative change appears to be a hope for the Federal Reserve to pivot from hiking to lowering interest rates. The “Magnificent Seven” stocks account for almost all of the market move up this year. Economist John Hussman (excerpt below) compares the “Nifty 50” of the 1970’s to the “Magnificent 7” of today. In 1973-1974 many of the “Nifty 50” fell 50-80%, similar to what some of the Magnificent 7 did last year. I have included some excerpts from Hussman’s extensive graphs and research explaining how these extreme valuations could complete the market cycle with significant downside. While some may characterize his conclusions are “crazy,” historical market cycles and his mathematically correlated data analysis provide the basis for the comments.

Please continue to The Details for more of my analysis.

“Speculation, I imagine, is a theme almost as popular as love; but in both cases most of the comments made are rather trite and not particularly helpful.”

–Benjamin Graham

The Details

After an extended bear market rally, ending at the end of July, the bear market downtrend resumed for about three months. By the end of October, the S&P 500 had moved to an extremely oversold position, from a short-term technical point of view. Then, for no fundamental reason, another rapid bear market rally began, recouping the three-month downturn in about three weeks. The market now remains in an extremely overbought position, looking at the two standard deviation Bollinger band for the 20-day moving average. Economist John Hussman described the past three weeks as follows in his monthly comment,

“If anything characterized the first half of November, it was the reflexive release of pent-up ‘PIVOT!!!!’ jubilation, on the belief that the Federal Reserve is finished with rate increases, and that the economy will enjoy a ‘soft landing.’ My impression is that this belief led to a sudden ‘fear of missing out’ (FOMO) and eagerness to get in front of a ‘Goldilocks’ scenario combining continued economic growth with eventual Fed easing. […]

At present, despite the breakneck ‘clearing rally’ we’ve seen over the past few weeks, our measures of internals remain clearly unfavorable. Indeed, the narrowness of the market’s favor toward large-cap glamour stocks is itself a measure of risk-averse selectivity more than it is of robust speculation.”

Almost the entire upward movement in the stock market this year is attributable to the “Magnificent Seven”: Apple, Microsoft, Alphabet, Amazon, Meta, NVIDIA, and Tesla. The equally weighted S&P 500 versus the market cap weighted index – which is heavily weighted by the Magnificent Seven – is up only about 3.5% for the year. And that is after the recent extreme three-week rally. It is important to realize that many of the seven were down significantly last year, including Meta down over 70% and NVIDIA dropped over 60%.

The following quote from Forbes Magazine, 1977, The Nifty Fifty Revisited (via Hussman) illustrates a situation from the 1970’s similar to today,

“The Nifty Fifty appeared to rise up from the ocean; it was as though all of the U.S. but Nebraska had sunk into the sea. The two-tier market really consisted of one tier and a lot of rubble down below. What held the Nifty Fifty up? The same thing that held up tulip-bulb prices long ago in Holland – popular delusions and the madness of crowds. The delusion was that these companies were so good that it didn’t matter what you paid for them; their inexorable growth would bail you out.”

And from Hussman, “As Forbes wrote about the 1973-74 market collapse that brought many of the Nifty Fifty down by 50-80%, The delusion was that these companies were so good that it didn’t matter what you paid for them; their inexorable growth would bail you out.’”

And so, with the Russell 2,000 up under 3% for the year and the S&P 500 – Equal Weight also barely up, many are under the false impression that the stock market has been strong this year. This is all attributable to the soaring prices of the Magnificent Seven. When these stocks begin to tank, the rest of the market will follow.

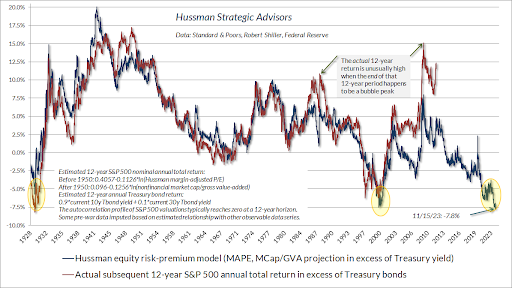

The runup in the broad S&P 500 Index this year has once again pushed valuations to extreme levels. The chart below from John Hussman, based upon the valuation methodology most correlated with subsequent returns, shows valuations above the 2000 Technology Bubble level and almost back to the peak 2021 reading.

Using this valuation analysis to project future 12-year returns for the S&P500 Index above Treasury Bonds, current valuation levels suggest investors can expect future 12-year average returns to be in the neighborhood of -7.8% per year. Of course, this is an average, so it isn’t an annual projection. This estimate describes what the overall result could be over the next 12 years in the S&P 500. While it is possible for the outcome to be different, as stated, this is the most correlated methodology resulting from extensive research by John Hussman.

Using the above analysis along with his other research, the following represents John Hussman’s conclusion, “At present, we estimate that the S&P 500 would have to decline to roughly 2630 for the expected 10-year S&P 500 total return to match the prevailing yield on 10-year Treasury bonds. A loss closer to the 1650-1730 area would restore historically run-of-the-mill expected returns and risk premiums. I know that seems preposterous, but it’s also how market cycles have typically been completed over time. Nothing in our discipline requires this outcome. As usual, we would describe these figures as historically informed risk estimates rather than ‘forecasts.’”

Based upon the completion of prior market cycles, the above conclusion for the current bear market cycle would not be out of the ordinary. However, when this is presented to financial pundits, most would say it is “crazy.” At least the ones who have not studied the history of markets and market cycles.

The S&P 500 Index closed at 4,514, up 2.2% for the week. The yield on the 10-year Treasury

Note fell to 4.44%. Oil prices dropped to $76 per barrel, and the national average price of gasoline according to AAA decreased to $3.31 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.