Executive Summary

With mortgage rates fluctuating between 7-8%, consumer sentiment for house buying conditions has dropped to the lowest level since 1982 (first graph). However, housing prices have not fallen substantially due to low inventory (third graph). Once supply levels sufficiently exceed demand, and if mortgage interest rates remain high, expect home prices to adjust downward.

Please continue to The Details for more of my analysis.

“Talk is cheap because supply exceeds demand.”

–Anonymous

The Details

With mortgage interest rates topping 8% in some areas, one would think that housing prices would have plummeted. Additionally, according to a University of Michigan survey, consumer sentiment for buying conditions, shown below, dropped to its lowest level since August 1982. (h/t Liz Ann Sonders)

Yet, according to The Kobeissi Letter, “The median list price on US homes has declined for 4 consecutive months, according to Reventure. However, even with these declines, prices are still only down ~6% from their all-time high. The median house in the US is now selling for a whopping $425,000.”

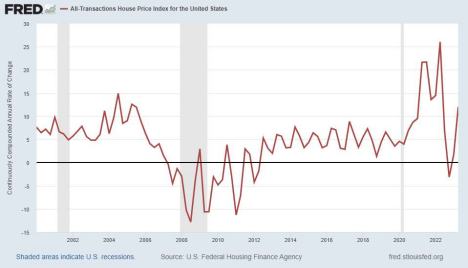

As illustrated in the graph below, the House Price Index rose dramatically post-Covid. In 2022 prices dropped a mere 3%, only to rise again in 2023.

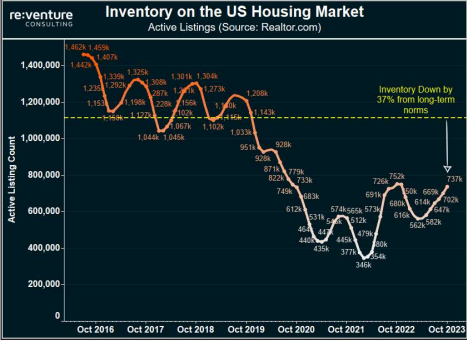

The reason housing prices have not plummeted (yet) is purely a function of housing supply. The graph below from Reventure shows inventory bottoming near the end of 2021. Since then, housing inventory has jumped by 113%, yet remains 37% below long-term norms.

As demand slows and inventory builds, housing prices will eventually fall further. Also, as shown in the graph below, there are a record number of multi-family housing units under construction. Once these units hit the market, some house-seekers could choose to rent apartments instead of purchasing houses. If so, this will add to the downward pressure on prices.

Although housing inventory has risen, it has not reached a level of oversupply. Therefore, housing prices continue to hover at high levels. Once supply levels sufficiently exceed demand, if mortgage interest rates remain high, expect home prices to adjust downward.

The S&P 500 Index closed at 4,415, up 1.3% for the week. The yield on the 10-year Treasury Note rose to 4.63%. Oil prices dropped to $77 per barrel, and the national average price of gasoline according to AAA decreased to $3.37 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.