Executive Summary

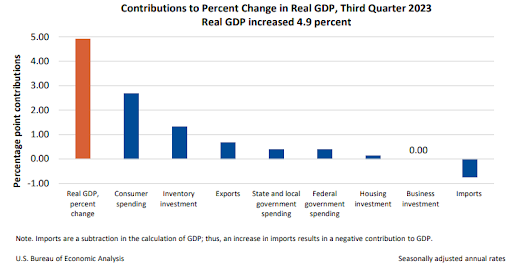

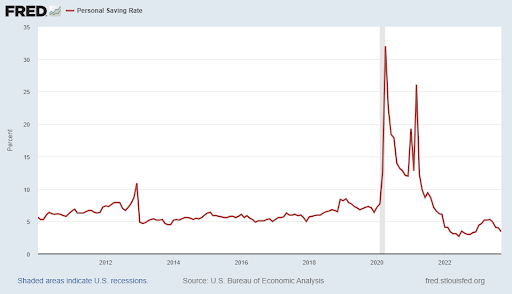

Third quarter real GDP grew at a 4.9% annualized rate, yet many people are expressing concern about rising interest rates and soaring prices. So, are things rosy? Remember that 70% of GDP comes from consumer spending, which was the main contributor to third quarter growth (first graph). Consumers are using credit cards to pay for items their declining disposable income will not cover. Federal stimulus funds are depleted, student loan repayments are no longer in deferral, forcing consumers to forgo savings (see last graph) and use credit cards to supplement their income. Please see below the except from economist Daniel Lacalle’s summary. Then see if you draw the conclusion: things are not rosy.

Please continue to The Details for more of my analysis.

“If you put the federal government in charge of the Sahara Desert, in 5 years there’d be a shortage of sand.”

–Milton Friedman

The Details

Hearing the rate of growth of the economy during the third quarter, released last week, one might think everything is rosy. Real Gross Domestic Product (GDP) rose an impressive 4.9% in the third quarter on a seasonally adjusted, annualized basis. Yet, talk to most people about their thoughts, and you hear concerns about rising interest rates and massively higher prices. So, how did GDP soar…over one quarter, seasonally adjusted and annualized? In this missive, I will attempt to look under the hood and explain the causes, and whether one should expect the same in the fourth quarter.

Generally speaking, 70% of GDP growth is derived from personal consumption. The chart below from the Bureau of Economic Analysis (BEA) shows the breakdown of third-quarter GDP.

As can be seen in the chart above, the largest contributors to growth during the third quarter were consumer spending and inventory adjustments. The interesting factor is that although consumer spending accounted for 2.7% of the increase in GDP, real personal disposable income decreased 1% during the quarter. So, what accounted for the increase? In a nutshell, credit cards! As shown in red in the graph below, credit card usage has increased at dramatic rates relative to GDP growth over the past four quarters. The total balance of credit cards and revolving loans outstanding has surpassed $1 trillion.

To realize the severity of this problem, interest rates on credit card balances have now reached a record 21.2%. When combined with the impact of higher interest rates on mortgages, auto loans and personal loans, the drop in real disposable personal income should signal a warning of upcoming personal financial difficulties.

Economist Daniel Lacalle summarized it well when he wrote,

“A strong economy does not show a decline in investment of this magnitude. Nonresidential business investment fell 0.1%, including a 3.8% slump in equipment investment. According to Morgan Stanley, capital expenditure plans have fallen to May 2020 levels.

The mirage of construction is also gone, as it fell to just 1.6% after a one-off double-digit increase in the past quarter. Furthermore, a large part of the growth in GDP came from bloated government spending financed with more debt and inventory reevaluation, adding 0.8 and 1.4 percentage points to GDP growth. Many of these temporary effects will revert in the fourth quarter.

The level of public debt is exceedingly concerning. The increase in gross domestic product between the third quarter of 2022 and the same period of 2023 was a mere $414.3 billion, according to the Bureau of Economic Analysis, while the increase in public debt was $1.3 trillion ($32.3 to $33.6 trillion, according to the Treasury).”

With the economy still exhibiting high inflation and rising interest rates, the impact on consumers will begin to be more visible in the fourth quarter. The personal savings rate has now fallen to 3.4% as shown in the graph below. Federal stimulus funds are depleted, student loan repayments no longer on deferral, forcing consumers to forgo savings and use credit cards to supplement their income.

The Conference Board estimates fourth quarter GDP growth to be 1%, while Hedgeye Risk Management estimates -0.55%. Many pundits now are calling for a “soft landing.” It is my opinion that the data indicates a recession is coming soon, if not already here. The outlook is not so rosy!

The S&P 500 Index closed at 4,117, down 2.5% for the week. The yield on the 10-year Treasury

Note fell to 4.85%. Oil prices dropped to $86 per barrel, and the national average price of gasoline according to AAA decreased to $3.50 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.