Executive Summary

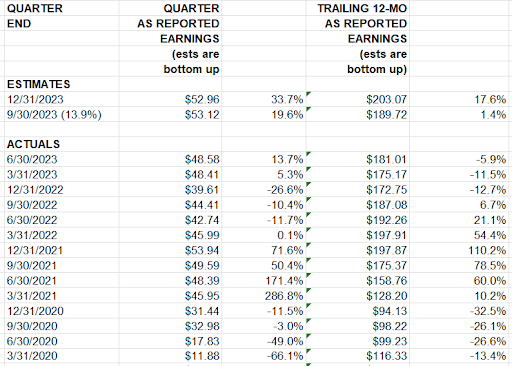

Forecasting corporate earnings seems to be an exercise in futility, and Wall Street analysts are always going to error on the optimistic side – even in an economic downturn. The second graph illustrates the profit drop of the pandemic, the resulting spike caused by extreme government stimulus, and the fall after the stimulus wore off. In the first chart, the numbers show the actual percentage changed in corporate profits. Curiously, after two down quarters this year, and the third quarter estimate of 1.4% growth, the fourth quarter is projected to be 34% higher! Thus, resulting in 2023 earnings growing 17.6%. Interestingly as well, in The Details, explains how another outlook is for “adjusted earnings” of only 7%. Quite a difference, but that is how the game is played.

Please continue to The Details for more of my analysis.

“I insist that more damage has been done to stock values and to the future of equities from inside Wall Street than from outside Wall Street.”

–Benjamin Graham

The Details

Forecasting corporate earnings seems to be an exercise in futility, especially when the business cycle turns down. There are a couple things to keep in mind when looking at earnings forecasts: first, Wall Street analysts are always going to error on the upside; and two, what earnings are you examining? (i.e., “adjusted” or GAAP (Generally Accepted Accounting Principles) earnings)

Now that the business cycle has turned down, as evidenced by the index of leading indicators falling for 16 consecutive months, and despite the projected high third quarter – government spending boosted – GDP reading, let’s take a look at corporate earnings. The shuttering of businesses during the pandemic in 2020 sent earnings plunging. Then, in response to unprecedented government stimulus, including massive forgivable PPP loans, corporate earnings skyrocketed in 2021. As the sugar high wore off with the arrival of 2022, earnings once again began to fall. As shown in the chart below obtained from the spglobal.com website (edited for highlighting earnings data), trailing 12-month GAAP earnings as of September 30, updated with data through October 18, are projected to be up 1.4% year-over-year. And then, for some unknown reason, in a business downturn, fourth quarter earnings are supposed to soar 34% year-over-year, resulting in 2023 S&P 500 earnings up almost 18% over 2022.

This projection is about as silly as it looks but is par for Wall Street estimates. Many financial firms use data from FactSet to analyze S&P 500 earnings data. FactSet uses “adjusted” earnings as opposed to GAAP earnings. According to FactSet, as of October 20, S&P 500 is projected to report a third quarter earnings decline (year-over-year) of 0.4% which would be the fourth quarterly year-over-year decline in the index. FactSet expects fourth quarter earnings to grow at about 7% year-over-year versus the 34% shown in the chart above. And for the full year, FactSet projects earnings growth of 0.7%. This is a far cry from the 17.6% growth rate projected in the chart above.

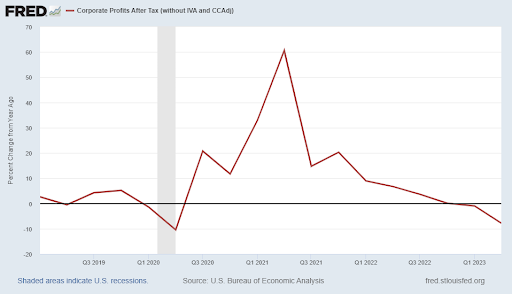

Looking at corporate profits beyond the S&P 500, the Bureau of Economic Analysis (BEA) shows actual corporate profits through the second quarter 2023 in the graph below.

The graph of BEA data above clearly shows the plunge in corporate profits during the pandemic, and the astounding recovery in 2021 attributable to colossal government stimulus programs. The short-term impact of the stimulus is apparent, as profits fell during the end of 2021 through the second quarter 2023. The wearing-off of the stimulus and slowing of the business cycle is evident.

It is my opinion that the expectation for soaring fourth quarter earnings, absent further government intervention, is a pipe dream. I expect the U.S. to enter – if it hasn’t already – a recession, which will lead to a plunge in corporate profits. I believe the there will be substantial revisions to both fourth quarter 2023, as well as all of 2024 earnings. But that is how the game is played.

The S&P 500 Index closed at 4,224, down 2.4% for the week. The yield on the 10-year Treasury

Note rose to 4.92%. Oil prices remained at $88 per barrel, and the national average price of gasoline according to AAA dropped to $3.55 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.