Executive Summary

As a result of the COVID19 pandemic, student loan payments were suspended. However, on October 1 the payments resume, which will affect around 28 million borrowers. On average these payments will be about $350 per month, which reallocates around $7-8 billion per month from consumer spending to debt repayment. With 70% of the U.S. economy coming from consumer spending, $7-8 billion reallocation is significant. The consumer spending component of second quarter GDP was just revised down, now fourth quarter growth could be negatively impacted by student loan debt.

Please continue to The Details for more of my analysis.

“He who buys what he doesn’t need steals from himself.”

–Swedish Proverb

The Details

Last Sunday, October 1, marked the end of the suspension of student loan payments brought on by the pandemic. For over three years close to 40 million borrowers have been able to use these funds for other purposes. The resumption of payments will likely affect about 28 million of the 40 million, as about 12 million borrowers are either in school, on deferral or in default.

This reallocation of about $7 to $8 billion per month, according to Scott Mushkin, founder and CEO of R5 Capital, a consumer research consulting firm, will have a dramatic drag on economic growth. As written in an article on CNBC.com, “‘The economy will struggle in the fourth quarter, in meaningful part due to the end of the student loan payment moratorium,’ said Mark Zandi, chief economist at Moody’s Analytics.”

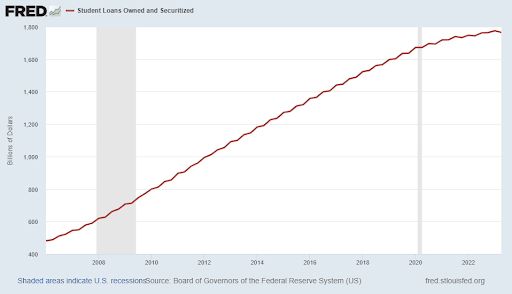

The size of the problem is considerable due to the amount of student loan debt outstanding. The graph below shows the tremendous rise from about $480 billion in 2006 to an astonishing $1.77 trillion outstanding currently.

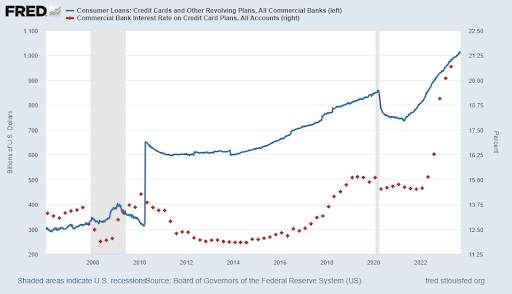

The roughly 28 million borrowers expected to start payments will be out about $350 per month on average. However, it is estimated that about 10% will be paying $700 or more per month. This drain on consumers is occurring as credit card balances reach all-time highs, and interest rates on credit card balances soar to over 20%. As a result of these extra obligations, consumer spending will suffer.

Consumer spending is the engine on which our economy runs. Almost 70% of economic growth comes from consumer spending. The latest revision of second quarter GDP growth saw a collapse in consumer spending from 1.7%, prior to the revision, to 0.8%. This is a drop from first-quarter spending growth of 3.8%. Any further cutback in consumer spending would be disastrous for the economy.

Almost 28 million debt-ridden consumers must re-start payments on their student loan obligations. This while interest rates remain high and consumer spending has already begun to slow. The result could be a dramatic slowing in economic growth in the fourth quarter. Will this be the straw that breaks the camel’s back and unleashes an official recession?

The S&P 500 Index closed at 4,288, down 3.6% for the week. The yield on the 10-year Treasury

Note rose to 4.57%. Oil prices remained at $91 per barrel, and the national average price of gasoline according to AAA fell to $3.82 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.