Executive Summary

As a result of the COVID19 pandemic, student loan payments were suspended. However, on October 1 the payments resume, which will affect around 28 million borrowers. On average these payments will be about $350 per month, which reallocates around $7-8 billion per month from consumer spending to debt repayment. With 70% of the U.S. economy coming from consumer spending, $7-8 billion reallocation is significant. The consumer spending component of second quarter GDP was just revised down, now fourth quarter growth could be negatively impacted by student loan debt.

Please continue to The Details for more of my analysis.

“There is nothing constant in this world but inconsistency.”

–Jonathan Swift

The Details

Each month the Bureau of Labor Statistics (BLS) issues their Employment Situation Summary which provides the much anticipated “new jobs” number. This number is often a market mover and is proclaimed by many pundits as one of the most important data points released. Of course, just a cursory dig below the surface reveals enough confusing data to render the report almost useless. In addition to the BLS report, ADP, a payroll company, issues a monthly employment report a few days before the release of the BLS report. The ADP numbers rarely agree with the BLS report. In this missive I will highlight some of the inconsistencies.

Looking at September’s reports, ADP issued a report indicating the private sector added a mere 89,000 jobs. The report stated, “September showed the slowest pace of growth since January 2021, when private employers shed jobs. Large establishments drove the slowdown, losing 83,000 jobs and wiping out gains they made in August.” ADP chief economist Nela Richardson said, “We are seeing a steepening decline in jobs this month. Additionally, we are seeing a steady decline in wages in the past 12 months.

Naturally, after seeing such dismal numbers, most pundits were expecting the BLS jobs numbers to plunge. Therefore, when the jobs number was announced as a strong 336,000, many were confused. The jobs number is derived from the Establishment Survey. However, the unemployment rate is calculated using data from the Household Survey. The Household Survey indicated that the total number of people employed increased by 86,000, in line with the ADP report. The employment-to-population ratio and unemployment rate, both calculated in the Household Survey, remained unchanged.

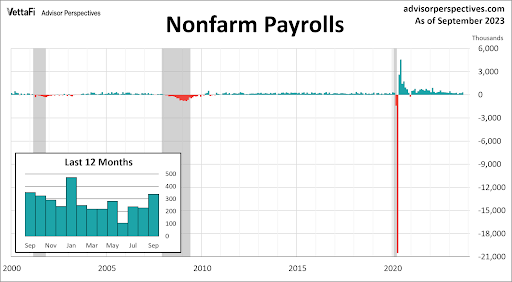

Notice in the call-out box in the graph below, the Establishment Survey new jobs numbers over the past 12 months hovered between 200,000 and 300,000 on average. These numbers have been seasonally adjusted.

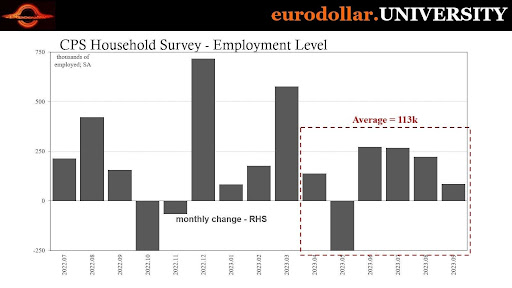

However, the graph below shows the change in employment according to the Household Survey. This report shows an average job creation of about 113,000 over the past six months.

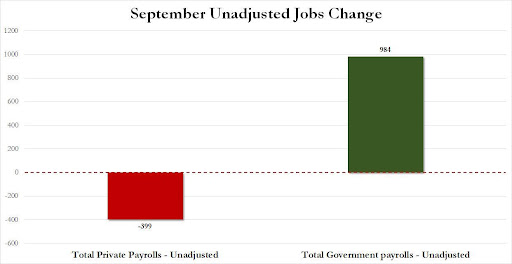

To add a little more flavor, the graph below from Zero Hedge shows unadjusted numbers for September. Here, total private payrolls fell almost 400,000, while government jobs increased by a whopping 984,000! So where are the new jobs coming from…Uncle Sam.

And to confuse the subject further, all of the survey numbers are subject to revision. And the revisions have not been insignificant. So, one must ask, when dealing with payroll reports from three sources, ADP, the Establishment Survey, and the Household Survey – on both an actual and seasonally adjusted basis – do the reports really mean anything? More often than not, the three reports assert inconsistent data. Which report is one supposed to assume is correct. One thing is certain, Wall Street and their economists will grab the most optimistic numbers and run with them. But are they the right numbers?

The S&P 500 Index closed at 4,309, up 0.5% for the week. The yield on the 10-year Treasury Note rose to 4.80%. Oil prices fell to $83 per barrel, and the national average price of gasoline according to AAA dropped to $3.71 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.