Executive Summary

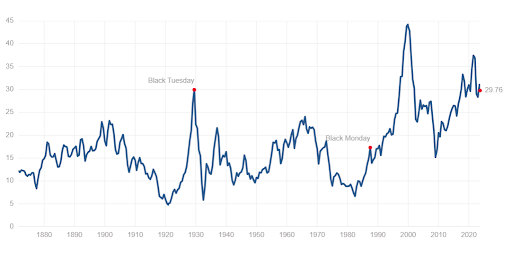

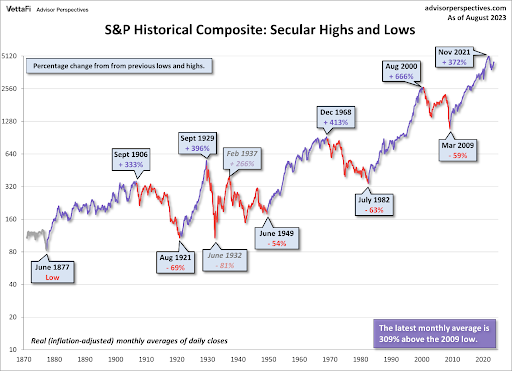

Long-term (secular) bear markets are normally much shorter than long-term bull markets. However, they usually return stock prices to an undervalued state. Currently the valuation methodology of the Shiller P/E is 30, with the long-term average being about 16 (See first graph). Since the turn of the century, the Fed and Federal Government have attempted to control market downturns through stimulus and other intervention efforts – preventing downturns reaching single-digit Shiller P/E ratios. They also have resulted in the most overvalued stock market bubble in history, as well as soaring inflation. The latter sparked the Fed to raise interest rates. Will this change in policy allow the long-term bear market to play out and reduce overvaluation? Investors’ memories are short due to government- program conditioning them for only brief market downturns. Look at the second graph and see it is possible for a secular bear market to last as long as 20 years (1929-1949) …just not recently.

Please continue to The Details for more of my analysis.

“What the wise man does in the beginning, the fool does in the end.”

–Howard Marks, Mastering the Market Cycle: Getting the odds on your side

The Details

The purpose of secular (long-term) bear markets is to burn off extreme valuations, typically returning stock prices to an undervalued state. Secular bear markets normally are shorter with more intense movements than secular bull markets. The Shiller Price-to-Earnings (P/E) ratio is a frequently used methodology to determine the value of the stock market. The Shiller P/E represents the price of the S&P 500 Index divided by 10-year inflation-adjusted average earnings. This methodology reduces the impact of short-term earnings swings due to the business cycle. The long-term average Shiller P/E is around 16. Currently, the Shiller P/E is about 30, or almost 88% above the mean. See a chart of the Shiller P/E below from Multpl.com.

Historically, secular bear markets began when valuations rolled over from their cycle peaks. The end of secular bear markets occurred when valuations bottomed, usually with the Shiller P/E reaching single digits. However, with increased intervention by the Fed and the Federal Government, to attempt to control the markets and the economy, the patterns have changed. As shown in the graph of the Shiller P/E above, the last time the Shiller P/E was allowed to fall to single digits, without massive government intervention, was in the 1970’s. This was also the last time the stock market spent a significant amount of time under the long-term valuation mean.

The graph below from VettaFi/Advisor Perspectives illustrates the historical secular stock market cycles. A marked difference in the ending of the last secular bear market and the propelling of the prior secular bull market was the extent of Federal stimulus and Fed monetary policy required to turn a Financial Crisis with plunging stock prices into a raging secular bull market. Said bull market becoming the most overvalued market in the entire history of the stock market, when the Shiller P/E is adjusted for profit margins.

The impact of the unprecedented intervention not only led to the greatest stock market bubble ever, but also resulted in a combination of record debt levels and rising inflation. To combat inflation, artificially low interest rates have been pushed higher, sparking the current secular bear market.

At their peak in 2021, valuations far exceeded those achieved leading up to the Great Depression. Notice in the graph above that the secular bear market after the 1929 market crash lasted close to 20 years. Many investors today have been programmed by the Fed to believe any downturn in markets will quickly be rectified, sending markets back to the stratosphere. If history is any guide, the outcome could be far different. In order for the Shiller P/E to fall to single digits, as occurred during every secular bear market prior to the turn of the century, the S&P 500 would have to fall by 70% or more. To be clear, I am not predicting a 70% drop in the stock market. I am merely explaining what occurred during historical bear markets, before the massive government and Fed intervention.

I suspect that politicians and the Fed will do all they can to avoid such a result. The markets entered a bear market in January 2022. How this plays out, only time will tell. However, what most investors don’t realize is that the “intervention” could have more devasting long-term consequences than allowing markets to take their natural course.

The S&P 500 Index closed at 4,320, down 2.9% for the week. The yield on the 10-year Treasury

Note rose to 4.44%. Oil prices decreased to $90 per barrel, and the national average price of gasoline according to AAA fell to $3.85 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.