Executive Summary

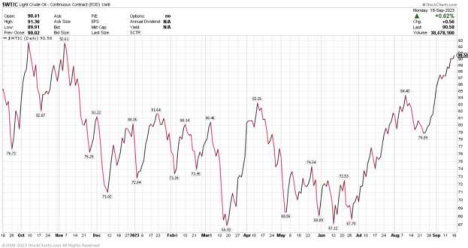

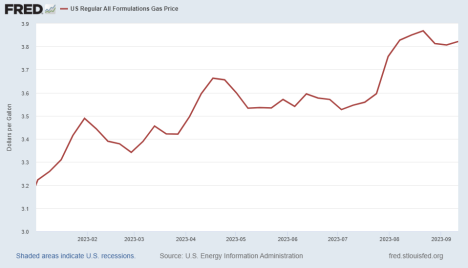

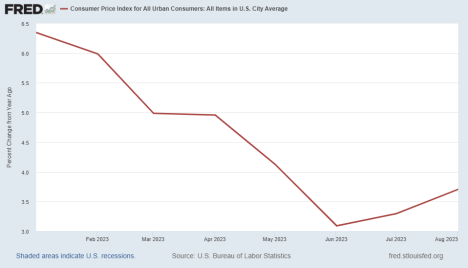

Recently crude oil prices have risen to over $90 per barrel, largely a result of production cuts by OPEC. Many have felt the pain at the pump (see 2nd graph). Demand has not dropped after the summer travel season, thus keeping prices on the rise. And the CPI began rising in June (3rd graph). The U.S. could be in a situation where a recession begins, unemployment rises, and inflation continues to escalate. The Fed would be forced to continue raising interest rates, which hurts the debt laden consumer even more. Combine this all together and it spells challenges ahead. The Fed meets this week; time will tell how they react.

Please continue to The Details for more of my analysis.

“If inflation continues to soar, you’re going to have to work like a dog just to live like one.”

–George Gobel

The Details

If you have filled-up your gas tank lately, you might have noticed that gas prices are, once again, approaching $4.00 per gallon. Recently crude oil prices have risen to over $90 per barrel. This surge in price since June of this year is largely a result of production cuts by OPEC (Organization of the Petroleum Exporting Countries) along with Russia.

With the economy expected to enter recession soon, many thought demand for oil would decrease, thus reducing prices. However, demand has not fallen, while supply has been reduced, thus supporting a rise in prices. After the third quarter, the economy should exhibit a more pronounced and visible slowdown. And although this could reduce the demand for oil and gasoline, further cuts in production could keep prices rising.

The graph below illustrates the sharp rise in gasoline prices during 2023.

Many pundits have been espousing a turn to deflation, as the CPI fell through the first half of this year. Most recessions produce a slowdown in the economy resulting in disinflation or outright deflation. However, this time might be different. If oil prices keep rising along with wages, the economy could return to rising inflation. Notice in the graph below that the CPI began rising on a year-over-year basis in June of this year.

If oil prices increase to $100 per barrel this year, as some experts have predicted, then consumers should expect gasoline prices of $4 or higher per gallon. If unemployment starts to rise due to a possible recession at the same time student loan payments resume and gas prices hit $4 per gallon, any economic downturn could be exacerbated. The U.S. could be in a situation where a recession begins, unemployment rises, and inflation continues to escalate. This could force the Fed to continue raising interest rates, hurting the consumer even more. In a debt-driven economy, high interest rates on top of mountains of debt in a weakening economy, spells problems ahead.

The Fed meets this week, and we will see if they are truly “data dependent” since the CPI has risen over the past two months. Or if they will succumb to political pressure in election season? We find out this week if they see inflation returning, recognizing the rise in oil prices, or if they decide to pause rate hikes to appease the political pundits.

The S&P 500 Index closed at 4,450, down 0.2% for the week. The yield on the 10-year Treasury Note rose to 4.32%. Oil prices increased to $91 per barrel, and the national average price of gasoline according to AAA rose to $3.88 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.