Executive Summary

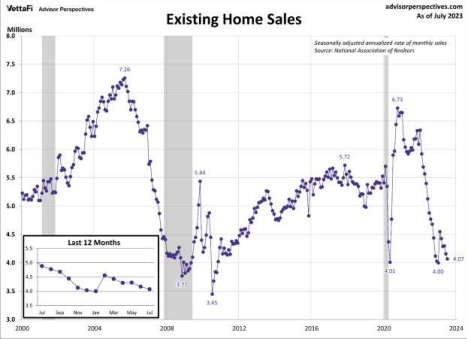

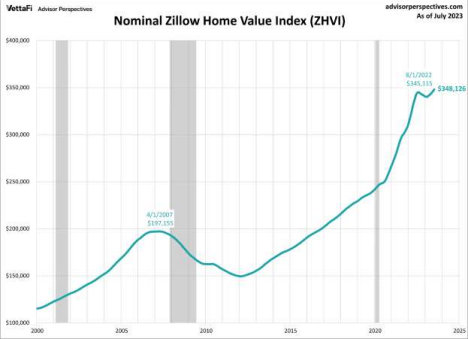

With mortgage interest rates soaring, many people expected a sudden drop in home prices. The data shows the quantity of homes sold has decreased significantly (see first graph). Yet, according to the Zillow Home Value Index, home values have risen back to new highs (second graph). One explanation is the number of home buyers has dwindled due to soaring mortgage rates, but also home inventory is low because existing owners locked in low rates and don’t want to sell. In the event of higher rates and an economic downturn, job losses could force more homeowners to sell – pushing up inventory levels. With fewer buyers and more homes for sale, prices could drop.

Please continue to The Details for more of my analysis.

“There is nothing constant in this world but inconsistency.”

–Jonathan Swift

The Details

With mortgage interest rates soaring, many people expected a sudden drop in home prices. Over the last decade, anomalies seem to have become the norm. For instance, the stock market rose during the pandemic and related recession…thanks to the Federal Government working in tandem with the Federal Reserve Bank (Fed). So why have home prices not plunged? First, let’s look at existing home sales. As can be seen in the graph below from Advisor Perspectives, the quantity of homes sold has decreased significantly. During the real estate boom in the early 2000’s, annual home sales peaked at around 7.26 million units. In the post-pandemic surge, with consumers’ pockets full of stimulus money and mortgage rates below 3%, sales reached 6.73 million. Currently, the number of homes sold has dropped to 4.07 million units.

With such a drop in home sales, one would expect home values to plummet. Yet, according to the Zillow Home Value Index, after a brief dip in value last year, home values have risen back to new highs.

This inconsistency is confusing to many people. One explanation is that although home buyers have dwindled due to soaring mortgage rates, home inventory is low because existing owners locked in low rates and don’t want to sell. In effect, they feel trapped because of their low mortgage rates.

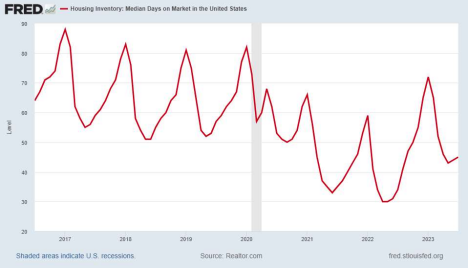

The graph below shows the jump in rates in red and the low inventory in blue. And, although inventory has risen off of its 2022 lows, it remains far below historical norms.

The following graph shows the median days on the market for homes for sale. Again, up some from the 2022 lows, the current rate of 45 days is low compared to pre-pandemic numbers.

It appears that, at least for the time being, the rise in interest rates is not transferring to a drop in prices. The anomalies continue. Until enough inventory hits the market, the value of homes for sale will remain elevated. However, in the event of higher rates and an economic downturn, the

number of home buyers could shrink. If a recession arrives and job losses rise, homeowners required to sell could also increase pushing up the inventory levels. With fewer buyers and more homes for sale, prices will drop. The decrease in prices will likely come, just not as fast as many expected. And remember, not all locations will react the same way. The three most important words in real estate are: Location, Location, Location.

The S&P 500 Index closed at 4,406, down 0.8% for the week. The yield on the 10-year Treasury Note fell to 4.24%. Oil prices decreased to $80 per barrel, and the national average price of gasoline according to AAA dropped to $3.82 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.