Executive Summary

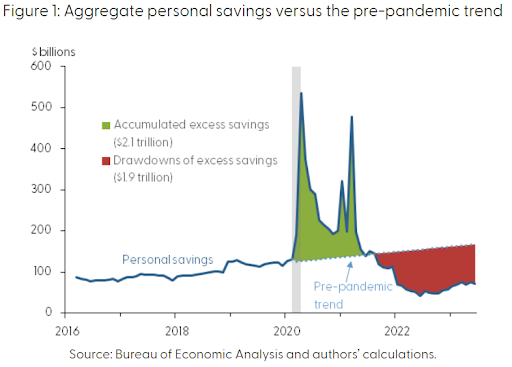

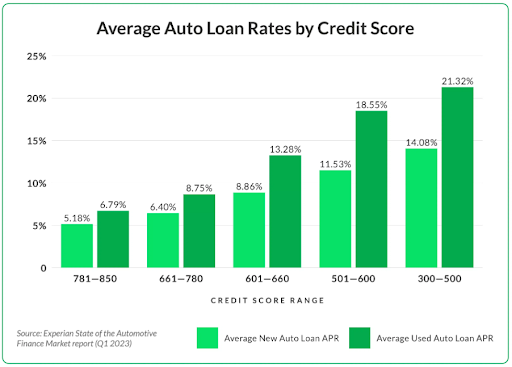

Prior to the pandemic, household savings were trending upward and then spiked with multiple rounds of government stimulus money (see green in first graph). In 2022, the savings drawdown accelerated (see red in first graph). A study by the San Francisco Federal Reserve estimates at current depletion rates, aggregate excess savings could be drained by the third quarter of 2023. Many consumers turn to debt once savings are gone. Rising interest rates have resulted in fixed mortgage rates over 7%, credit card rates over 20%, and car loans between 6-12% – meaning much higher interest expenses. Many are not even talking about the student loan payments which must resume in September 2023. Moody’s investor services predicts an average of $250 a month in extra payments for student loan debts. Households need to prepare!

Please continue to The Details for more of my analysis.

“Beware of little expenses; a small leak will sink a great ship.”

–Benjamin Franklin

The Details

Prior to the pandemic, households, on average, were saving about 8% of disposable personal income. The unprecedented stimulus distributed during the pandemic sent household savings soaring. A study by the San Francisco Federal Reserve reported (emphasis mine):

“Figure 1 [below] shows that estimates of accumulated excess savings, in nominal terms, totaled around $2.1 trillion by August 2021 when it peaked (green area). Since then, aggregate personal savings have dipped below the pre-pandemic trend, signaling an overall drawdown of pandemic-related excess savings. The drawdown on household savings was initially slow but started to accelerate in 2022 and has remained around $100 billion per month on average.

The red area in Figure 1 shows our updated estimate for cumulative drawdowns, which reached more than $1.9 trillion as of June 2023. This implies that there is less than $190 billion of excess savings remaining in the aggregate economy. Should the recent pace of drawdowns persist—for example, at average rates from the past 3, 6, or 12 months—aggregate excess savings would likely be depleted in the third quarter of 2023.”

Note: Excess savings calculated as the accumulated difference in actual de-annualized personal savings and the trend implied by data for the

48 months leading up to the first month of the 2020 recession as defined by the National Bureau of Economic Research.

As households adjust to depleted excess savings, they are being hit with another gut punch as interest rates continue to jump. Interest rates on 30-year fixed mortgages are now the highest they have been in over 20 years. According to Bankrate.com, the National average rate just hit 7.58%. Other consumer loan interest rates are also soaring. Lending Tree reports that the average APR (Annual Percentage Rate) on new credit cards is a whopping 24.37%! And although auto loan rates depend upon the term of the loan and the credit worthiness of the borrower, the average across credit profiles have reached 6.58% for new cars and 11.17% for used cars. See the chart below showing auto loan interest rates by credit score based upon a study by Experian.

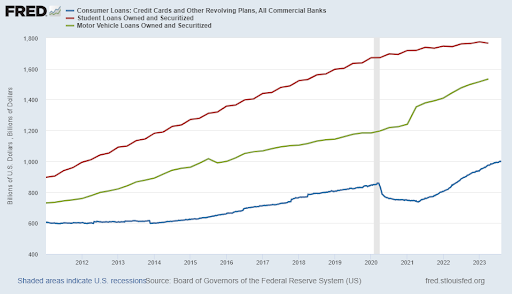

These high and rising interest rates are hitting at the same time loan balances climb to all-time highs. The graph below from the St. Louis Fed FRED database shows credit card and revolving loans have risen to about $1.8 trillion, student loans are close to $1.5 trillion and motor vehicle loans total approximately $1 trillion. Some government estimates put student loan debt closer to $1.7 trillion.

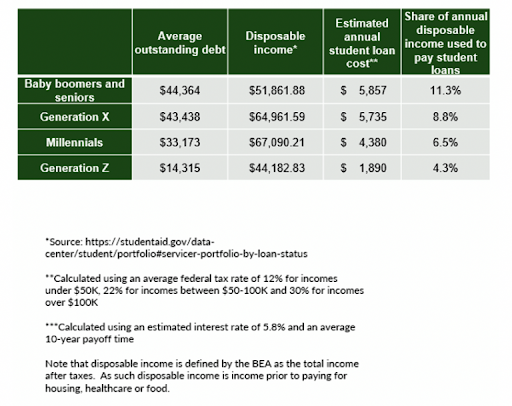

After a long delay, Americans with student loan debt must begin to repay their loans in September of this year. The magnitude of this hit to household finances is being underestimated by many. The following is from an article in TalkBusiness.net:

“Financial services firm Jefferies estimates student loan payments will cost U.S. consumers $18 billion a month by September. Some economists suggest the hit to household budgets will slow a national economy already slowing due to high interest rates and inflation.

‘Americans owning student loan debt will have to pull back on other things like travel and restaurant spending to fit the resumed payments into their budgets. Belt-tightening could hurt an economy that relies heavily on consumer spending,’ noted Jefferies economist Thomas Simmons.

Mark Zandi, chief economist at Moody’s Investor Services, predicts student loan borrowers will face an average of $250 a month in extra payments in September when the moratorium is lifted after more than three years. He said the loan repayments reduce consumer spending and will reduce economic growth by 0.2% in the final quarter of 2023.

‘In a more typical time, that’s not really that big a deal,’ Zandi said. ‘The economy can digest that gracefully. But in the current environment where the economy is weakening, it raises the risk for recession.”

The chart below from PYMNTS.com shows the estimated percentage of disposable income that will be used to repay student loans broken down by generation.

The impact on households, and thus the economy, of the loss of excess savings, significantly increased interest expenses and a return to student loan payments will have a notable effect on spending patterns. If households are spending above their net income levels, then additional debt will accumulate at the same time interest rates are rising. This could throw some families into a vortex, which could be difficult to escape. Households should be planning how they will handle these added expenditures.

The S&P 500 Index closed at 4,370, down 2.1% for the week. The yield on the 10-year Treasury

Note rose to 4.25%. Oil prices fell to $81 per barrel, and the national average price of gasoline according to AAA rose to $3.87 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.