Executive Summary

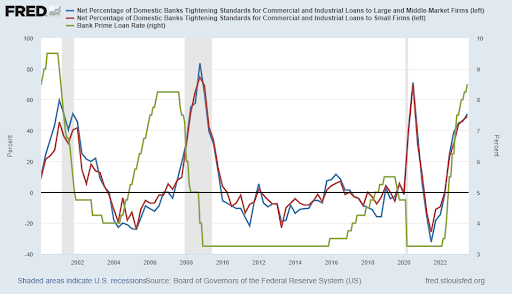

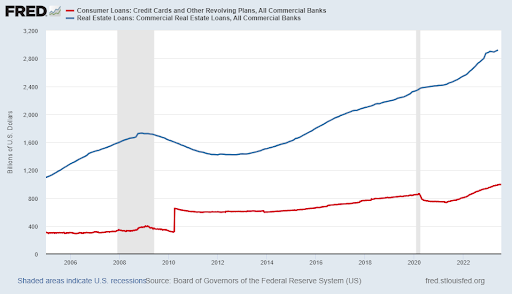

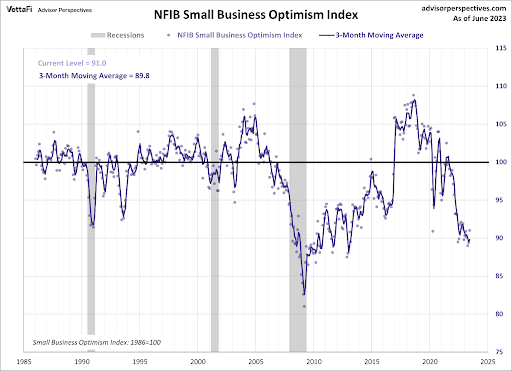

Most U.S. businesses use debt to maintain operations. The first graph shows how banks are tightening lending standards compared to the concurrent rise in prime interest rates on loans moving from 3.25% to 8.5%. Revolving debt outstanding is around $1 trillion. These loans normally contain variable interest rates, which are rising. Commercial real estate loans are nearing $3trillion, many of which will be refinanced over the next couple of years at significantly higher rates (see 2nd graph). Even more concerning is the Small Business Optimism Index (3rd graph) has only been significantly lower during the ’08 Financial Crisis, dating all the way back to the 1980’s. With lending standards tightening and interest rates rising, businesses are not optimistic.

Please continue to The Details for more of my analysis.

“A bank is a place where they lend you an umbrella in fair weather and ask for it back when it begins to rain.”

–Robert Frost

The Details

The U.S. economy is built on a foundation of debt. In some manner, most businesses run their operations with the use of a line of credit or installment debt. The majority of real estate transactions involve the use of debt. As concerns about the economy rise along with inflation and interest rates, banks are tightening lending standards. Many variable rate loans are tied to the bank prime lending rate. This rate (shown in green in the graph below) has climbed from a low of 3.25% to a current reading of 8.5%. Notice that lending standards for commercial and industrial (C&I) loans to large and middle market firms (blue line), as well as to small firms (red line), have tightened enormously since the end of 2021. Over the past 30 years, C&I lending standards for small firms have only been tight twice, during the Financial Crisis and Covid.

An article in Zero Hedge recently summarized the Senior Loan Officers Opinion Survey on Bank Lending Practices (SLOOS report) stating, “…July SLOOS report…showed that the incredibly shrinking U.S. loan market has accelerated its shrinkage even more in the second quarter, when bank lending standards tightened across most products, while loan demand – not surprisingly with rates at the highest level in 40 years – dropped to levels where one wonders just how the debt-addicted U.S. economy is funding itself.”

Revolving debt uses variable interest rates; therefore, as rates rise, these borrowers are impacted almost immediately. Notice in the graph below (red line), there is almost $1 trillion in commercial revolving loans and credit cards currently outstanding. Commercial real estate loans often have short terms with balloon payments at the end. These loans are typically refinanced at current rates as they mature. There are almost $3 trillion in commercial real estate loans outstanding (blue line).

In an article on Market Watch, John Fish recently wrote, “As the U.S. emerges from the COVID-19 pandemic, much attention has been given to rising inflation and the interest-rate hikes to combat it. But there is another looming threat with equally impactful and widespread implications for consumers and the economy: commercial real estate. About $1.5 trillion worth of commercial real estate loans are due to mature over the next two years, at a steep increase.

The combination of the tightening of lending conditions and loans refinanced at higher, unsustainable rates could potentially stifle construction and development in major cities struggling to bounce back from the pandemic.”

The impact of tightening lending standards and rising interest rates can be seen in the NFIB (National Federation of Independent Business, Inc.) Small Business Optimism Index shown below. Since the mid-1980’s, the three month moving average of this index has only been significantly lower once – during the depths of the Financial Crisis.

The Zero Hedge article referenced above went on to state, “…what is more troubling is that looking at the second half, banks reported they expect to further tighten standards on all loan categories. The most cited reasons for expecting to tighten lending standards were ‘a less favorable or more uncertain economic outlook, an expected deterioration in collateral values, and an expected deterioration in credit quality of CRE [Commercial Real Estate] and other loans.’”

It is quite apparent that tightening lending standards, inflation and rising interest rates are taking their toll on small businesses and owners of commercial real estate. The situation is becoming so dire that some pundits are already calling for help restructuring commercial real estate loans. Although a recession has not been officially declared, the lag effect of higher interest rates and less available debt will have a drastic impact on the economy.

The S&P 500 Index closed at 4,582, up 1.0% for the week. The yield on the 10-year Treasury

Note rose to 3.97%. Oil prices increased to $81 per barrel, and the national average price of gasoline according to AAA rose to $3.75 per gallon.

© 2023. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.