Executive Summary

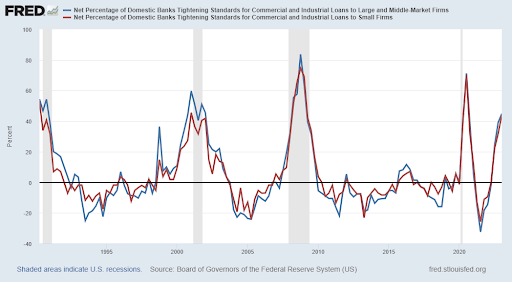

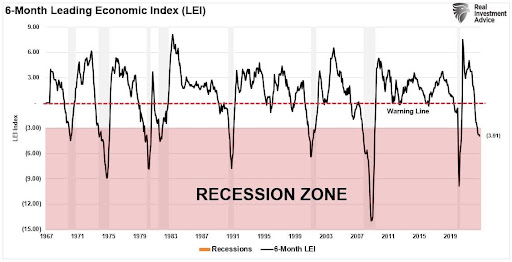

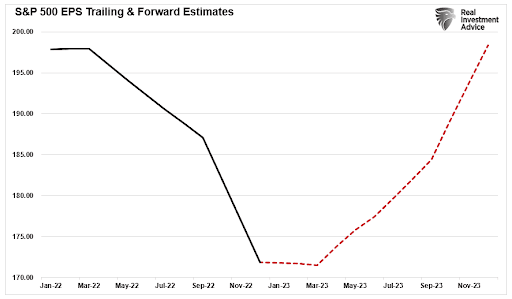

Recently stock markets have appeared optimistic, even though financial data does not agree. In the first graph below, one can see banks are tightening lending standards, which is consistent with prior recessions. In a debt driven society, reduced lending results in lower demand and smaller corporate profits. The six month Leading Economic Index (third graph) shows indicators have again entered the recession zone. However, estimates for forward earnings and GDP are still optimistic. Will the first-quarter earnings season promote more speculation and optimism, or will reality send prices lower?

Please continue to The Details for more of my analysis.

“Mankind will never see an end of trouble until…lovers of wisdom come to hold political power, or the holders of power…become lovers of wisdom.”

–Plato

The Details

This week is the start of earnings season as corporations will report first quarter earnings. It is time for the quarterly “beat the expectations” game, where analysts lower expectations so reported earnings will be tallied as a “beat” or better than expected. This allows speculators and analysts to remain optimistic in the face of a troubling macro outlook.

As economic concerns have been building, banks have been tightening lending standards for loans to both large and small companies, as shown in the graph below. Notice this is consistent with prior recessions highlighted in gray.

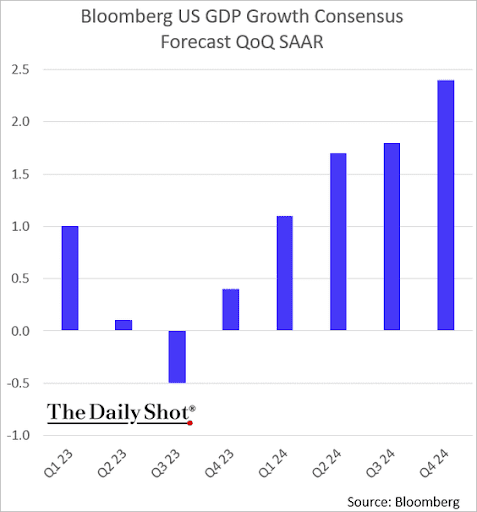

In a debt driven society, less lending means lower demand, thus a slowdown in economic growth. Perpetual optimists are attempting to ignore reality by denying the economy is either in or on the cusp of a recession. According to the Atlanta Fed GDPNow model, first quarter 2023 annualized growth is estimated to be 2.2%. Although slightly lower for Q1, Bloomberg’s growth consensus only shows one negative quarter (Q3) before a resurgence in growth appears as shown in the graph below prepared by The Daily Shot.

The graph below from Real Investment Advice illustrates the 6-Month Leading Economic Index (LEI). As illustrated, since 1970, once this indicator broke into the shaded area, a recession was occurring or about to start. The U.S. is currently in the “Recession Zone.”

If the economy is in or near a recession and bank lending is slowing, corporate earnings will likely continue falling. In the fourth quarter 2022, net S&P 500 earnings fell 27% according to SPGlobal.com. However, first quarter estimates show a mere 2% year-over-year drop. This will likely be revised lower as earnings season progresses. Forward estimates are notoriously optimistic. This can be seen in the estimates below in another graph from Real Investment Advice.

The next several weeks will be volatile as actual GAAP earnings will likely fall more than projected yet will “beat” lowered analysts’ “expectations.” The initial reaction to a “beat” is for the stock price to rise. Then upon further analysis, the extent of the damage is understood, and the price falls to reflect reality.

Irrational exuberance continues, especially in the popular “FANG” stocks. However, raising interest rates into a recessionary economy is not the recipe for growing earnings. The speculation will likely end soon, as investors grasp the reality of the current economic environment.

The S&P 500 Index closed at 4,105, down 0.1% for the week. The yield on the 10-year Treasury Note fell to 3.38%. Oil prices increased to $81 per barrel, and the national average price of gasoline according to AAA rose to $3.60 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.