Executive Summary

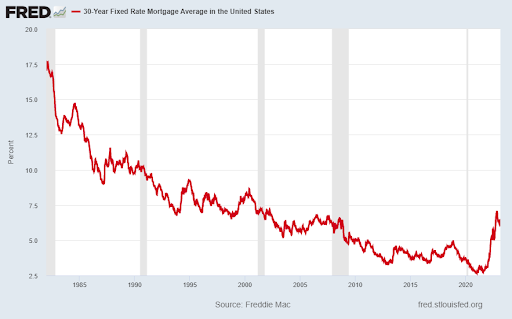

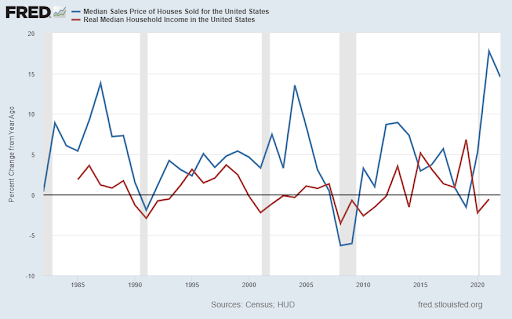

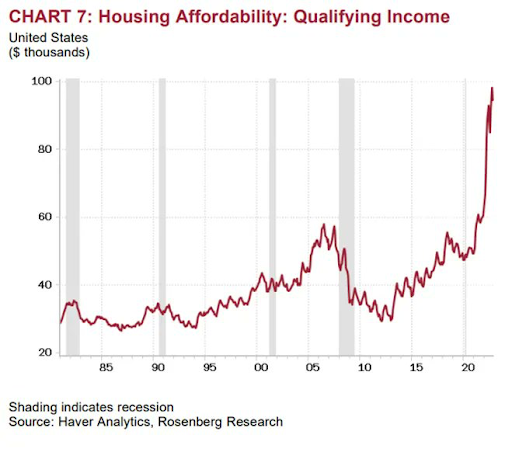

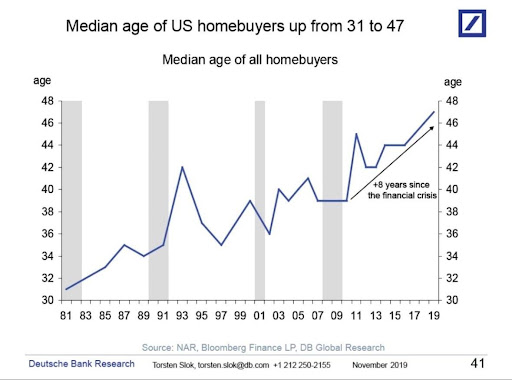

For almost forty years mortgage interest rates were trending down (see first graph), until 2022 when the Federal Reserve Bank started raising the Fed Funds rate to fight inflation. In 2021 home prices skyrocketed (2nd graph) in part due to low rates and Federal COVID stimulus money. Combine the housing price increases with the much slower household income growth, and the result is (3rd & 4th graphs) unaffordable housing markets. Younger Americans are renting for longer as can be seen by the median homebuyer age climbing from 31 to 47 (5th graph). It appears many millennials are being forced to rent instead of purchasing new homes.

Please continue to The Details for more of my analysis.

“This may be the worst time in my living history for the home buyer — it just doesn’t make sense.”

–Mark Zandi

The Details

Since the early 1980’s, mortgage interest rates have been on a downward trend. This trend was interrupted when massive pandemic stimulus spending ignited inflation. Responding to the rise in inflation, the Fed began raising the Federal Funds Rate.

The pre-pandemic drop in mortgage rates pushed home prices upwards. As shown in the graph below, this jump in prices turned higher prior to the Financial Crisis, then nearly vertical after the pandemic stimulus payments.

Over the decades, the rate of change in home prices far exceeded the rate of change in real household income. As a result, even though falling mortgage rates made more expensive homes more affordable, this was offset by a decline in relative income. Therefore, purchasing and maintaining a home consumed a larger percentage of household income.

After the Financial Crisis, home prices fell along with interest rates. As a result, qualifying income began to surge again along with home prices. As shown below, the amount of qualifying income soared from around $50,000 in 2020 to close to $100,000 recently, due to pandemic stimulus effects.

A deleterious effect of rising home prices and falling affordability has been the rise in the median age of homebuyers. The median age of homebuyers has jumped from 31 in 1981 to 47 in November 2019. With the recent ascent in prices, I am sure the median age is rising even higher.

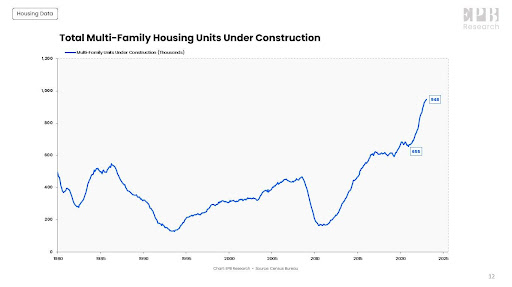

With more younger people forced to live in apartments, rent costs have risen. Seeing a shortage of multi-family units, builders jumped all-in to multi-family development. As renters are told of rising rental rates, many are not aware of the massive number of units currently under construction. As shown below, there are almost 950,000 multi-family units currently under construction. When these units are completed and hit the market, likely around the same time the economy falls into a recession, expect rental rates to fall.

The recent surge in home prices, along with mortgage rates pushing 7%, has made home ownership impossible for many. As shown above, the median age of home buyers is rising. Many millennials and Gen Zers are forced to remain in apartments or other rental units, even as rents have also jumped. However, the wave of multi-family housing under construction could overwhelm the market putting downward pressure on rents.

The S&P 500 Index closed at 3,970, down 2.7% for the week. The yield on the 10-year Treasury Note rose to 3.95%. Oil prices decreased to $76 per barrel, and the national average price of gasoline according to AAA fell to $3.37 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.